|

| By Beth Canova |

Investors are hungry for the next big thing.

Some chase the runaway winners while they trend even higher.

Others search for values long before that.

Before analysts track and try to predict their every move.

Before trading history gets written.

That’s one of the big draws of cryptos and startup companies.

Both offer fertile ground to own a piece of the newest assets to hit the market. And, in some cases, BEFORE those hit the market. (Like this one.)

Your Weiss editors have shown you time and again that, if you can get in on or near the ground floor … you can profit from every rally, big or small.

But the process for how to target these opportunities looks very different in the crypto space versus TradFi.

ICOs Offer Instant Crypto Access

Back in 2017, Initial Crypto Offerings were the wild frontier of crypto. And they created the first generation of crypto giants.

But that gold rush didn’t last. By 2018, the SEC ruled that most ICOs were unregistered securities offerings.

Enforcement actions followed. Within months, token sales disappeared from the U.S. market entirely.

For years, American investors were effectively locked out of early stage opportunities.

Private funds and offshore platforms continued to participate. But retail investors could only watch from the sidelines.

That started to change about a decade ago for traditional startup companies. Now, that it’s changing for cryptos, too.

And it’s happening in a way that could permanently reshape how crypto innovation gets funded. That’s thanks to …

Coinbase’s Regulatory Breakthrough

Coinbase just released its new platform with an important upgrade.

It brings ICOs back under a compliance-first framework.

Now, every sale comes with …

- Identity verification.

- Investor disclosures.

- A six-month lockup for issuers and affiliates. This boosts accountability and helps avoid “pump-and-dumps.”

- A new “filling from the bottom” allocation system for orders. This is designed to prioritize the “little guys” and prevent “whales” from loading up.

- And post-sale rules. If users dump their tokens right away, they may receive fewer or even none in future ICOs. This should encourage longer-term participation instead of quick speculation.

In other words, the ICO model has been rebuilt for transparency and fairness.

This isn’t just a return to the wild days of 2017.

It’s the dawn of a new age of ICOs, one focused on structure and regulation.

And one that’s easily accessible.

How YOU Can Participate in This New ICO Revolution

All you need is a Coinbase account.

Then, click on Token Sales to find the latest ICO opportunity.

Coinbase plans to offer a new one each month. And the app even lets you set up notifications so you’ll know right away when the next ICO is announced.

In short, Coinbase’s new model opens the door for ordinary investors to participate in ICOs, safely and transparently.

And the success of this endeavor could spark a wave of compliant token launches.

This could go a long way toward helping the U.S. reclaim leadership in digital asset innovation.

ICOs, Like IPOs, Put You at the Starting Line

Crypto tokens get listed (via ICO) so users can use them on the blockchain.

But companies go public (via IPO) for a number of very different reasons. Most want to:

- Get seen by a bigger pool of potential investors.

- Raise capital to invest into the business.

- Reward early (pre-IPO) shareholders for their loyalty.

IPOs are one of many ways venture capital (bigger investors) and private-equity investors (friends, family and other individuals) cash out their stakes in a company.

Already, this divergence gives potential investors something to consider.

Knowing the goals of the IPO can help you narrow down which opportunity to target based on your own investment goals.

That said, information like this tends to hard to find. Many pre-IPO companies are also pre-revenue.

While a company is still private, it is not required to share its financials or other product information.

But once it IPOs … and trades on a regulated stock exchange … the SEC requires AUDITED financial, data once a quarter.

But until then, there may not be accessible financial information for investors who want in as soon as possible.

Sure, you can always review a startup’s filing with the SEC, which should contain all relevant financial information. And you can find already public competitors to see how they’re performing.

But without any trading history on public markets or lengthy historical financial results, determining an IPO's prospects is rarely an easy task.

That brings me to the top commonality between these two early-bird strategies: volatility.

Early Access Means Volatility Exposure

In crypto, it’s not uncommon to see a new coin skyrocket immediately upon listing … only to correct most of the way soon after.

Monad, for example, shot up roughly 80% in just the first 24 hours of trading last week …

Before it began a jagged decline to just above its ICO price yesterday.

As of this writing, it sits just above 3 cents.

Newly listed stocks can see similar volatility. But often, it can last well beyond the first day.

To combat this, both ICOs and IPOs have some form of lockup structure.

These rules are designed to prevent issuers, C-suites and angel investors from dumping and sending prices down on launch.

While the goal is to prevent excessive volatility … and to allow the market to determine the asset’s true value …

The lockup periods alone are not always enough.

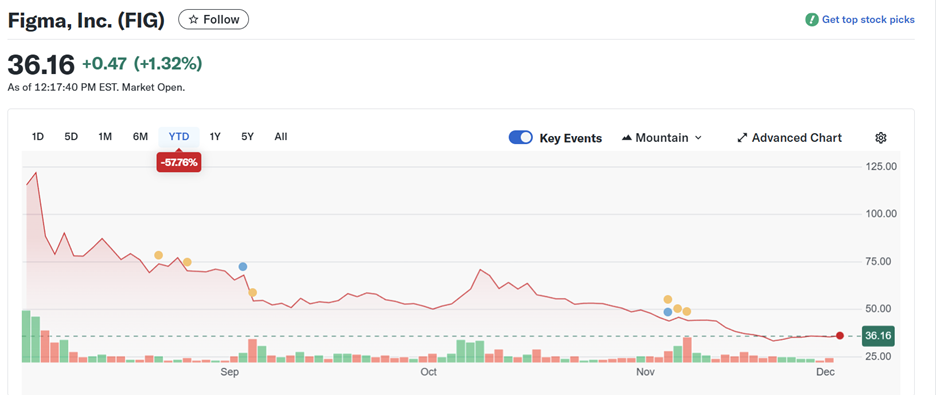

Figma is a great example.

It debuted on the NYSE on July 31, 2025, at $88 a share.

That was after it was priced at $33 by the company and its underwriters.

Shares ran up so fast that trading got halted at $112 within just a couple hours. That was 240% above the original price!

That was a Thursday. Shares ran above $142 during the next day’s trading session. They spent the next month trending lower, but still well above $33.

At the time of this writing, Figma is still within its 180-day lockup period, which expires in January 2026. And it’s trading near $36.

Early retail investors who held beyond that first 24 hours are likely sitting on pins and needles as they wait to see how that January unlock — when the earliest investors can sell shares without penalty — will impact the price.

But for many traders, the chance to use the early volatility to their benefit is too enticing.

And for long-term investors, ICOs and IPOs offer a great opportunity to get in on the ground floor and leg into a long-term position.

That said, there is one group of investors still in the green on Figma: the early stage investors.

Buy in Before the IPO

For most investors, the ICO or the IPO is the starting line.

But there are people in line ahead of THEM.

To get a leg up in the race to ICO/IPO, you want to invest before the thundering herd.

- In crypto, users do this all the time by scanning for new airdrops. And Coinbase’s new Token Sales platform offers a more user-friendly path, though time will tell if it takes off.

- In TradFi, that market was reserved for the ultra-wealthy and well-connected. In the past, it was almost impossible for average investors to get in on the ground floor.

That is, until the 2012 Jumpstart Our Business Startups — or JOBS — Act. The passing of this law unlocked the private-equity market to retail investors like you.

In fact … it puts you at the starting gate IN FRONT of venture capitalists and other big-money investors!

That means, instead of taking your place among the hungry crowds eager to get their stake in an IPO …

You could already be a shareholder long before that first bell rings!

As I said, vetting a private company is more challenging than a public one. Or vetting a new crypto, for that matter.

So it’s no wonder most Americans have yet to explore this new avenue of investing.

But that’s where my colleague Chris Graebe shines.

Chris a startup investment specialist.

He’s put money into over 30 startups valued at just a few million dollars in total when he first invested.

Today, they’re worth a combined $1 billion and counting — including the ones that didn’t work out.

And he’s getting ready to invest HIS OWN MONEY into yet another startup this week!

Chris recently released a new briefing.

In it, he gives you the details on a NEW deal that’s opening to Weiss Members in just two days.

It’s an Alpha Round opportunity that could RAPIDLY disrupt three fast-growing biomedical markets, valued at over $700 billion.

Jumping In … Or Jumping the Gun?

Getting into the latest opportunity as soon as possible isn’t for everyone. It’s a strategy that carries a fair amount of risk and typically requires a strong stomach for volatility.

But early exposure to the right pick could put you on the path to incredible gains.

If that sounds good to you, consider this your call to look further into the ICO, IPO and private equity opportunities on the market today.

Best,

Beth Canova

Crypto Managing Editor

P.S. Chris Graebe is getting ready to tell his subscribers about a sizzling pre-IPO startup. It’s behind one of the greatest medical technology innovations in history. Something that could disrupt three global markets valued at over $700B in total.

And the only way to get to the head of the line is to watch this video before midnight Wednesday and fill out the form at the end.