|

| By Jurica Dujmovic |

Well, well, well … look who finally got invited to the grown-ups' table!

In a move that would have seemed utterly fantastical just a few years ago, Coinbase (Coin) — yes, that crypto exchange your nephew wouldn't stop talking about at Thanksgiving last year (most likely because of this article) — is officially joining the S&P 500.

The financial world's most exclusive club is getting its first crypto member, and it's causing quite the stir on Wall Street.

The Changing of the Guard

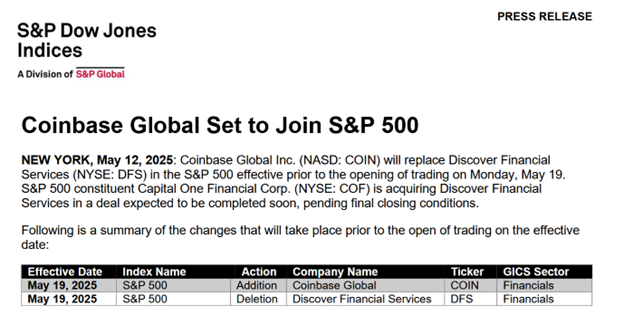

As of Monday, May 19, Coinbase has replaced Discover Financial Services in the venerable index.

Pour one out for Discover, which is exiting due to its acquisition by Capital One.

There's something deliciously poetic about a traditional credit card company being replaced by a crypto exchange — don’t you think?

But this isn't just symbolic — it's a seismic shift.

In one elegant corporate shuffle, the guardians of traditional finance have essentially stamped "LEGITIMATE" on the forehead of the crypto industry.

Coinbase has become the first crypto-native company to join the S&P 500's ranks, a development that even the most optimistic Bitcoin evangelists might have thought was years away.

What This Means for Your Money

(Even If You've Never Touched Crypto)

Here's the kicker: Since Monday, millions of Americans who wouldn't know a blockchain from a Beanie Baby now own a slice of Coinbase.

That's because every S&P 500 index fund — those cornerstone investments in 401(k)s and retirement accounts nationwide — has had to buy Coinbase shares to properly mirror the index.

This isn't pocket change we're talking about.

Analysts at Bernstein estimate this inclusion could drive approximately $16 billion of buying pressure.

That breaks down to roughly $9 billion from passive index funds and another $7 billion from actively managed funds that benchmark to the S&P.

Another brokerage, KBW, suggests index funds will need to purchase around 36 million Coinbase shares.

That’s equivalent to about four days' normal trading volume.

No wonder Coinbase stock jumped nearly 15% the day after the announcement!

At one point, it was up almost 24% from its pre-announcement level, adding about $8 billion to its market cap in a single session.

That's what happens when Wall Street's buying algorithm suddenly gets programmed to snap up your shares.

Wall Street and Crypto: A Marriage of Convenience?

The timing here is fascinating.

Coinbase is joining the S&P 500 just as the political winds have shifted. With Donald Trump back in the White House since January 2025, the regulatory landscape for crypto has markedly improved.

But it's not all good news for Coinbase.

Just a week before this momentous announcement, the company disclosed a cyberattack potentially costing between $180 million-$400 million.

There are also reports of an SEC investigation into whether Coinbase misreported its user numbers.

Even blue-chip companies have their blues.

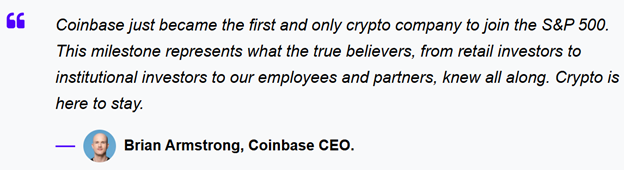

Still, Coinbase's CFO Alesia Haas was understandably triumphant, calling the inclusion a "major milestone" that reflects "how far [the industry] has come" and serves as a "signal of where the world is heading."

CEO Brian Armstrong echoed this sentiment on social media, declaring that "this milestone represents what the true believers … knew all along. Crypto is here to stay."

What History Tells Us About S&P Newcomers

I can already hear you saying, "Jurica, this is incredible news! I need to add Coinbase to my portfolio immediately!"

Well, hold your horses, dear reader.

Before you rush to load up on Coinbase shares, it's worth noting that index additions often follow a pattern: rally on announcement, continued climb into inclusion day, followed by potential profit-taking once index funds finish their obligatory purchases.

Take Tesla's 2020 addition to the S&P 500, for example. The electric carmaker's stock rallied about 70% between announcement and inclusion, only to face a bout of profit-taking afterward.

History suggests Coinbase's current surge might see similar patterns, so timing matters if you're considering a trade.

That said, historical data also shows S&P 500 additions since 2017 have outperformed by an average of 5.2% on the day after the announcement. (There are exceptions to this rule, though!)

Plus, joining the index typically can reduce a stock's liquidity-driven volatility over time as ownership broadens among institutions.

The Crypto Skeptic's New Dilemma

Here's an irony that's too delicious not to savor:

Starting Monday, even the most ardent crypto skeptics — the very people who've been rolling their eyes at blockchain technology for years — will likely own a piece of Coinbase through their index funds.

As one market commentator quipped, "Even people who despise crypto will now own a piece of the industry."

Avoiding Coinbase would mean deviating from the S&P 500, something most index investors are specifically trying not to do.

The Bigger Picture: What This Really Means

When the most-watched stock index in the world makes room for a crypto exchange, it's time to acknowledge a new reality.

Coinbase’s inclusion in the S&P 500 isn't just about one company. It's about an entire industry gaining mainstream acceptance.

Just as Netflix's addition to the index in 2010 signaled streaming's ascendance over traditional media, Coinbase's entry marks crypto's transformation from financial outlier to establishment player.

This transformation, while undeniably significant, comes with a certain irony that isn't lost on longtime crypto observers.

Many of us who've followed cryptocurrency since its early days dreamed of overthrowing traditional finance altogether to create a truly decentralized system outside Wall Street's control.

Instead, we're witnessing a segment of crypto being co-opted by the very institutions it was designed to disrupt.

But that's life, isn't it?

Revolutions rarely end precisely as the revolutionaries envision. And perhaps there's something to be said for changing the system from within.

For the crypto industry, this provides a blueprint: Meet the stringent requirements of the market, and the doors to mainstream finance will open.

Coinbase has proven that a crypto-focused company can achieve these thresholds … despite the industry's notorious volatility.

The Bottom Line

Whether you're a crypto enthusiast or still wondering what exactly a Bitcoin (BTC, “A”) does, Coinbase's S&P 500 inclusion matters to your portfolio.

It represents a tipping point: Digital assets have now become too big, too profitable and too integral to the financial landscape to ignore.

The days of dismissing crypto as a fringe movement are officially over.

Digital assets have now been given a key and invited to make themselves at home in the halls of mainstream finance.

Just … don't expect your financial adviser to start accepting Dogecoin (DOGE, “C+”) payments quite yet.

Best,

Jurica Dujmovic

P.S. While Coinbase has gone mainstream, Bitcoin and select cryptos remain a hedge against Wall Street weakness.

But they’re not the only opportunities available if you want to protect and grow your wealth outside the stock market.

To learn more, I suggest you check out our recently released Emergency Wealth Conclave.

This free presentation reveals even more off-the-grid assets and how they can help you navigate this delicate market.