Readers Agree (and Disagree!) Over Social Security

|

| By Nilus Mattive |

Last week, I wrote about the Social Security system for the first time in quite a while … and as I expected, you had a lot to say in return!

Many people agreed with everything I said … others had different takes … and plenty of additional points and follow-up questions were raised in the process. (You can add your thoughts here.)

That’s precisely what I hoped for.

Better yet, the feedback wasn’t just intelligent … it was almost universally cordial.

I could probably keep going on this topic every week for the rest of the year and not cover everything.

But there’s a lot happening in the markets right now, too. So, let’s just spend today highlighting some of the things you shared … along with some of my responses … and then we’ll agree to come back to this subject again soon.

After going through A LOT of comments, I can say almost everyone agreed with my first point that Social Security benefits should not be taxable.

This is just plain common sense. And again, if we need to reach some type of temporary compromise, let’s at least adjust the thresholds from 1983 standards to amounts that make sense in 2025.

A majority also agreed that paying married couples as much as 150% of what they originally contributed might be well-intentioned but doesn’t make fiscal sense.

There were some dissenters, of course. For example, one reader said it would be unfair to suddenly pull the rug out from under people who have become accustomed to their current benefit levels.

I get that.

Perhaps a gradual tapering of those benefits could ease the shock. Or at least a moratorium for anyone filing from here on out. Or both.

One thing that’s certain: If we don’t start making more drastic changes, EVERYONE is going to end up getting less than they expected a decade from now anyway.

As expected, the biggest point of debate centered around the recently passed Fair Act.

Several different readers who benefited from these changes argued that undoing the Windfall Elimination Provision and the Government Pension Offset corrected injustices in the system.

I will say that the topic is more nuanced than what I was able to cover in my short section on these changes.

For example, there might be a situation where someone worked as a teacher for several decades but also had another job — perhaps during summers — which generated enough contributions to Social Security to have them qualify for commensurate benefits upon reaching retirement age.

That’s not a problem in my book. They deserve to collect payments back out of the system.

However, the Social Security system calculates different benefit rates based on the earnings records it “sees” — i.e., what was paid into the system.

The formulas are a bit complicated, but the basic idea is that lower lifetime earners get an extra boost. (You can read the full explanation here.)

That means someone like the person above could end up receiving a higher benefit because they appear to be a lower-wage worker even though they made substantial amounts of money that is outside the Social Security system.

The WEP was designed to fix this problem. And as explained here, the GPO was put in place to address similar discrepancies regarding spousal benefits.

Note that eliminating benefits for living beneficiaries as I suggested would take care of a lot of this as a byproduct anyway.

Okay, that brings us to the number one thing people wrote in about …

A lot of you are worried that Social Security simply doesn’t have the money it needs to keep paying benefits well into the future.

It’s a valid concern.

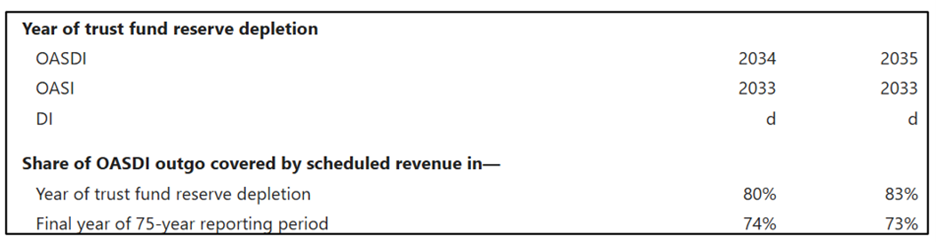

Based on the latest projections, the Social Security trust fund will be fully depleted by 2035. At that point, it will only be able to pay out 83% of the benefits currently being promised.

Generally, it is believed there are two ways to address this.

The first is just reducing benefits.

The second is getting more money into the system.

Many readers expressed interest in doing the latter by raising or removing the cap currently placed on the amount of earnings subjected to Social Security taxation.

Under current law, that limit is $176,100 for 2025. That amount puts someone in the 93rd percentile of workers.

So, at first blush, simply taking more money from the top seven percent of earners seems like an easy fix. Or at least it’s a wildly popular idea for 90-some-percent of Americans.

The problem I see is that it further stretches Social Security away from its original intention — a basic safety net woven together by the same people who would land in it … constructed in a way that made the benefits proportional to the contributions.

Does that mean I’m suggesting we cut benefits to less fortunate Americans so the biggest earners can keep more of their paychecks?

No.

Maybe there’s a third alternative that almost nobody is talking about — investing the trust fund in a more intelligent way to make up the shortfalls and provide bigger returns in the future.

After all, Social Security has simply earned bare minimum returns with a 100% allocation to Treasury bonds for as long as it’s been operating.

Meanwhile, most private pension plans — as well as national retirement plans in other countries like Canada — invest in a much wider range of assets, including stocks.

Why, in a country that has generated the most wealth in the history of the world, are we completely ignoring these same opportunities and doing the complete opposite of what any normal financial planner would recommend?

Perhaps that’s something we should discuss more thoroughly in the future. In fact, let me know your thoughts on all of this here.

Best wishes,

Nilus Mattive

P.S. If you’re looking to build up a nest egg outside of Social Security, you’ll want to attend tomorrow’s exclusive event. This opportunity is not only outside of Social Security, it’s outside of the stock market … for now. Grab your seat here.