|

| By Beth Canova |

The Cosmos (ATOM, Tech/Adoption Grade "C+") network is a collection of independent blockchain communities that connect and interact with each other via the Cosmos Hub.

Transacting via the Hub requires a fee payable in Cosmos' native token, ATOM. In fact, this was an early value accrual mechanism for the token.

But Cosmos has come quite a way from those early days. Now, you can validate transactions and contribute to the security of the network by staking your ATOM tokens for a solid 19% yield.

But Cosmos isn't done yet. A recently released 2.0 White Paper revealed a proposal by notable community members for four major expansions to the utility of the Cosmos Hub.

These upgrades have the potential to make ATOM more highly prized than ever — by users and investors alike!

Let's dive in one by one …

1. Interchain Security Sharing

Interchain security sharing is simply a mechanism whereby Cosmos Hub could make its superior decentralization and network security available to other community blockchains.

New or smaller blockchains in the Cosmos ecosystem would be able to benefit from the protection against bad actors andpotential regulations. In exchange for a fee, of course.

This will result in extra fees to ATOM stakers, payable in the coins of the networks that are being secured.

Here's how it works: By virtue of its maturity and visibility as the very first Cosmos blockchain, the Hub has a more diverse validator set than any of its Cosmos peers, with 175 validators total.

And the network is well diversified largely because it offers more airdrops of free tokens to those who chose to stake with smaller validators. Hence:

- A whopping 87% (152 out of 175) of these validators each control less than 1% of the voting power. Likewise …

- The two largest validators, Coinbase Custody and Binance Staking, currently control just 6.96% and 5.56%, respectively.

In other words, a more diversified validator set means more security.

And thanks to ATOM's robust 19% staking yield, a remarkable two-thirds (66.4%) of all exiting ATOM is currently staked. That amounts to roughly $2.5 billion, which means the network is being defended with $2.5 billion against attacks.

2. Liquid Staking

As stated earlier, ATOM token holders can earn passive income by staking their tokens with validators. But doing this involves locking the tokens up on the blockchain where they cannot be sold.

Liquid staking solutions allow investors to trade their staked, locked-up assets via a derivative token representing their stake. For example, there's a famous LIDOprotocol which issues liquid stETH to those who stake Ethereum (ETH, Tech/Adoption Grade "A").

In the same way, there will be stATOM for staked ATOM.

This basically opens the door to earning more than one stream of income from a single investment.

The Cosmos Hub will soon code liquid staking into the core of the network's code. Meaning, you will be able to free up and use your ATOM in decentralized finance spaces or elsewhere while still receiving those juicy yields and various tokens!

3. Interchain Scheduler

This completely new proposed feature is about maximal extractable value. MEV is the maximum value that can be extracted from block production beyond the standard block reward and gas fees.

For example, arranging the order of transactions in ways that permit or even encourage front running would increase MEV. So would rules that accept payments ponied up by users for preferential order flows.

Interchain Scheduler is the novel idea of creating a cross-chain marketplace for maximum extractable value. It would form a Cosmos-based multichain relay service that lets interested Cosmos users bid on block space across chains connected to the Hub.

By buying block space on different chains, users can lock in arbitrage opportunities with strong transaction-execution guarantees. Scheduler will then redirect revenue generated from the cross-chain MEV marketplace into the Cosmos Hub treasury.

4. Interchain Allocator

Interchain Allocator is a proposed new software module that lets Cosmos-based chains work together on economic coordination.

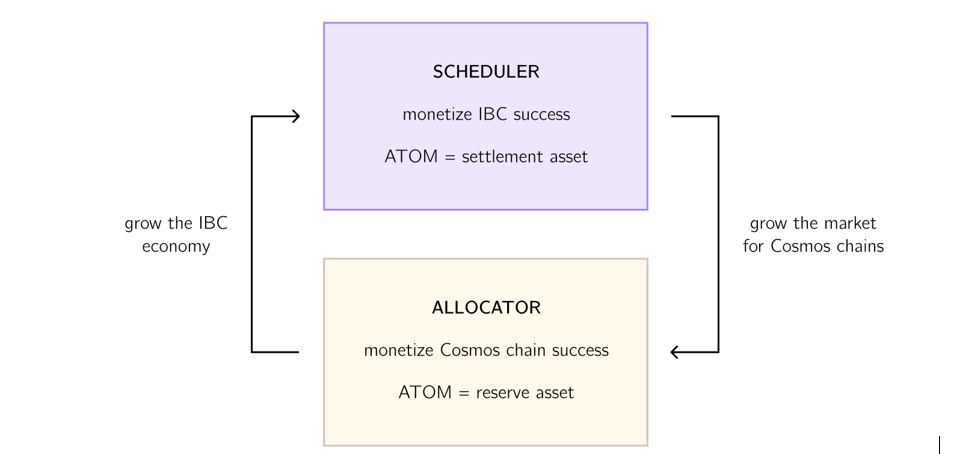

Together with Interchain Scheduler, the 2.0 White Paper envisions making the Cosmos Hub a self-propagating economic engine that drives the expansion and integration of the Cosmos Network, with ATOM as the preferred collateral.

Basically, Scheduler earns money and gives it to Allocator, which spends it on stuff to grow the system. In a larger system, Scheduler should make more money, which means still more money for Allocator to plow back into future growth.

As envisioned, it's a big positive feedback loop for Cosmos Hub and the value of ATOM.

So, those are four enticing new reasons to give ATOM a closer look as we wait for the market to bottom … and consider what tokens could outperform once it does.

If you want to keep a closer eye on ATOM, you can always add it to your alerts by going to the Cosmos page on our website and clicking the notification bell to the left of the rating:

Best,

Beth Canova