|

| By Nilus Mattive |

I started working on Wall Street back in the late 1990s when a whole new crop of technology stocks was all the rage.

It was a heady time full of hope and excitement.

But old-school “value” investors like Warren Buffett weren’t buying it.

In fact, here’s a little snippet from a CNN Money article published back on Jan. 20, 2000 …

“[Buffett] claims to know nothing about technology and steers clear of that sector. Berkshire's website portrays the pointedly down-to-earth billionaire as a ‘technophobe’ who can't figure out email.

“Buffett, who declined to be interviewed for this story, has said he can't ‘see’ what technology businesses will look like in 10 years or who the market leaders will be. So he has shied away.

“By doing so, he has completely missed a roaring tech market that pushed the Nasdaq Composite up 86% in 1999. That's more than any major index has ever risen in a year.”

We now know that those Nasdaq gains evaporated rather quickly. And we also know that thousands of tech companies never recovered.

But the very best companies not only survived that downdraft … they’ve been posting astronomical gains all the way to the present time!

A look at Amazon.com (AMZN) really puts things into perspective.

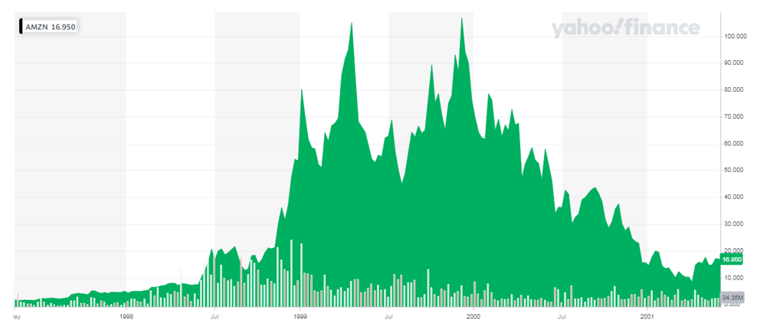

The company went public in 1997 to much fanfare and shot up from the single digits all the way to $100 a share as investors piled into everything tech related.

Then, it gave back almost all those gains in a single year …

Brutal, right? Buffett and other naysayers looked really smart for avoiding that kind of pain.

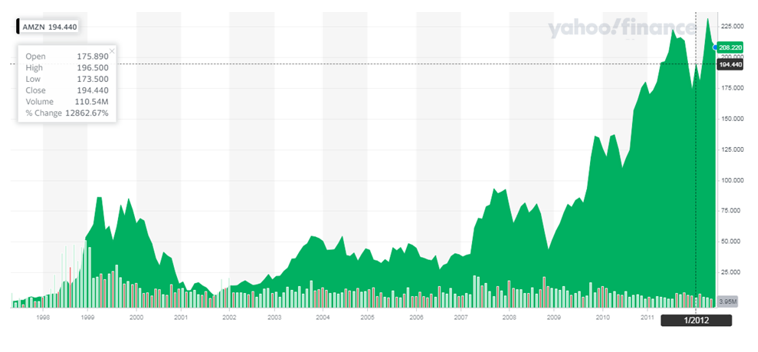

Of course, anyone who simply held their underwater Amazon shares — or had the guts to buy in on the weakness — was greatly rewarded.

Amazon’s stock not only got back to $100 a share before the Great Recession hit, but it emerged from that next bear market and doubled yet again by 2012 …

And what if you were on the sidelines for that entire 15 years, watching Amazon go through two or three gut-wrenching drops … while ultimately soaring from single digits to more than $200 a share?

Well, you STILL could have made a fortune even if you only bought at that new all-time high.

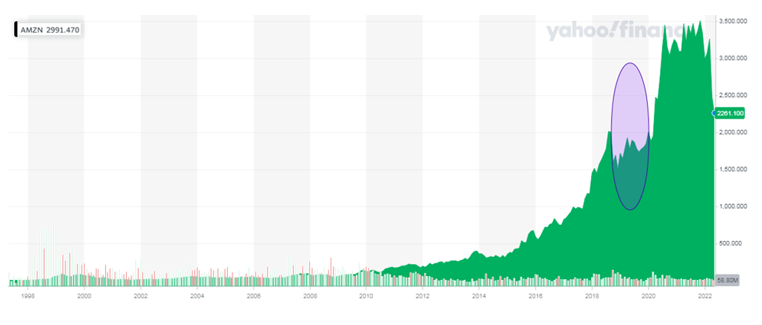

Because here’s what Amazon has done through May 2022 …

As you can see, the stock went from $200 a share in 2012 to as much as $3,500 a share earlier this year. That’s enough to turn every $1,000 invested into more than $17,500 over a single decade.

And do you see that circle on my chart?

Well, that’s where Buffett’s Berkshire Hathaway finally started buying into Amazon back in 2019 … after the stock had already gone from single digits to a high around $2,000 a share over the course of two decades.

As Buffett told CNBC at the time, “Yeah, I’ve been a fan, and I’ve been an idiot for not buying.”

And now, Buffett’s making the same mistake. This time, with crypto.

Bitcoin Is Much Like Amazon Back in 2000

In fact, at last month’s Berkshire Hathaway shareholder meeting, he told the audience …

“Whether [Bitcoin] goes up or down in the next year, or five or 10 years, I don't know. But the one thing I'm pretty sure of is that it doesn't produce anything. It's got a magic to it, and people have attached magic to lots of things.”

Considering how new crypto still is, it’s natural to hear the same type of skepticism we heard about the internet, e-commerce and all the other tech developments of the late ‘90s and early 2000s.

And some of that skepticism is even justified.

A lot of early dot-com investments WERE completely empty promises or half-baked ideas. The same is true of many of the 19,000+ cryptocurrencies trading right now.

But the internet HAS reshaped the way we live, work and play in even more profound ways than originally imagined.

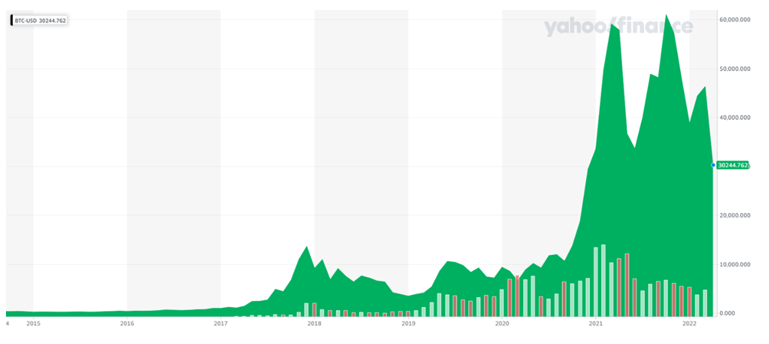

It will be the same thing with blockchain, crypto and web3 going forward. The market for these investments has already seen several big surges, followed by large drops. And in each instance, the very best cryptos came back even stronger and went on to much higher highs.

The key is targeting the top cryptos that will weather any storm to shape the industry, much as Amazon did for e-commerce.

In fact, this chart of Bitcoin (BTC, Tech/Adoption Grade “A-”) looks a lot like an early chart of Amazon …

And a virtual store of value like Bitcoin, in reality, is no different from fiat currency, precious metals or seashells.

None of these mediums of exchange have much inherent utility other than the collective value humans give them.

If anything, Bitcoin is more secure … more easily transported and stored … programmatically limited in supply … and only gaining GREATER acceptance each and every year.

Bottom Line: HODL your current top-performing cryptos. And if you’re not invested, use market weakness as a buying opportunity.

As my colleagues have told you over the past week, a near-term bottom is very overdue in this market. Do we know exactly how long this new downdraft might last or precisely where the bottom will hit? No.

But we do know that high-quality cryptos like Bitcoin and Ethereum could still have as much future upside as Amazon and Apple had back in 2000.

At this point, more than a trillion dollars has already flowed into the crypto space …

Real innovation is taking place every single day …

And the transformation has only just begun.

So, while we will continue to see massive ups and downs in the crypto space … and some catastrophic failures along the way …

Those are normal growing pains.

Just as it was with the best tech companies over the past couple decades, extreme volatility is the price you pay for truly life-changing profit potential.

As long as you’re investing appropriate amounts of money, diversifying your bets and keeping your focus on the long-term upside, the rewards far outweigh the risks.

In fact, one or two four-digit winners — including ones this newsletter has already delivered — are more than enough to make up for other bumps and bruises along the way.

If history is any guide, Berkshire Hathaway will end up buying high-quality cryptos like Bitcoin and Ethereum someday.

And by the time that happens, prices will be five or 10 times higher than they are today.

Best,

Nilus Mattive