|

| By Chris Coney |

Aside from the initial complexity of setting up a decentralized finance wallet, I believe the only reason to use a centralized exchange is the lack of a DeFi alternative.

After all, I would never sacrifice having full autonomy over my funds for a bit of extra convenience.

Once blockchain and smart-contract technology were invented, the process of rebuilding the entire financial system began.

The apparent explosion of DeFi innovation is simply a reflection of how many systems, products and protocols need reinventing on these new rails.

And that’s why I suspect there will likely come a time when decentralization is the norm.

Introducing the Gains Network

When I come across something new and innovative, I sit back and observe three factors before jumping in:

- How long is it going to last?

- How is it going to develop?

- Has someone pointed out a glaring flaw that I’ve missed?

My latest discovery is the Gains Network. While it’s still relatively new, I believe it has reached a level of development where it’s safe to talk about.

Gains Network is utilizing the Polygon (MATIC, Tech/Adoption Grade “B”) network to build out its first product, gTrade, which is a fully on-chain decentralized exchange designed to rival CEXes without any of the custodial risks.

It’s a perpetual exchange, so it’s an app aimed squarely at traders as no crypto assets are changing hands like on Uniswap (UNI, Tech/Adoption Grade “B”).

With gTrade, you’re able to trade pretty much any asset it has a price feed for … including cryptos, stocks and forex.

You can go long or short with up to 150x leverage.

All you need to have in your wallet to use gTrade is some DAI (DAI) stablecoins.

Listed assets all trade against the U.S. dollar; profits and losses are all in DAI.

Additionally, unlike Uniswap, you’re able to place limit orders and stop orders at your desired price.

Notable Innovations

One thing any trader will immediately notice about gTrade is there’s no order book, which is essentially an electronic list of an asset’s buy and sell activity on a trading platform.

Then who’s taking the other side of the trade? And where’s the money coming from to trade with leverage?

The answer is simple: liquidity providers.

In the staking section of the Gains Network app, there’s an opportunity for investors to stake their DAI stablecoins to help fund the exchange’s bankroll.

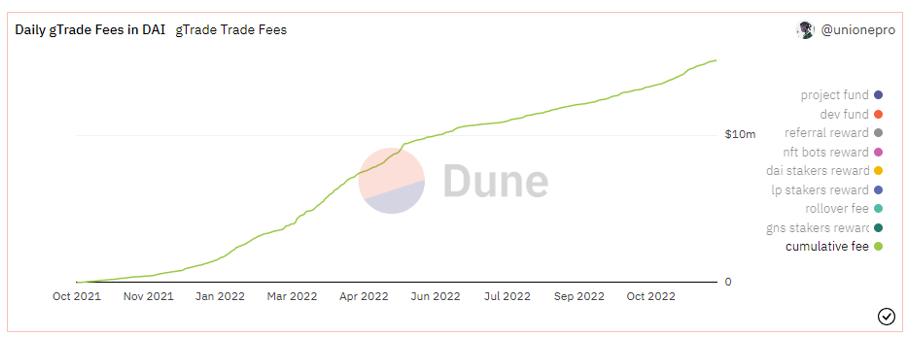

In return, stakers can earn a percentage of trading fees — which currently amount to $32,000 per day and is climbing fast:

Click here to view full-sized image.

Robust Oracles

Blockchains and smart contracts have no knowledge of the outside world. This presents a dilemma for gTrade, as it needs to know the prices of all the assets it lists.

That’s where oracles come in. An oracle is a piece of middleware — or software in the middle — that sits between two systems and passes data from one to the other.

In this case, gTrade takes price feeds from half a dozen oracles and then takes the average of those feeds to determine the price for its own internal use.

The benefit of using many oracles is to filter out random spikes in the data.

It also prevents anyone from attempting to unfairly profit by opening a large position on gTrade and then manipulating the price feed to trick the system into awarding the trade in the attacker’s favor.

Trading On-Chain

When a trade is placed on gTrade, it’s recorded as a transaction in the Polygon blockchain. That removes a trust layer normally placed on the organization running the exchange.

This way, the system is operating autonomously and beyond the control of the developers.

As a result, this should give traders confidence that the system operates fairly.

The Investment Opportunity

The most obvious investment opportunity in my mind is the DAI vault.

Because most traders lose money, it makes more sense to be the house, which is what the Gains Network is.

By depositing DAI stablecoins in the vault, you’re providing the pool of money from which traders take their profits. So if more money is lost than made overall, the house will profit.

At the time of writing, the DAI vault pays an annual percentage yield of 10%. It will rise if trading fees grow faster than the size of the liquidity pool sharing those fees.

If you’d like to look further into the Gains Network, you can view various on-chain stats for it here.

But as always, remember to do your own research and due diligence before hopping on any investment to make sure it’s right for you.

That’s all I’ve got for you today. Let me know what you think about the Gains Network by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

Until then,

Chris Coney