We live in tumultuous times. Almost in real time, we can see fear, panic and paranoia seep into markets as macroeconomic factors add downside pressure to crypto markets.

Indeed, January has been rough. Just last week, we had the worst Bitcoin (BTC, Tech/Adoption Grade “A-”) price crash in this month. Bitcoin has recovered some since, but we’re still in the extreme fear territory.

Does this mean BTC isn’t a safe haven like we’ve come to see it as?

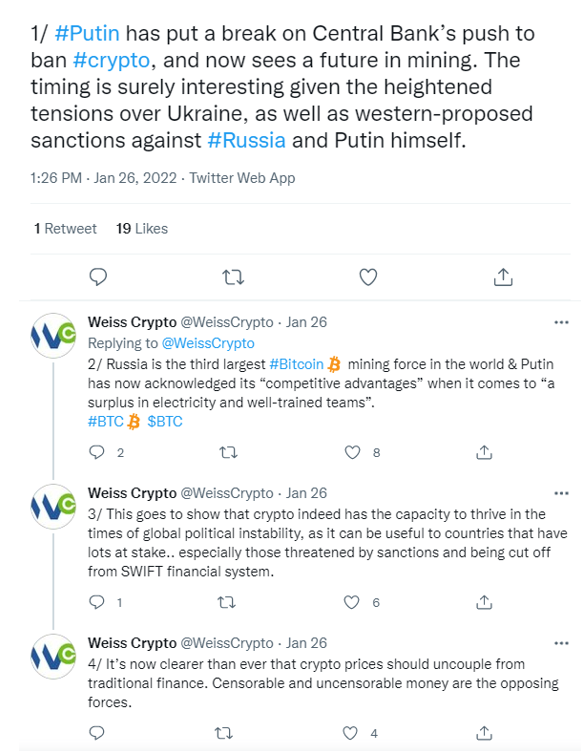

Not at all. Just look at what’s happening over in Russia, a country that has previously been vehemently against crypto:

Meanwhile in the U.S., assets across the board sold after the Federal Open Market Committee meeting concluded. In his article, Alex Benfield explained yesterday how the Fed holding onto its hawkish outlook would affect the markets.

Pressure on crypto is coming from across the ocean as well.

The E.U. is doing its utmost to prepare the ground for their central bank digital currency (CBDC). One of the key strategies seems to be to put a stranglehold on any competition this faux crypto may have. This time, they’re going after proof-of-work (PoW) miners — namely the ones mining BTC, but also other cryptos utilizing the PoW architecture. The excuse for shutting them down is that PoW mining uses too much energy.

The end game here is to turn the heat up even further on a market already sweltering under extreme fear and horrible price action to paralyze miners and cause an institutional exodus from crypto.

This is hardly surprising. No large power will ever be OK with crypto as it undermines their authority and ability to influence the economy and society at large. However, crypto does not care. In the words of Weiss Crypto analyst and editor of the Weiss Crypto Portfolio, Juan Villaverde, crypto need not ask for permission; it will build, expand and apologize later.

A good example of this in action is the fan favorite Cardano (ADA, Tech/Adoption Grade “B”):

As a project with one of the strongest communities out there, Cardano deserves a more thorough insight. Luckily, our own Marija Matić gave it a proper look and delivered a well-received analysis:

Even though the price action has been less than favorable for quite a while now, the crypto machine doesn’t care. It keeps on churning, and both mainstream adoption and project growth continue improving at a steady pace.

I’ve said it before, but in times like these, it bears repeating: Crypto is here to stay — now, and for many years in the future.

Stay safe and trade well,

Jurica Dujmovic