|

| By Sam Blumenfeld |

The crypto market continues swinging as investors digest inflation and developments in Ukraine.

Bitcoin (BTC, Tech/Adoption Grade "A-") was able to eclipse $40,000 this morning, but it struggled after running into resistance. Its market dominance has trended higher over the past three months, increasing from about 40% to 44% during recent spikes, as funds generally flow into Bitcoin when uncertainty spooks investors.

The asset has traded range-bound since Feb. 2, never closing below $37,000 but has also never been able to close above resistance at $45,000.

But Bitcoin did manage to overtake its 21-day moving average on March 9 before losing ground yesterday. It was able to retake it earlier today, but it wasn't able to gather enough momentum to hold itself above $39,700.

If Bitcoin is able to sustainably cross $40,000, it would bode well for making another run at overtaking its recent triple top at $45,000.

Here's Bitcoin's price in U.S. dollars via Coinbase Global (COIN):

Ethereum (ETH, Tech/Adoption Grade "A") has struggled more than Bitcoin recently, continuing its trend of recently setting lower highs. However, it's a good sign that the asset isn't setting decisively lower lows.

ETH has found support between $2,500–$2,600 several times since Feb. 21, and buyers will need to come to the rescue again to keep Ethereum above the important $2,500 level. It attempted to overtake its 21-day moving average just below $2,700 earlier in today's trading session, but it ran into resistance and pulled back.

Altcoins follow the movements of Ethereum more closely than Bitcoin, so it would be a better sign for the broader market if ETH can manage to rebound and hold itself above the early March top around $3,000.

Here's Ethereum's price in U.S. dollars via Coinbase:

Index Roundup

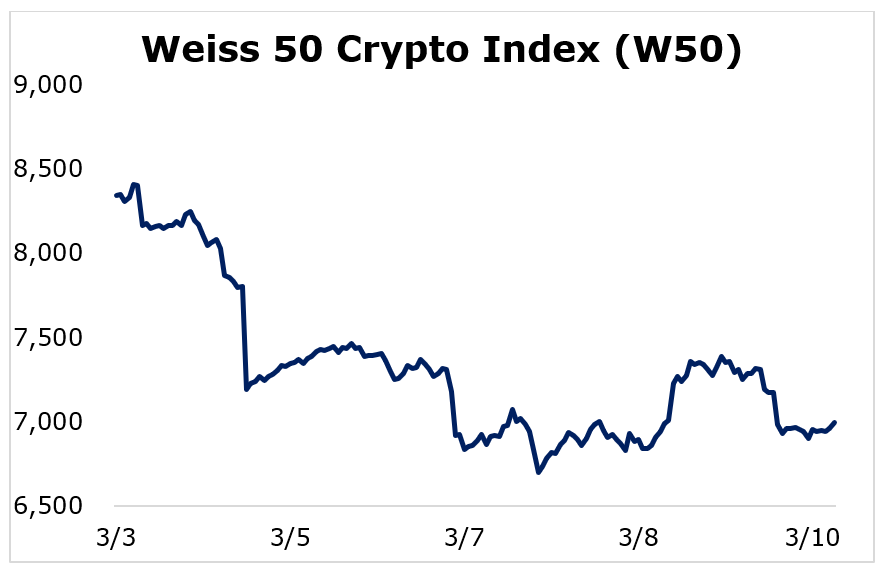

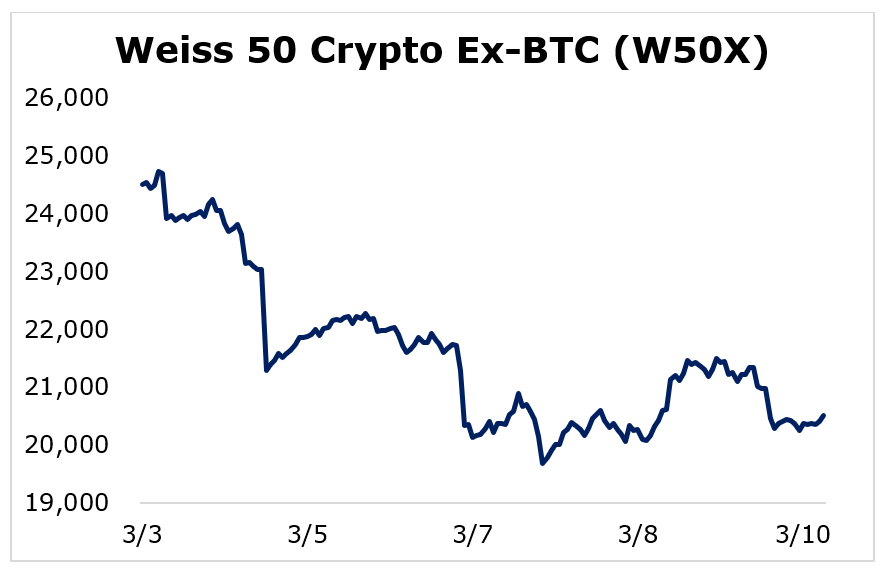

Most of the crypto market finished the seven-day trading week ending Thursday in the red after a rough start.

The Weiss 50 Crypto Index (W50) fell 16.16%, as most cryptocurrencies finished decisively lower.

The Weiss 50 Crypto Ex-BTC Index (W50X) lost 16.32%, highlighting that Bitcoin traded almost exactly in line with the broader market.

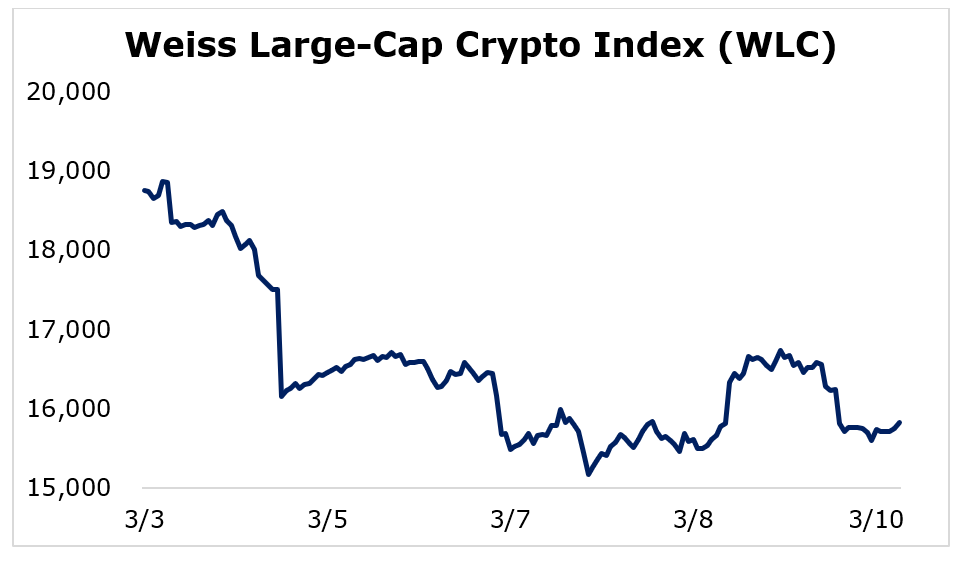

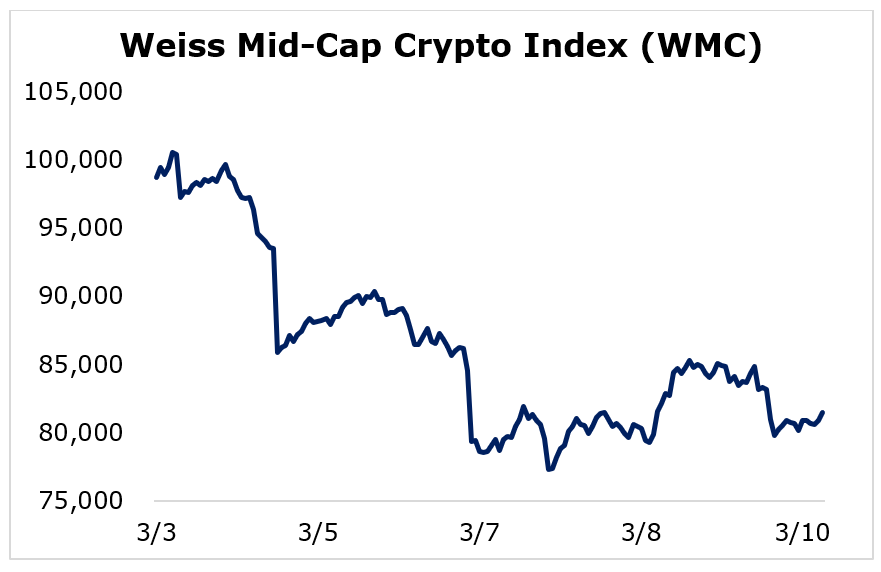

Breaking down this week's performance by market capitalization, we see that, unlike last week, mid-cap cryptocurrencies fared the worst , while the largest and smallest cryptocurrencies slid less.

The large-caps finished in the middle of the road, with the Weiss Large-Cap Crypto Index (WLC) slipping 15.58%.

The mid-caps struggled the most, as the Weiss Mid-Cap Crypto Index (WMC) declined 17.46%.

The smallest cryptocurrencies managed to hold their value better than the largest and mid-sized cryptocurrencies. The Weiss Small-Cap Crypto Index (WSC) decreased 11.57%.

The crypto market is still looking to establish a direction after it bounced off its late-January lows into a relief rally. While small-cap cryptocurrencies were the most resilient this week, they'll likely still rely on Ethereum and the large-caps for a sense of future direction.

Notable News, Notes and Tweets

- Pomp emphasizes that ordinary citizens are worse off due to the recklessness of governments and central banks.

- Michael Saylor claims that war will speed up Bitcoin's adoption.

- The Securities and Exchange Commission (SEC) has denied spot Bitcoin ETF applications from NYGID and Global X, following its rejections from WisdomTree and VanEck.

What's Next

The crypto market is struggling to establish a definitive direction as information pours in about inflation and the war in Ukraine.

Thursday's inflation data from the Bureau of Labor Statistics showed that purchasing power is nearly 8% lower than a year ago as households continue feeling the effects on food, shelter and gasoline prices.

As governments and central banks erode value by carelessly spending and printing money, the case for crypto continues to build. Americans are increasingly placing their bets on crypto, with about 16% of citizens — or 40 million people — holding or trading it.

With a strong use case and constantly growing adoption, crypto's long-term prospects are extremely bright.

Best,

Sam