|

| By Bob Czeschin |

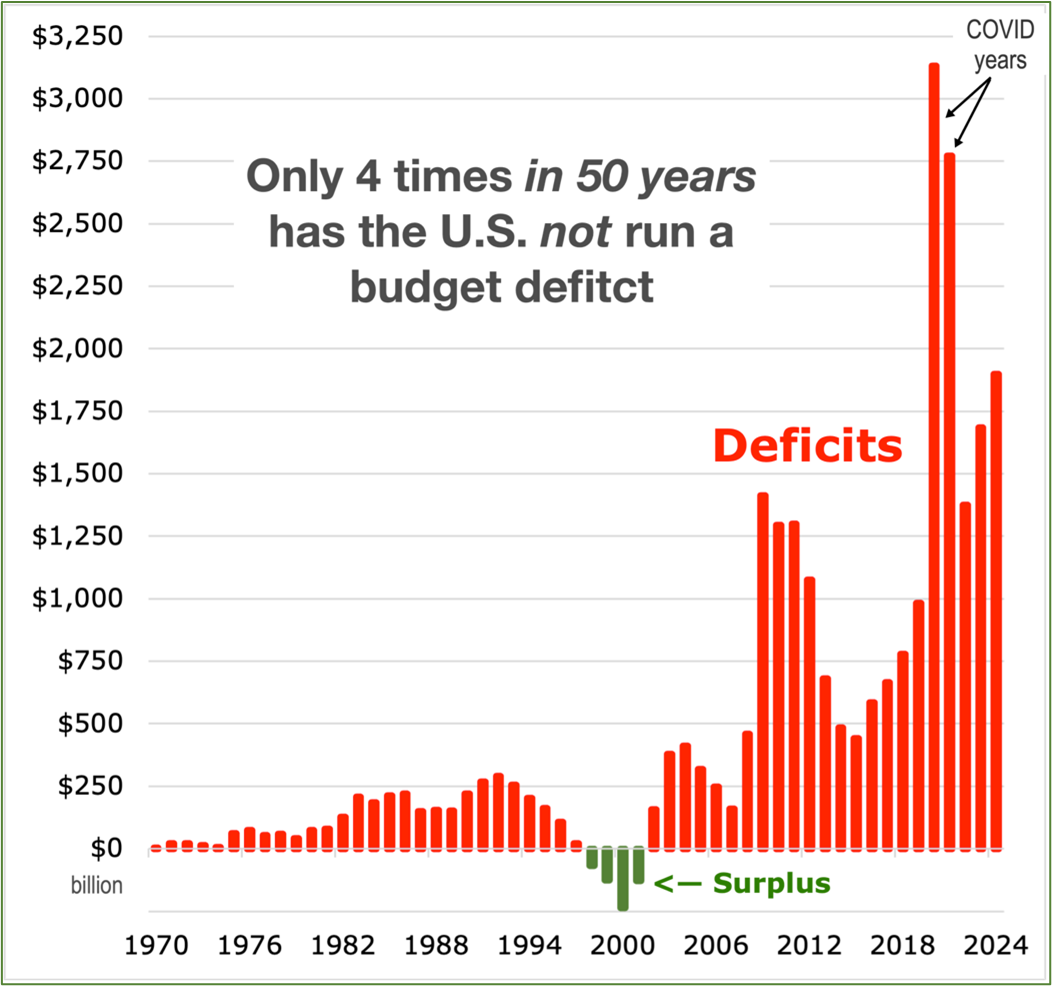

President Trump’s Big Beautiful Bill will add another roughly $5 trillion to the national debt (over the next decade).

But even before it passed, America was already facing $1.9 trillion annual deficits (about 6% of GDP). Plus, accumulated debts of $35 trillion.

Pile on that new $5 trillion … and the trajectory is set.

Trillion-plus deficits — as far as the eye can see.

And when push comes to shove, these deficits are funded by creating more currency.

That happens in two distinct ways …

Directly via the Fed.

Or indirectly via banks, under Fed guidance.

5 Core Reasons Uncle Sam

Will Never Balance His Budget

Perverse political incentives. In a democracy, politicians win votes by spending money — not saving it.

Conversely, cutting programs or raising taxes is generally a quick ticket to getting voted out of office.

On the left, politicians promise more social benefits (healthcare, pensions, etc.) On the right, they typically campaign on tax cuts and smaller government.

This amounts to a formula for bipartisan profligacy.

When the left is in power, the government spends more. When the right is in power, it taxes less.

Over time, the outcome is ever-growing deficits.

Entitlements on cruise control. Social Security, Medicare, Medicaid and various welfare programs are politically untouchable third rails. Any serious attempt to squeeze them ignites public outrage.

Problem is, these programs are gigantic and getting costlier as the population ages.

Beyond its $36 trillion public debt, the United States faces an estimated $50 trillion in promised future Social Security and Medicare benefits — that aren’t paid for yet.

Related story: The Easy Fix for Social Security

The modern welfare state is a dead man walking. But few dare admit it.

Growth is a serpent’s promise. Some say America can “grow its way” out of debt. Such soothing words, however, are a dangerous illusion.

For this to work, GDP must increase faster than the amounts owed.

But since COVID, Washington’s budget deficits have grown faster than GDP.

Worse, a lot of GDP growth nowadays stems directly from government deficit spending!

Cut the deficit, you also hobble economic growth — at least in the near term.

And when growth stalls, what happens?

Tax revenues fall, and welfare costs (like unemployment benefits) rise — which worsens the deficit.

This feedback loop means any serious austerity measures risk triggering a recession. Which, ironically, makes the debt load even heavier relative to a shrunken GDP.

Elected officials know this. That’s why spending cuts are so often a career-ending move.

It’s far “safer” just to keep the fiscal accelerator pedal-to-the-metal — and let final reckoning be some future officeholder’s nightmare.

Interest-rate trap. In the old days, whenever excess money-creation caused inflation to pick up, the Federal Reserve would raise interest rates to tamp it down.

Nowadays, the accumulated debt is so huge, higher interest rates blow out the deficit — increasing Uncle Sam’s interest expense — faster than they slow down private credit growth.

U.S. debt is so large, servicing it already costs more than the Pentagon. So, even small rate hikes force the Treasury to borrow a lot more.

In other words, policymakers are damned if they do, damned if they don’t.

Keep rates high, and the government drowns in interest expense. Push rates down, inflation and asset bubbles bloom like mushrooms after a summer rain.

It’s a Catch-22. With no way out.

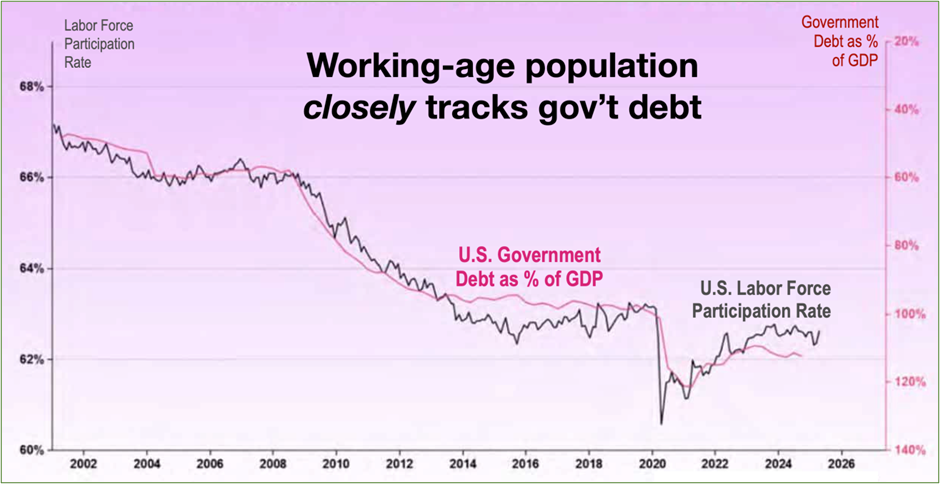

Demographic time bomb. As populations age, labor force participation drops, as spending on pensions and healthcare rises. Fewer working taxpayers supporting more and more retirees is a recipe for deficits.

This has been a structural trend since Baby Boomers began retiring in the early 2000s. But it went into overdrive after the 2008 financial crisis and the 2020 pandemic panic.

No power on earth can stop this — which is why balanced budgets are a fairy tale in the modern era. And what this implies is simple:

Currency Debasement Is Not Just a Risk.

Or a Theory. It is an Inevitable Outcome.

Governments will continue to finance their deficits by printing money —one way or another. Which erodes the purchasing power of fiat currencies.

Between 2008 and 2014, for example, Fed officials increased the monetary base nearly fivefold. Another round came in 2020, as they reacted to pandemic panic — with trillions more printed in a matter of months.

But in the end, someone always pays.

Typically, it’s the saver. The pensioner. The wage-earner whose income doesn’t keep up with rising prices.

Eventually, we all pay — as our dollars buy less house, less education, less everything … than they did a decade ago.

The shrinking value of paper currency is effectively a slow-motion tax most people fail to recognize — which is what makes it so insidious.

But your government is well aware of this — and frankly, likes it this way.

Printing money to cover spending is far less politically risky than overtly raising taxes.

Safer to have inflation, or taxation by stealth.

This is why, in the grand sweep of history, this cycle of debt and debasement has only ever ended one way, with the destruction of the currency.

Sometimes it’s gradual (a few percent inflation year after year). Sometimes it’s rapid (as in a currency crisis).

But it’s never benign.

Faced with this stark reality, how do you protect yourself? With …

A Natural Beneficiary of Debasement

While the dollar is systematically diluted by money creation, Bitcoin’s supply is mathematically capped.

There can never be more than 21 million BTC. So, on a long-term time horizon, the fiat price of 1 BTC has nowhere to go but up.

Indeed, we’ve already seen this play out. Every cycle, Bitcoin’s lows are higher in dollar terms. Because the dollar itself is losing value.

If Washington prints another $5 trillion — or $50 trillion — Bitcoin is going to appreciate in corresponding measure. It’s basic scarcity economics.

Government debasement may be a runaway freight train no one can stop. But as individuals, we are not chained to the tracks.

What can you do?

You can get some meaningful exposure to Bitcoin before Sept. 17.

Markets are pricing in a Fed rate cut. This would likely flood the system with liquidity … and that tends to push up Bitcoin prices.

But here at Weiss Ratings, our data tells us there’s a better idea.

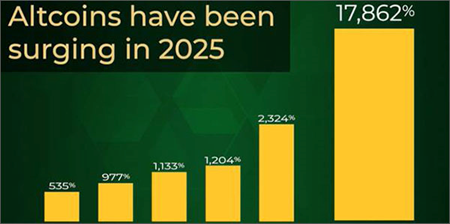

A select crop of newer coins — altcoins — is likely to steal the show … and give investors the most substantial gains.

Our crypto team believes we’re about to enter “major altcoin season.” In other words, any coin except Bitcoin.

So with the Fed getting ready to flood the system with money …

And central banks around the world following suit …

As soon as the next Fed meeting on Sept. 17 …

When all that fresh liquidity hits the markets, history shows it’s the smaller cryptos that can explode in value.

I hope you were able to attend today’s Emergency Crypto Briefing between Dr. Martin Weiss and my friend and colleague Mark Gough.

There, they discussed how specific coins could blow past bitcoin and even Ethereum when this altcoin season officially kicks off.

If not, and you want to see how to go for gains as large as 1,204% … 2,324% … and even 17,862% …

You can watch today’s replay right here.

I suggest you follow the instructions at the end as soon as you can.

After all, we live in historic times. Take heart, you can see the writing on the wall — when so many others can’t.

Best,

Bob Czechin