China’s Gold Rush Could Send $25 Billion Into Bitcoin

People may call Bitcoin (BTC, “A”) “the new gold,” but have you seen what’s been happening with old gold recently?

Prices soared to $2,400 an ounce. That’s a 32% increase since October 2023!

The second precious metal, silver, reached $29 an ounce for a 41% increase in the same period.

There are many factors contributing to this move, from geopolitical tensions to governmental buying. But the one driving force that has caught my attention is the manic buying spree coming from Chinese investors.

That’s because it has big implications for Bitcoin.

Let me explain …

Three years ago, Evergrande — a significant player in China's real estate market — faced severe financial difficulties. This has had a ripple effect on other property companies, leading to a crisis in the sector.

Consequently, the confidence level in the Chinese property and stock markets has declined, resulting in a significant increase in investors turning to precious metals.

This increased demand has been observed among both government and non-government entities.

In the last two decades up to 2023, the premium on gold shipments from London to Asia, commonly referred to as the “Shanghai Premium,” has averaged around 0.3%.

However, since 2023, this premium has increased significantly to 1.9%.

And in September 2023, it peaked at a record of 6.3%, equivalent to a premium of $120 per ounce.

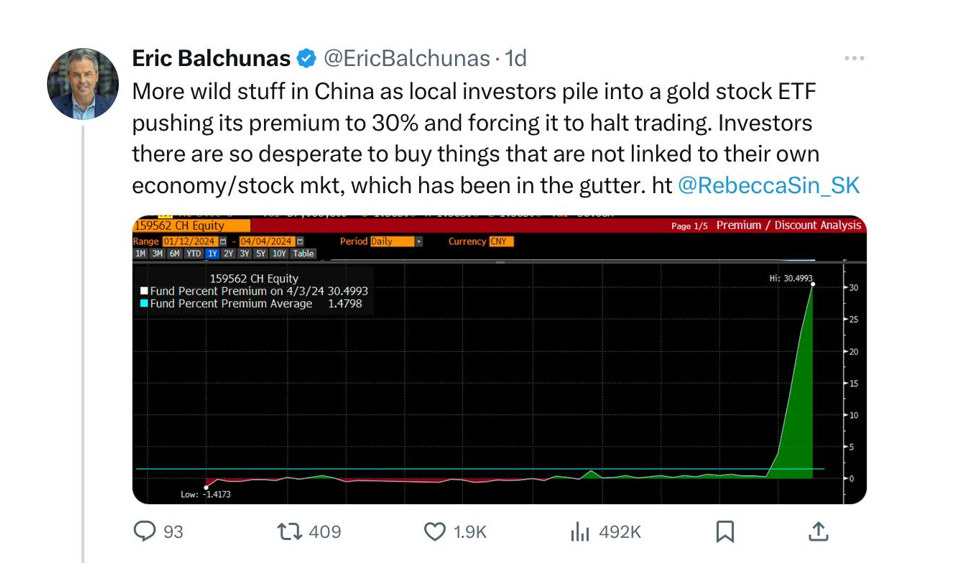

We have also observed similar actions in the silver market, with a silver ETF also hitting its halt trading limit.

These shifts come amid growing concerns over the property market's instability and the government's heavy-handed approach to the stock market.

Chinese investors have made themselves clear: They’re fleeing the instability of local markets into the relative safety of precious metals.

And demand is only increasing.

As I said at the top, Bitcoin has established itself as a type of digital gold, acting as a gold-like safe haven during particularly volatile periods in the TradFi market.

But Chinese investors have not been able to easily get into the crypto space.

Until now, that is.

According to a Reuters report, “spot Bitcoin exchange-traded funds could be launched in Hong Kong this month, with the first approvals likely to be announced next week.”

That timeline would make Hong Kong Asia's first city to offer the popular ETFs and is much faster than industry expectations of launches sometime this year.

And it could bring a wave of new investments into the crypto space, as well as push BTC to new heights.

We all remember the frenzy that accompanied the U.S.-based spot ETF approvals back in January. And with the exception of one week, they’ve averaged positive net inflows ever since.

Now, imagine that happening again in China. The big difference? It would open up access to Bitcoin investing for an even wider audience … one that’s starving for the relative safety of crypto.

A recent report from Singapore-based crypto services provider Matrixport claims that Chinese investors could pour $25 billion into a Hong Kong-listed ETF.

“China’s RMB [re: yuan] is at a 17-year low vs. the U.S. dollar. Indeed, there is a demand for diversification," according to Matrixport. It also noted the People’s Bank of China’s continued gold purchases.

In short: Chinese investors are seeking investment options that are not directly influenced by the Chinese government. If a Bitcoin ETF based in Hong Kong is approved, it could potentially cause a surge in the market.

After all, this is what Bitcoin was built for.

And the timing couldn’t be more perfect. If an approval comes in the next week, it would coincide with the Bitcoin halving event.

The convergence of these events could trigger the next rally in this bull market.

As such, any potential correction in Bitcoin's price could present an excellent opportunity to invest, directly or through a spot ETF.

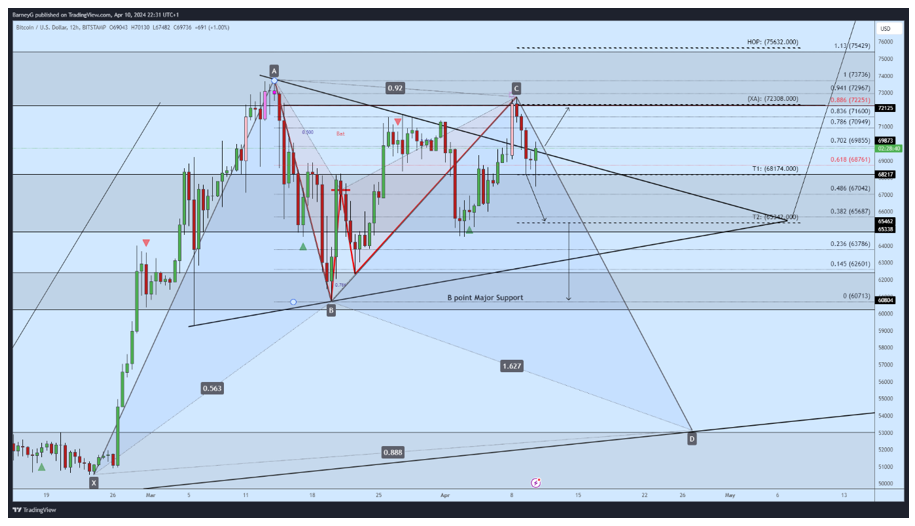

A key level to take note of if you’re just hopping in would be our current support level of $68,174.

If BTC closes below there, it could continue correcting further, presenting additional attractive entry prices.

But if Bitcoin remains above it, then savvy investors will want to hold on tight.

That strength could signal the start of a bullish trend towards $72,308 or even $75,623, which is a major target and resistance point. This would indicate a strong market momentum.

We’ll have to wait to see how events unfold next week before we can know which direction the markets will take. So be sure to check back in with Weiss Crypto Daily then.

Best,

Mark Gough