BTC Breaks $40,000 as Relief Rally Finally Hits

- Bitcoin (BTC, Tech/Adoption Grade “A-”) is up over 9% so far today and has broken above the psychologically important $40,000 level.

- Ethereum (ETH, Tech/Adoption Grade “A”) is trading 12% higher, and it’s approaching $3,000.

- Bitcoin’s crypto market dominance dropped a percentage point down to 42%, and it could slide back into the 40%-42% range that it just broke out of.

Bitcoin is having an excellent day today, and the broad market is following suit as the long-awaited relief bounce bounds through.

Recently, crypto has traded with a heightened correlation to technology stocks and other risk assets. Just yesterday, BTC saw weakness after Meta Platforms’ (Nasdaq: FB) poor guidance dragged prices lower during market hours. But efforts to decouple appear to be paying off, as it’s significantly outperforming the Nasdaq’s sub-1% move today.

Today’s bullish momentum means that BTC has surpassed its 21-day moving average. The real test now will be if it can hold this key level. Remember, it briefly topped the indicator intraday on two previous occasions, but couldn’t close above it since late-December.

Bitcoin is still down 34% over the past three months, but its 7% weekly gain is a step in the right direction.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global Inc. (Nasdaq: COIN):

Ethereum is moving in tandem with Bitcoin, targeting its own key resistance level at $3,000. Breaking through $3,000 could be difficult without a minor pullback, but the crypto market is trying to break its downtrend. Retaking the level with a decisive move would signal additional short-term strength.

The second largest cryptocurrency managed to overtake its 21-day moving average, highlighted by seven green candles in the last ten days. That’s a welcomed sign, but it’s still an overdue move considering the slow but consistent sell-off since November.

If Ethereum can continue gathering momentum, it would be a great sign for other altcoins.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Index Roundup

The crypto market rebounded after last week’s slide, but it still has plenty of ground to cover.

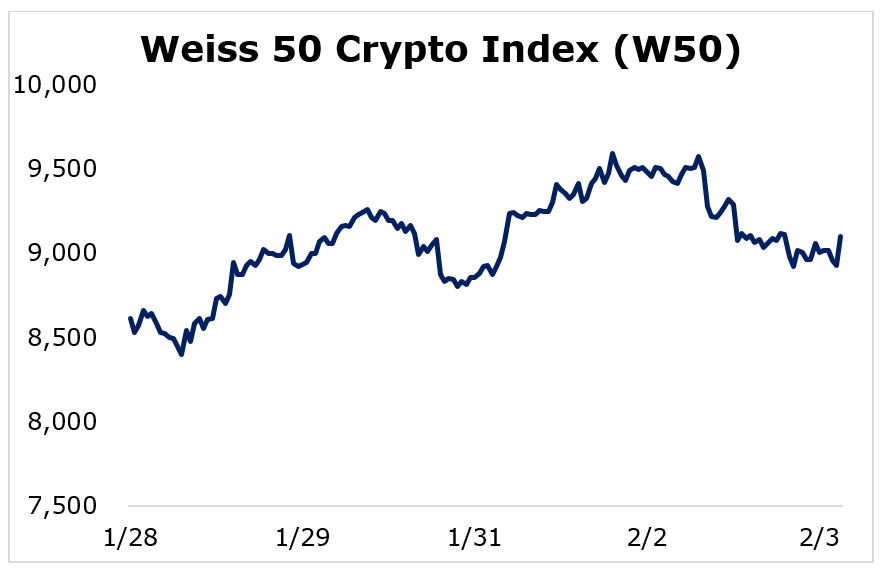

The Weiss 50 Crypto Index (W50) rose 5.58%, with most cryptocurrencies managing to finish the week higher.

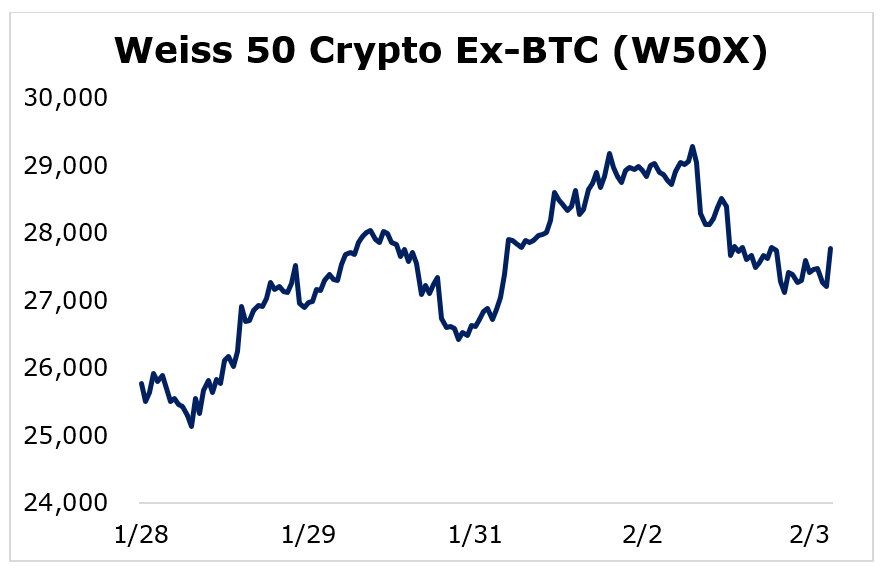

The Weiss 50 Crypto Ex-BTC Index (W50X) increased 7.75%, as Bitcoin slightly underperformed the broader market.

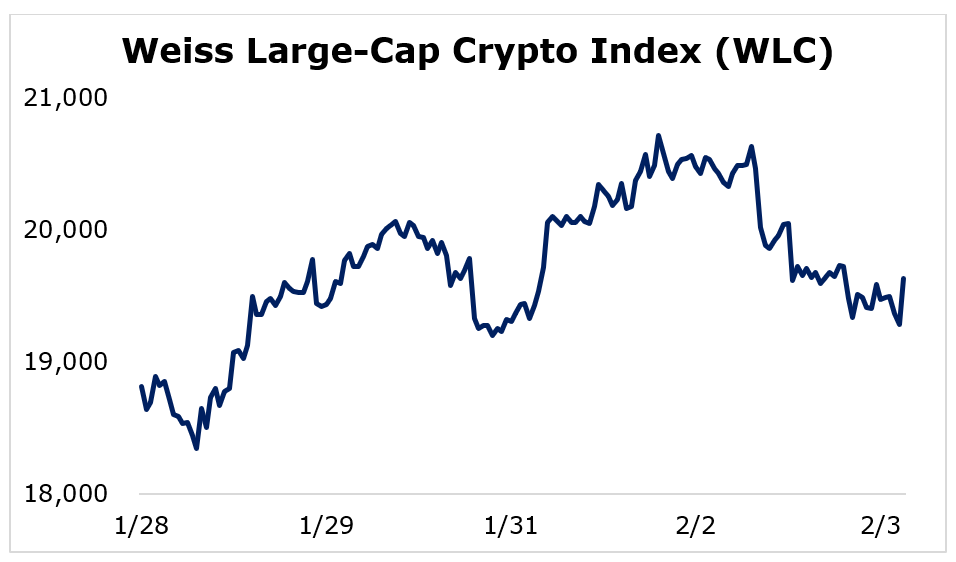

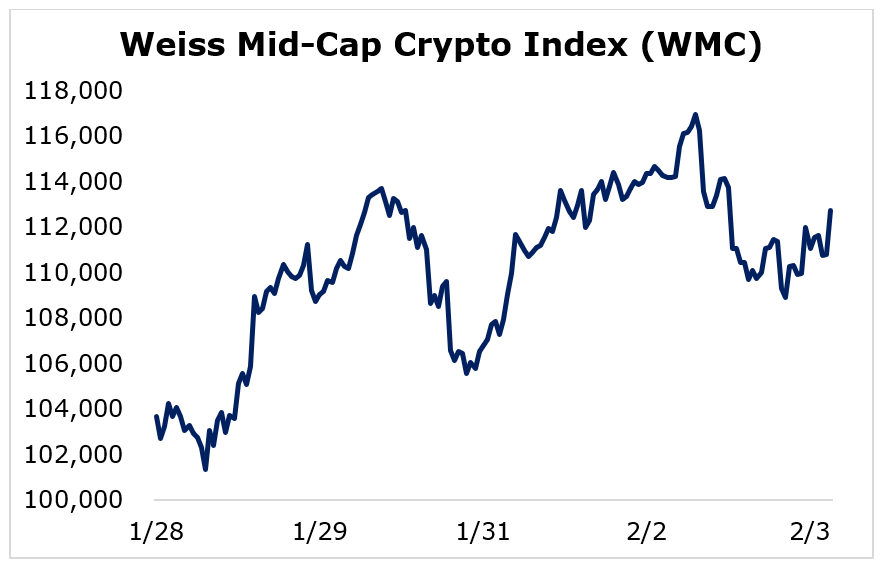

Breaking down performance this week by market capitalization, we see that the smaller and mid-sized altcoins saw a stronger rebound.

While the large-caps held their value better during the correction, the Weiss Large-Cap Crypto Index (WLC) only gained 4.33% as they couldn’t bounce as hard.

Mid-sized cryptocurrencies logged a solid week, with the Weiss Mid-Cap Crypto Index (WMC) finishing 8.74% higher.

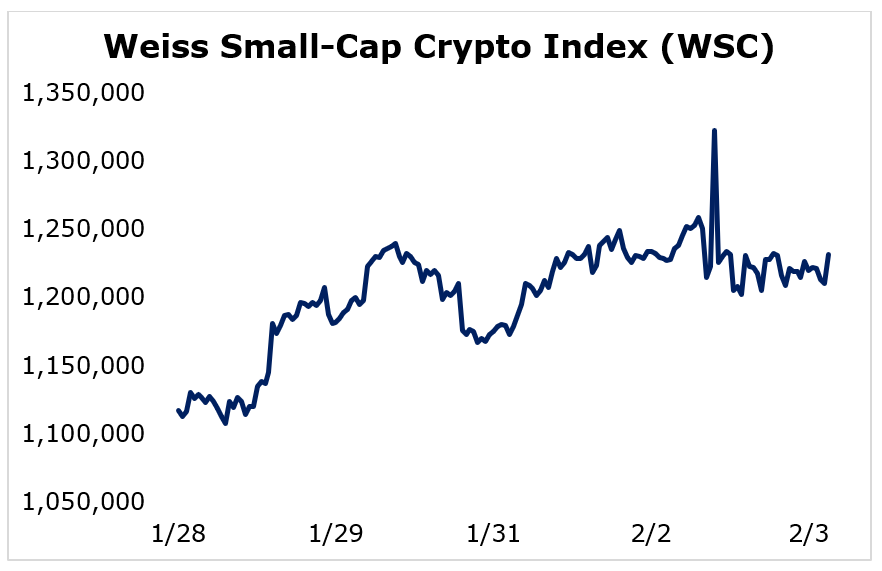

The small-caps were this week’s biggest winners as investors targeted speculative projects for higher returns. The Weiss Small-Cap Crypto Index (WSC) jumped 10.23%.

Less established projects often outperform when prices move higher, but they’re generally more susceptible during periods of weakness. So, expect them to continue following the large-caps’ direction with greater volatility.

Notable News, Notes and Tweets

- MicroStrategy Inc. (Nasdaq: MSTR) CEO Michael Saylor released that the company purchased an additional $25 million of Bitcoin.

- Could staking and mining rewards become tax-free?

- Unlike Russia’s central bank, President Vladimir Putin supports taxing and regulating crypto mining instead of banning the practice.

What’s Next

Russia will be regulating crypto, but probably not to the extent where it’s banned outright. Russians are estimated to hold about 12% of all crypto assets, which translates to about $214 billion. Like Vladimir Putin, Russia’s Minister of Finance Anton Siluanov wants to allow crypto services for companies with licenses. As usual, the fears surrounding Russia banning crypto were likely overblown.

The broader crypto market faces significant headwinds as Federal Reserve policy dominates headlines, but it’s a positive sign to see that the market’s long-overdue relief bounce could be forming.

Many crypto assets have retaken their 21-day moving averages, which could bode well for short-term price movements.

It’s likely that the crypto market extends this relief bounce in the immediate short-term considering the consistent downward pressure it has faced since November. But investors should remain wary of elevated risks.

Best,

Sam