|

| By Sam Blumenfeld |

Bitcoin (BTC, Tech/Adoption Grade “A-”) and the broader crypto market have struggled mightily over the past month. The market leaders are managing to hold their value better than less-established projects, but no names have been spared.

Notably, the crypto market decoupled from the traditional equity market trading this week. While that was something we were hoping to see, unfortunately, crypto decoupled to the downside. While technology stocks and other risk assets saw solid rebounds, crypto slid further.

Still, Bitcoin has been able to stay above key support, keeping the broad market moving sideways.

BTC tracks a 26% loss over the past 30 days and is still trading below its 21-day moving average. Because it’s mostly managed to trade sideways over the past week, it would only need to surpass $30,000 to overtake the short-term momentum indicator.

Bitcoin hasn’t been able to challenge its 21-day moving average since it crossed below on May 5.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (COIN):

While Bitcoin has mostly managed to trade sideways over the past two weeks, Ethereum (ETH, Tech/Adoption Grade “A”) broke lower. The asset closed below support at $2,000 and then $1,900, which could lead to the continuation of a pattern of lower highs and lower lows. This is the last thing altcoins need since most rely on Ethereum for direction.

ETH is down 38% over the past month, and it trades further away from its 21-day moving average near $2,070.

However, the second-largest crypto by market cap does have a potential positive catalyst coming at the end of summer. After its delay from June, Ethereum’s Merge event could happen in August.

As a reminder, the Merge event is when the Ethereum mainnet will "merge" with the beacon chain proof-of-stake (PoS) system. This will mark the end of proof-of-work (PoW) for Ethereum and the full transition to PoS.

The anticipation and hype could be enough to spark a rally. After all, previous steps taken toward this goal, like the London hard fork in 2021, have had positive impacts on price action.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Index Roundup

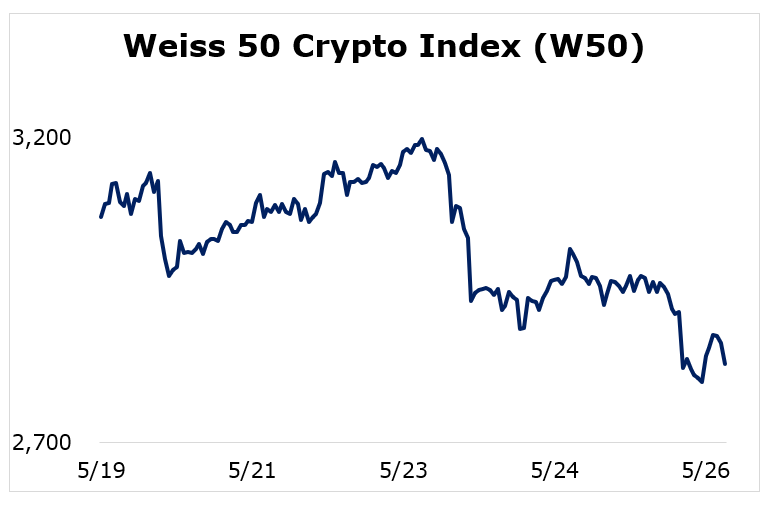

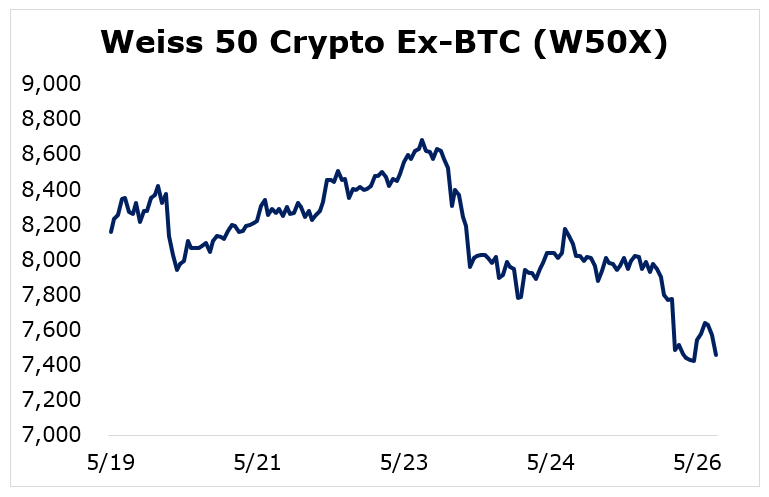

After last week’s relief bounce, the crypto market mostly finished the week lower.

The Weiss 50 Crypto Index (W50) finished 7.83% lower, as the crypto market gave back most of last week’s gains.

The Weiss 50 Ex-BTC Index (W50X) slid 8.56%, as altcoins continued losing ground to the market leader.

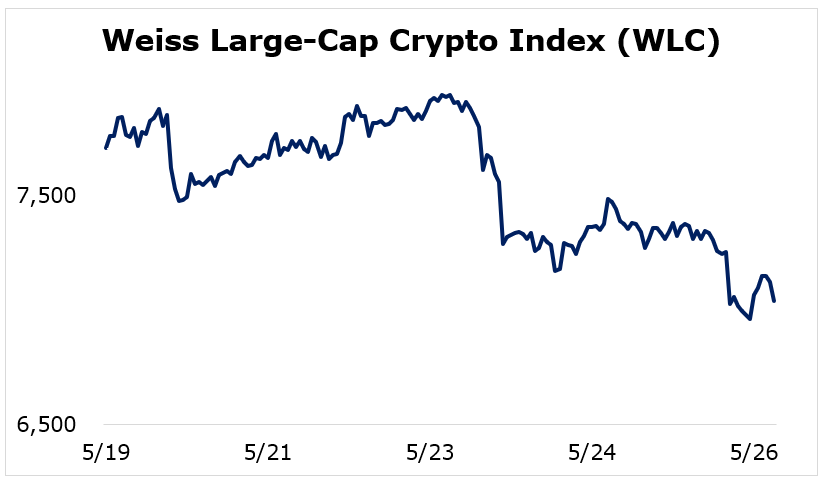

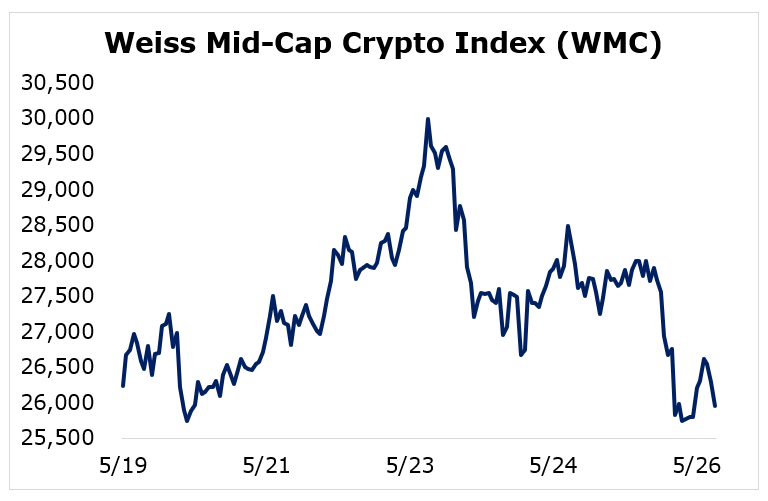

Breaking down performance this week by market capitalization, we see that the largest and smallest cryptocurrencies performed similarly while the mid-caps retained the most value.

The large-caps struggled this week, with the Weiss Large-Cap Crypto Index (WLC) declining 8.67%.

The mid-sized cryptocurrencies almost broke even, as the Weiss Mid-Cap Crypto Index (WMC) dipped 1.10%.

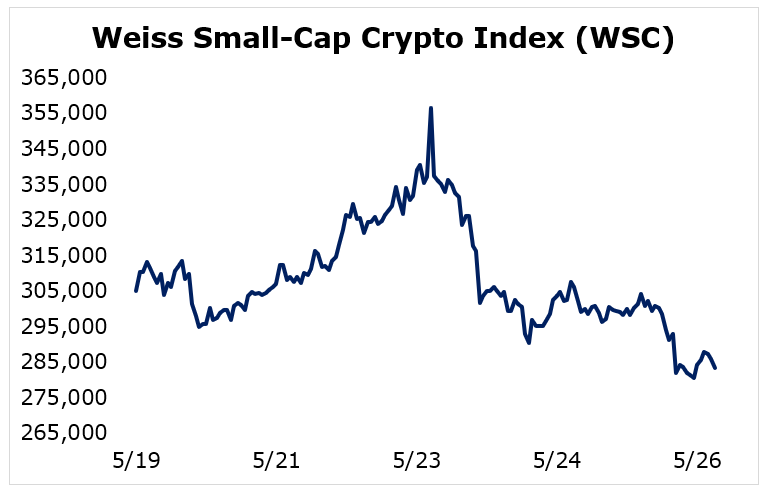

The smallest cryptocurrencies finished in the middle of the road, with the Weiss Small-Cap Crypto Index (WSC) losing 7.12%.

Large-cap cryptocurrencies weren’t able to extend last week’s relief bounce, which hurts upside in the short term.

However, Bitcoin’s increase in market dominance reflected how it was mostly able to hold its ground despite large-cap losses. If the established cryptocurrencies can follow its lead, price action could turn better.

Notable News, Notes and Tweets

- Pomp emphasizes that some central bankers are Bitcoin advocates behind the scenes.

- Russia is considering using cryptocurrencies as a form of international payment as Western countries impose sanctions.

- JPMorgan Chase (JPM) sees significant upside for Bitcoin despite its long-time skeptic CEO Jamie Dimon once calling it “worthless.”

What’s Next

The crypto market is struggling to maintain any momentum as assets continue sliding. However, the short-term negative of decoupling from technology stocks during a rebound could turn into a long-term blessing if crypto can maintain a lower correlation.

It’s likely that major macroeconomic policy decisions moving forward affect both traditional equity and crypto markets, but for crypto to eventually succeed in becoming fully mainstream, it needs to maintain its pricing independence.

The surging adoption and long-term prospects of crypto strengthen the argument that it’ll overcome its short-term challenges. Investors will likely always have to deal with the volatility of the asset class, but crypto’s upside should reward long-term holders.

Best,

Sam