Consider Applying an Old TradFi Strategy to Your Crypto Investments

|

| By Nilus Mattive |

For several months, we’ve been talking about the possibility of a so-called big bottom in the crypto markets.

And now, just a few weeks into the new year, we’ve received confirmation that an important low was established between Nov. 9 and Nov. 21 of last year.

Just last month, Bitcoin (BTC, Tech/Adoption Grade “A-”) jumped from roughly $18,000 to almost $21,000 in the span of a few days, while Ethereum (ETH, Tech/Adoption Grade “B”) went from just under $1,400 to almost $1,600.

That confirmed the first of two signals required by our Crypto Timing Model to officially declare the death of the bear market.

The second signal — a sustained rally above $21,400 — was hit shortly thereafter.

But markets don’t move in straight lines. So, just because we have confirmation a bear market low has been established, that doesn’t mean it’s all blue skies from here.

In fact, Bitcoin has now been rallying for almost two consecutive months — from the low on Nov. 21 to the present. That means it’s time to start looking for the next 80-day-cycle correction.

That correction could take the crypto markets into a low in late February or early March. But from there, expect a major rally into the second quarter of 2023.

Our Crypto Timing Model already suggests it could be the strongest of the year.

So, what moves can you make between now and then? Well, some of the same techniques that work for well-established investments — like stocks — can work equally well in the crypto market.

The one I want to call attention to today is called dollar-cost averaging, and it can help you smooth out any volatility we see from crypto going forward.

With this simple concept, you buy a fixed dollar amount of the same investment on a regular schedule … regardless of the price.

In the world of stocks, for example, that means buying a fixed dollar amount rather than a fixed number of shares.

This is a critical distinction that needs to be understood. By design, DCA buys you more of an investment when prices are low and less when prices are higher.

Many investors are already using DCA with payroll deductions into a retirement plan at work. But it also works if you have a lump sum to invest.

For a hypothetical example, suppose you want to invest $12,000 in ABC.

You could certainly invest all your money at once. But if the share price quickly takes a dip, you may start regretting your decision!

Alternatively, you could invest your money into ABC over a 12-month period using DCA.

On the first day of each month, you’d invest $1,000 … no matter what ABC’s share price is.

If the price drops during month two, your $1,000 would buy more shares than in month one.

And suppose the price soared in month three?

Well, your $1,000 would buy fewer shares then. But the shares you bought in months one and two would already be rising in value, too!

Obviously, DCA works just fine when the market is going sideways or perpetually trending higher. The biggest risk: There may be missing out on some upside.

However, we’ve studied the effect of DCA during big market downdrafts and found that it also works well during those periods, too.

For instance, what would have happened if you started investing in stocks back in 2007 and then suffered through the 2008–9 collapse?

DCA would have easily allowed you to profit handsomely even during that rough patch … not even factoring in the massive recovery that occurred from mid-2011 onward.

But does the concept always work?

Well, Vanguard released a study in which the company reviewed the performance of a portfolio from 1926 to 2011. The researchers analyzed 1,069 overlapping 12-month periods for the two strategies that included bull markets and bear markets.

The study found that an immediate investment strategy outperformed a systematic one approximately two-thirds of the time. Yet Vanguard still concluded that DCA provides some protection against the real-world psychological impact of experiencing losses and that DCA can moderate the impact of an immediate market dip.

That’s the important takeaway here: Theories don’t make you rich; disciplined, real-world action does. DCA is a great way to get started TODAY.

You’re reducing your risk to short-term price movements by investing equal dollar amounts over time ...

And you’re taking emotion out of the equation, too.

You don’t have to worry about timing the market because you’ve made the commitment to tiptoe in each month without making a series of separate decisions.

The process only takes a few minutes of your time and can even be set up automatically through many brokerages and investment platforms.

Better yet, you’re not limited to just one type of asset. You can do it on individual stocks … mutual funds … ETFs … gold coins … and yes, cryptos!

How DCA Would Have Worked During Crypto’s Last Bull Market

We declared the last big crypto bottom just over four years ago, on Dec. 12, 2018. Bitcoin went from trading around $3,000 to higher than $10,000 over the next six months. That’s quite a spectacular and speedy jump for anyone who acted quickly.

Of course, that’s not what a lot of people do.

They wait to jump in until things feel “safer” — that is, after a lot of the early gains have already happened. But after its first big leg up, Bitcoin largely traded sideways for another year and a half before exploding higher yet again starting in late 2020.

By October 2021, it had gone north of $60,000!

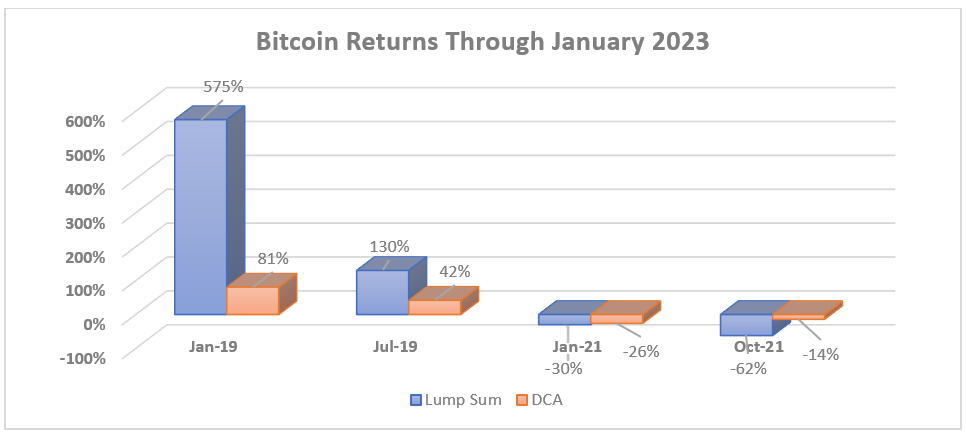

So, let’s look at returns through January 2023. Using a recent price of $23,198 for Bitcoin, the same buy points would have resulted in:

• A 574% return for someone who acted soon after our original big bottom call …

• A 130% return for someone who bought in July 2019 …

• A 30% open loss for someone who finally acted in January 2021 …

• And a 62% loss for the poor soul who bought in October 2021

It’s easy to see how timing is everything when you’re investing a lump sum of money into a volatile asset like Bitcoin.

So, how could DCA have changed the equation? We did a comprehensive study to find out.

Using monthly prices for Bitcoin, and assuming a fixed $1,000 investment each month, we compared a DCA approach with a lump sum approach over the same time periods mentioned above. Here’s a chart that summarizes everything:

You can see that a DCA approach would have led to substantially lower overall returns using start dates earlier in the bull market. However, it would have substantially reduced the losses for anyone who started buying later in the game.

So, the results largely mirror what Vanguard found during its study of DCA with traditional assets. It’s usually more profitable to buy as much and as soon as possible, especially at the beginning of a new bull market.

However, DCA is a terrific way to continually add to an existing position or start getting involved in crypto without undue worry or stress ... particularly for someone who doesn’t have a large lump sum to begin with.

So, if you’re looking to jump into crypto for the first time, it may be a strategy worth considering.

Alternatively, if you’re looking to narrow in on the best times to buy or sell, my colleague Juan Villaverde has been helping members do just that with a select group of top Weiss-rated cryptos in his Weiss Crypto Portfolio service since 2018.

In that time, he has a track record that boasts 50 open and closed positions averaging 113% gains on each.

Keep in mind, there’s only been one bull market in that time … but two bear markets.

Of course, past performance is no guarantee of future results. But with the most recent crypto winter behind us and a new bull market on the horizon, we predict the chances for continued high returns will be significantly better than usual.

To learn more about how Juan built his track record, and how he plans to move forward this year, I suggest you check out his presentation before we take it offline this week.

Best,

Nilus