• Bitcoin (BTC, Tech/Adoption Grade “A-”) is down 3% today, trading around $64,000.

• Ethereum (ETH, Tech/Adoption Grade “A”) is also down 3%, sitting close to $4,600.

• Bitcoin’s crypto market dominance gained 30 basis points to 43.3% as the broader market largely mirrored the leader’s performance.

Bitcoin has since fallen back after reaching a new all-time high at $69,000 earlier this week. While this isn’t the move we were hoping for, we were due for a pullback as the $70,000 level had notable resistance according to our Crypto Timing Model.

Given Bitcoin’s size and scale, it tends to underperform during bullish periods and outperform during sell-offs, which is what we’re seeing now.

BTC’s price is approaching its 21-day moving average at $63,000. If the bulls can regain control, BTC will be able to keep this level as support while it regains its momentum. If it doesn’t see a bounce, $60,000 could act as a stronger support.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (Nasdaq: COIN):

Ethereum, like much of the market now, is trading in line with Bitcoin. It set a new all-time high this week near $4,900 before retracing back to its current level. In this case, though, the slide was overdue considering its consistent upward price action.

The second largest cryptocurrency has been trading in an ascending channel since the beginning of October, and it has not broken down aside from minor pullbacks. Given the consistent recent uptrend, it wouldn’t be surprising to see ETH’s price pause for a brief period of consolidation.

Ethereum still hasn’t tested its 21-day moving average since Oct. 1, and it’s price action has outperformed Bitcoin’s. Plus, ETH will continue to see positive pressure from the EIP-1559 update’s fee burning — and the asset hit a significant milestone yesterday after $4 billion worth of ETH was burned since the upgrade.

All in all, ETH’s chart is still looking bullish even after this correction.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Index Roundup

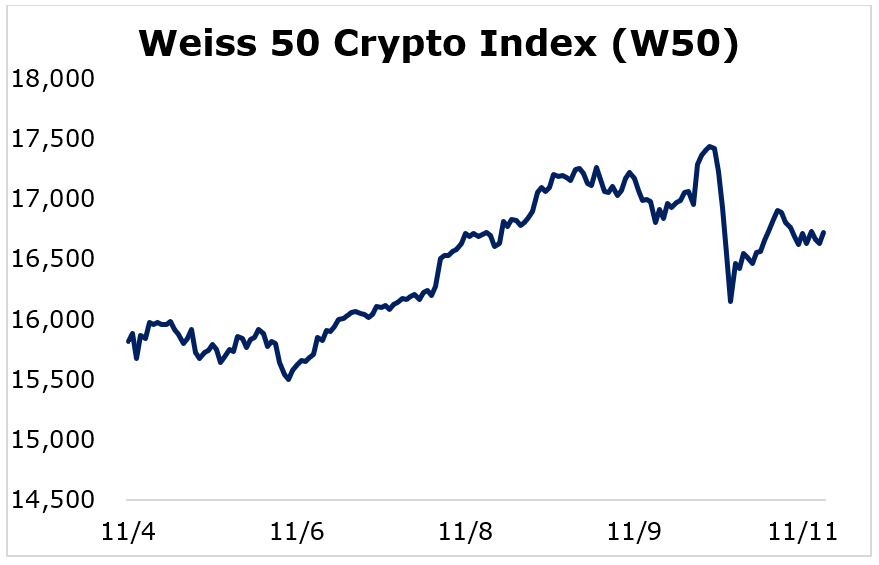

Despite the recent pullback, the crypto market ended the seven-day trading week in the green on Thursday.

The Weiss 50 Crypto Index (W50) gained 5.71%, which was similar to last week’s performance.

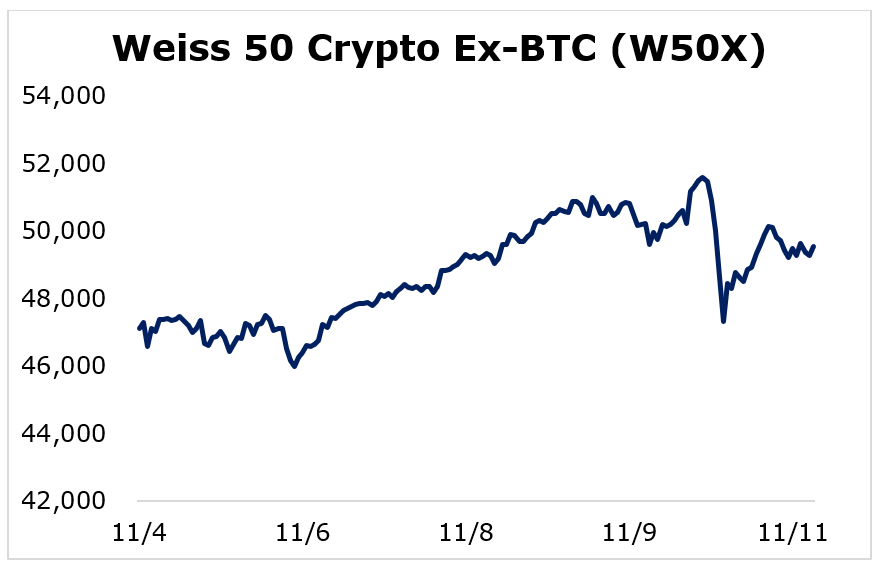

The Weiss 50 Crypto Ex-BTC Index (W50X) increased 5.16%, showing how Bitcoin performed mostly in line with the broader market.

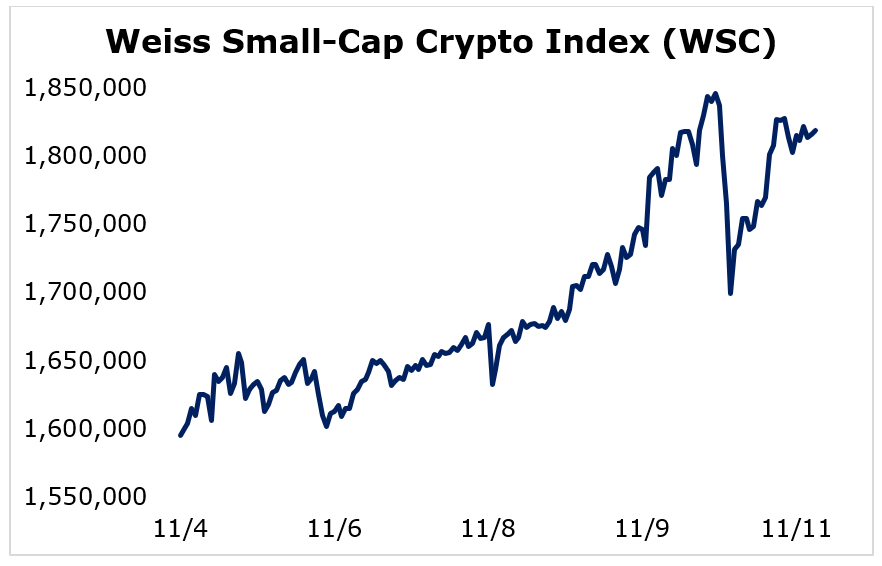

Breaking down performance this week by market capitalization, we see that the small-caps took the top spot again due to their quicker recovery after the dip.

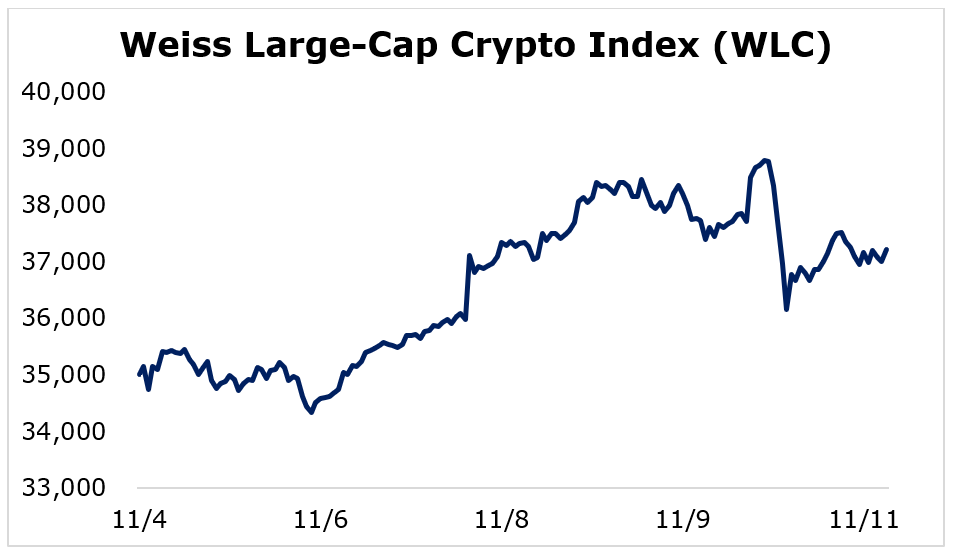

The Weiss Large-Cap Crypto Index (WLC) rose 6.33%, narrowly beating mid-cap performance as large-cap cryptos held their value better during the correction.

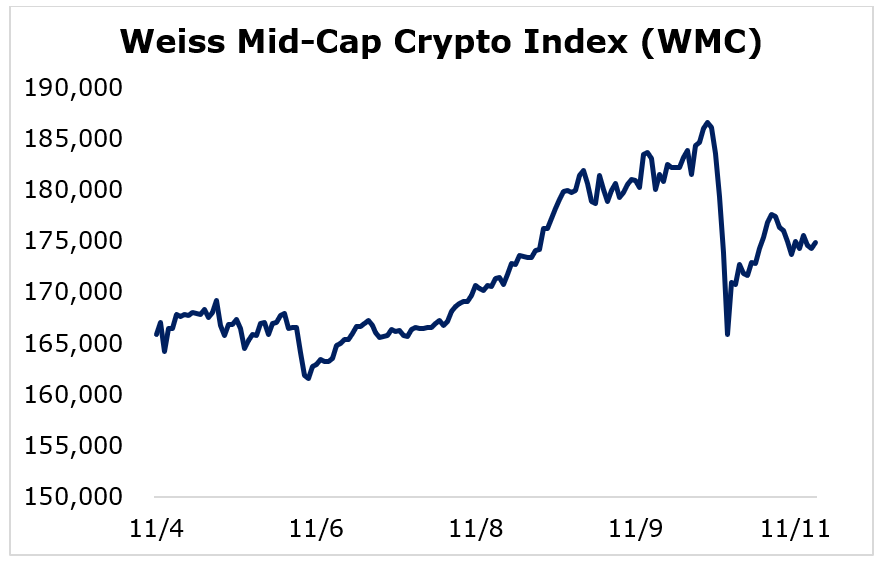

The mid-caps underperformed but still logged a positive week as the Weiss Mid-Cap Crypto Index (WMC) shows a 5.38% gain.

The Weiss Small-Cap Crypto Index (WSC) climbed 13.99%, finishing the week as the top performing index again.

During the sharp late-week drop, the largest cryptocurrencies held their value the best. However, the small-caps had the biggest rebound with a “V-shaped” recovery, allowing them to outperform.

Mid-cap cryptocurrencies experienced similar volatility to the smallest tokens, but they couldn’t manage to mirror their swift recovery.

While the small-caps outperformed, it’s a good sign to see Bitcoin setting records. It shows there’s still plenty of momentum in this bull run.

Notable News, Notes and Tweets

• Miami Mayor Francis Suarez announced that the city plans to distribute a Bitcoin yield to its residents.

• Michael Saylor highlights Bitcoin’s strength and performance vs. gold.

• The U.S. Securities and Exchange Commission (SEC) rejected VanEck’s application to launch a spot price Bitcoin exchange-traded fund (ETF).

What’s Next

Pullbacks are inevitable given the volatility of the crypto landscape, and the minor correction of the past few days is a healthy development. Nothing goes up in a straight line … and zigzagging upward price trends are much healthier than a hype-driven frenzy.

Taking a look at the fundamentals, there are plenty of reasons to be bullish on crypto long term.

October’s U.S. CPI data released on Nov. 10 showed a 6.2% increase in consumer prices over the prior 12 months, which was its largest change in the past 30 years.

With easy fiscal and monetary policies threatening purchasing power by eroding the value of the dollar, investors are looking for alternatives.

For the past several years, Bitcoin has sold itself as digital gold, the next-gen store of value. And it’s worked to pique the interest of those unsatisfied with what they’re seeing in the traditional markets.

Bitcoin adoption is progressing as expected, with more big-foot investors and institutions jumping in.

Beyond Bitcoin, other assets — specifically those in the decentralized finance sector — are building a strong case as alternative hedges against the traditional financial system, which should greatly help boost asset prices over the long term.

Best,

Sam