|

| By Nilus Mattive |

Back in March, we talked about Social Security — namely, its ongoing financial problems and several changes I’d like to see made to the system.

Many of you also sent in additional comments and suggestions, which I shared in a follow-up column.

But our conversation didn’t end with a single, relatively simple way to solve Social Security’s systemic shortfalls now and far into the future.

Today, I’d like to propose one.

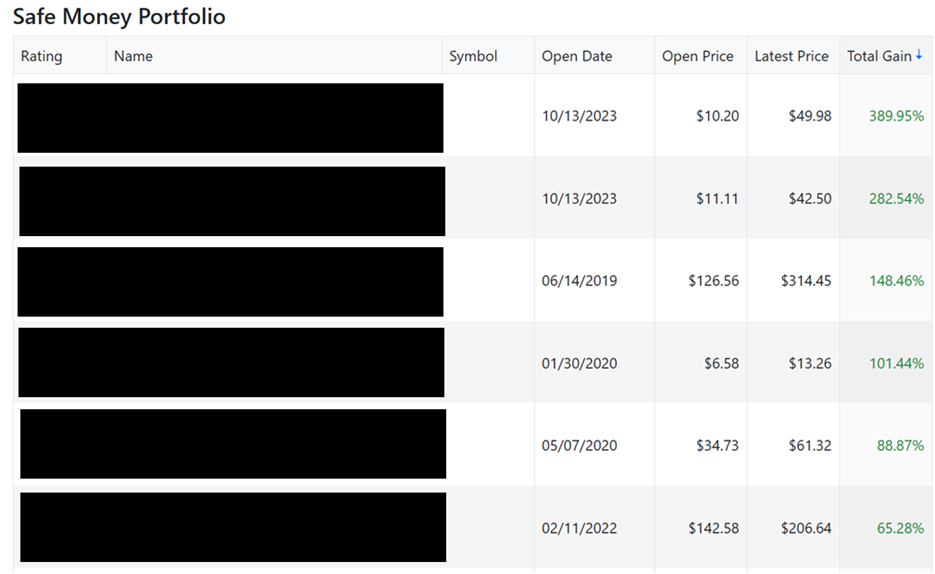

It’s the same core recommendation I make to my Safe Money readers … one that has helped them achieve individual open returns as high as 390% in less than two years.

Indeed, if you look at our model portfolio right now, you’ll see many double- and triple-digit winners … and NONE of which are high-flying tech shares.

My point: Overall, we’re achieving terrific overall portfolio returns without taking unnecessary risks and the Social Security trust fund could be doing the same thing.

All it has to do is diversify.

This is not a groundbreaking idea.

Just about every pension fund … college endowment … and even foreign national retirement systems … already do it.

That last point is especially ironic …

Other countries regularly invest their citizens’ retirement money in America’s best companies, while the United States itself never has!

Instead, all our money has only ever been parked in a special class of U.S. Treasury bonds.

The U.S. government loves this, of course.

It helps create automatic, continuous demand for the ever-growing pile of debt lawmakers rack up.

Plus, it has also allowed them to play additional accounting games whereby they borrow even more money from any surplus in the Social Security trust fund and leave even more IOUs in its place.

All the while, we have more and more money taken from our paychecks with nothing but below-average returns and empty promises to show for it.

I personally believe our government’s debt addiction is the only reason this problem has persisted for so long and why my solution will never be implemented.

What other objection could there possibly be?

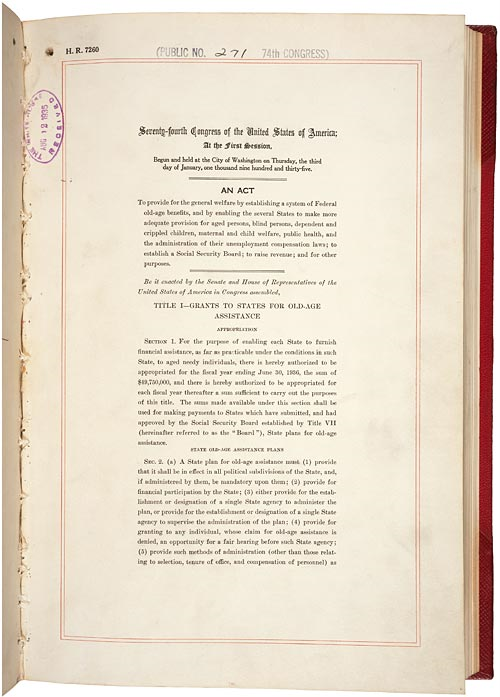

Back in the 1930s, when the system was first starting out, lawmakers decided against investing any of the trust fund in U.S. stocks for three main reasons …

1. They were worried about having to withdraw money at losses.

This might have been a valid concern when the fund was just establishing itself.

Though they could have easily solved the problem by establishing their equity allocation very slowly over time.

Today, it’s not an issue at all because the trust fund is massive. And legging into the market would be very simple.

2. They were worried that the fund’s buying and selling could disrupt the market itself.

Again, maybe there was some validity to this when there were far fewer publicly-traded companies and far less big market participants.

Today? Not so much.

3. They were worried about possible conflicts of interest once the government started investing in individual companies.

This might be the only concern from that time that still exists today.

But it doesn’t apply to Social Security investing in something like a broad-based stock market index fund or even gold or Bitcoin.

Instead, it applies to all the other random “investments” the U.S. government has done — and continues to do — OUTSIDE of our national retirement system.

I don’t care if we’re talking about prior bailouts for automakers … airlines … banks … or the most recent investment in Intel (INTC).

Many of those prior actions have handed taxpayers outright losses and didn’t meaningfully alter the companies’ long-term business prospects anyway.

I don’t have confidence that future ones will work out any better.

So, yes, President Trump is 100% right that the U.S. government should be thinking more like a business-minded investor.

However, it shouldn’t be doing that in a haphazard way that actively picks winners or losers … that reeks of “backroom bro deals” … or that takes place in some separate sovereign wealth fund with an unclear purpose.

The simple solution is to start with broad equity investments inside the Social Security system.

If they want to take things a step further, they can also look at small allocations to additional asset classes like corporate bonds, precious metals, private investments and maybe even crypto.

I would argue any patents, private placements, equity stakes or other investments should all be going into our national retirement system for the benefit of everyone.

Either that or let’s unwind the system altogether.

Because make no mistake: Social Security as it was originally constructed and as it continues to operate today IS a government-run Ponzi scheme.

Its “pay as you go” structure … combined with a circular investment logic revolving around low-yielding government debt … virtually guarantees that it will not be able to keep up with the future promises it has made without continually taking more and more money from people at the bottom of the pyramid.

Simply allocating its portfolio in a better way could go a long way to covering up the structural flaws … possibly forever.

However, knowing our lawmakers, I assume we will just keep going down the same unfortunate path we’ve been on for almost 100 years now.

Which is why I will continue to recommend you build and grow your personal nest egg in a far more responsible manner.

Best wishes,

Nilus Mattive

P.S. Fortunately, you can start as early as tomorrow. That’s when Dr. Martin Weiss is hosting a special Emergency Crypto Briefing.

Maybe the U.S. government should attend. Either way, you can.

And what you’ll find is a major shift coming. Billions of dollars are moving OUT of Bitcoin and into … well, you’ll see.

Grab your spot to find out where this money is headed … and how it has recently produced gains as large as 1,204% … 2,324% … and even 17,862%.