Crypto Extends Its Slide Amid Interest Rate Uncertainty

|

| By Sam Blumenfeld |

Bitcoin (BTC, Tech/Adoption Grade "A-) and other cryptocurrencies continue showing weakness along with traditional equities and other risk assets in reaction to the Federal Reserve's projected interest rate hikes.

Despite being a hedge against inflation and a weakening dollar, the crypto market is unlikely to decouple from traditional equity markets until investors gain greater clarity around the state of the economy and future macroeconomic policy … and how the broad crypto space factors into it all.

BTC is down about 17% over the past month and recently fell below key support. We'd need to see the market leader reclaim the $40,000 landmark again before we can expect any significant upside moves in the broad market. But as the market continues trading in a neutral cycle, it's entirely possible that Bitcoin finds itself moving back and forth in a wide range over the next couple of months.

Bitcoin attempted to overtake its 21-day moving average twice this week, but it faced immediate resistance. The asset would need to pass $40,250 to regain its short-term momentum. In the meantime, news about inflation, regulations and Ukraine will drive the direction of short-term trading.

Here's Bitcoin's price in U.S. dollars via Coinbase (COIN):

Ethereum (ETH, Tech/Adoption Grade "A") has trended downward with most altcoins since the overdue pullback at the beginning of this month. Like Bitcoin, Ethereum was able to challenge its 21-day moving average before pulling back with the rest of the crypto market. ETH's 21-day moving average sits just above $3,000, which could prove to be an important psychological resistance level for traders.

Ethereum's chart shows a bit more volume than BTC's, and it briefly overtook the $3,000 level earlier this week … before sliding back down to $2,800, where it found support. A sustained breakout past $3,000 could signal that Ethereum is regaining its short-term juice. Investors can still look forward to its shift to proof-of-stake (PoS) consensus later this year as a potential positive catalyst.

Here's Ethereum's price in U.S. dollars via Coinbase:

Index Roundup

The broader crypto market finished the seven-day trading week lower, but the established cryptocurrencies held their ground better than their more speculative counterparts.

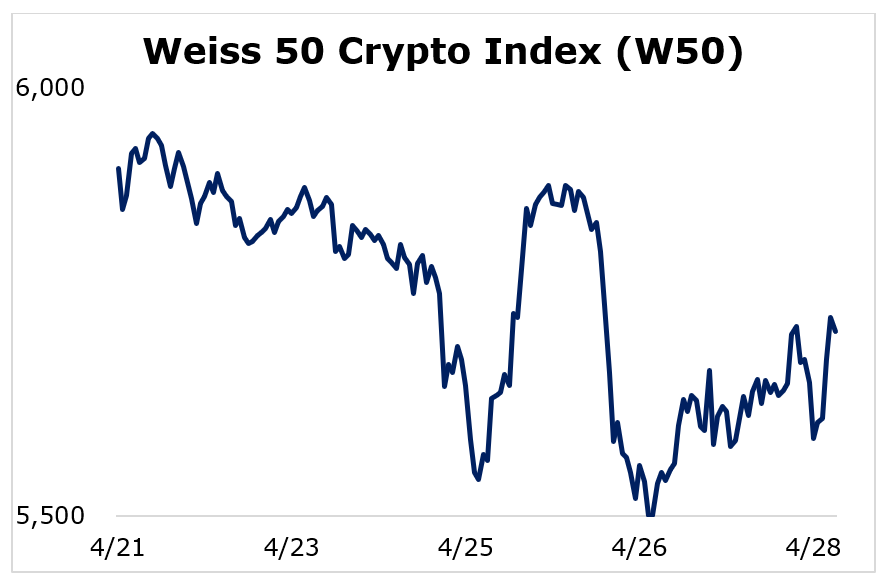

The Weiss 50 Crypto Index (W50) slid 3.23%, with most cryptocurrencies sliding below their weekly starting positions.

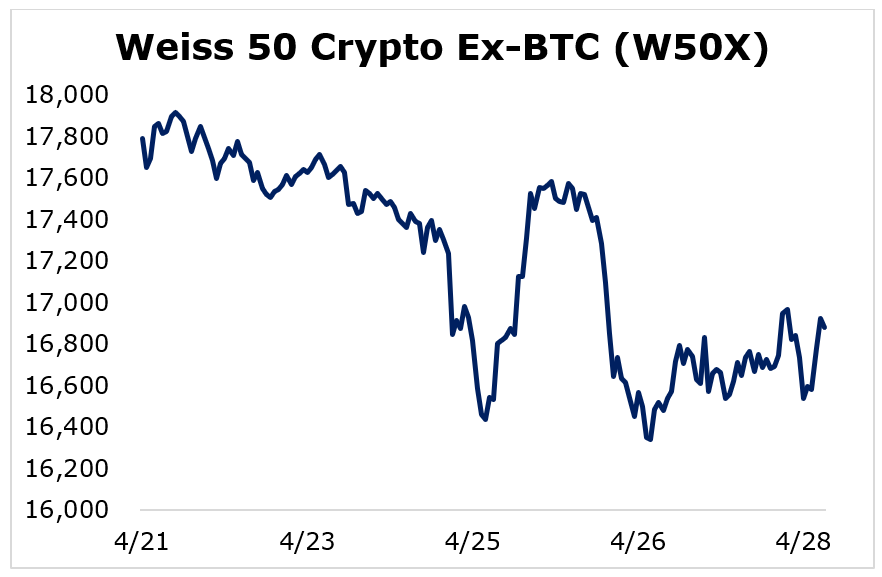

The Weiss 50 Crypto Ex-BTC Index (W50X) lost 5.13%, highlighting how Bitcoin managed to outperform the broader market.

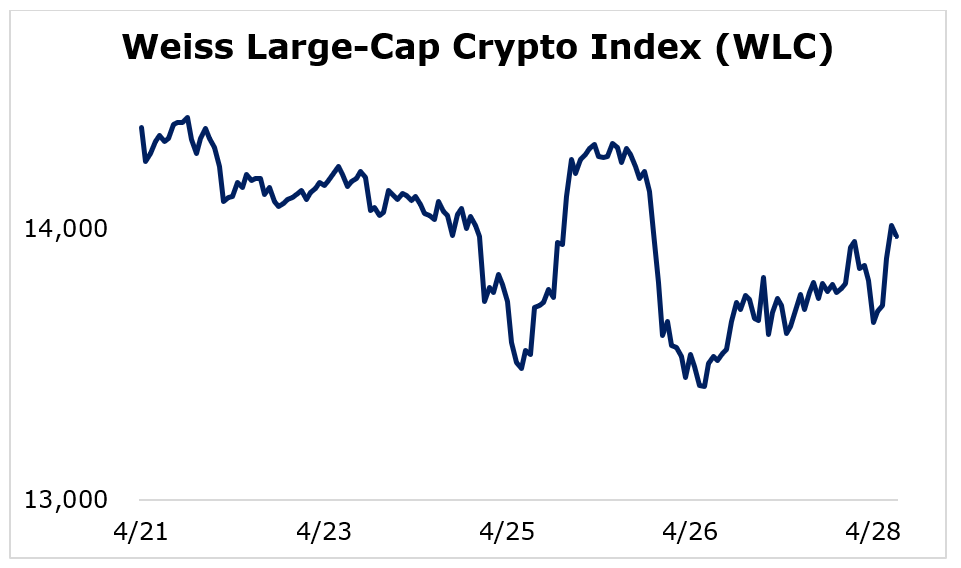

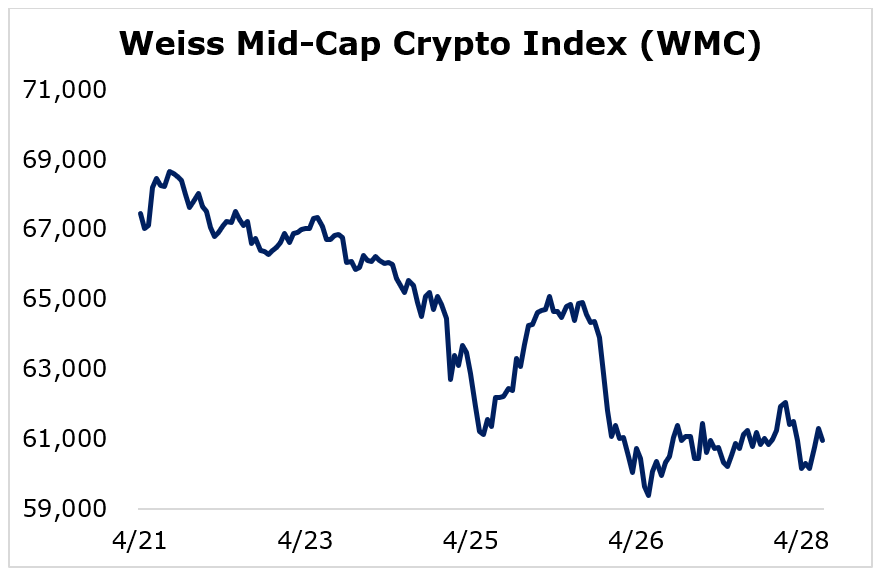

Breaking down performance this week by market capitalization, we see that the large-caps fared better than the smaller and mid-sized cryptocurrencies. This is usually expected during pullbacks.

The large-caps showed resilience in a choppy trading week, as the Weiss Large-Cap Crypto Index (WLC) dipped 2.80%.

Mid-cap cryptocurrencies were the biggest underperformers, with the Weiss Mid-Cap Crypto Index (WMC) falling 9.63%.

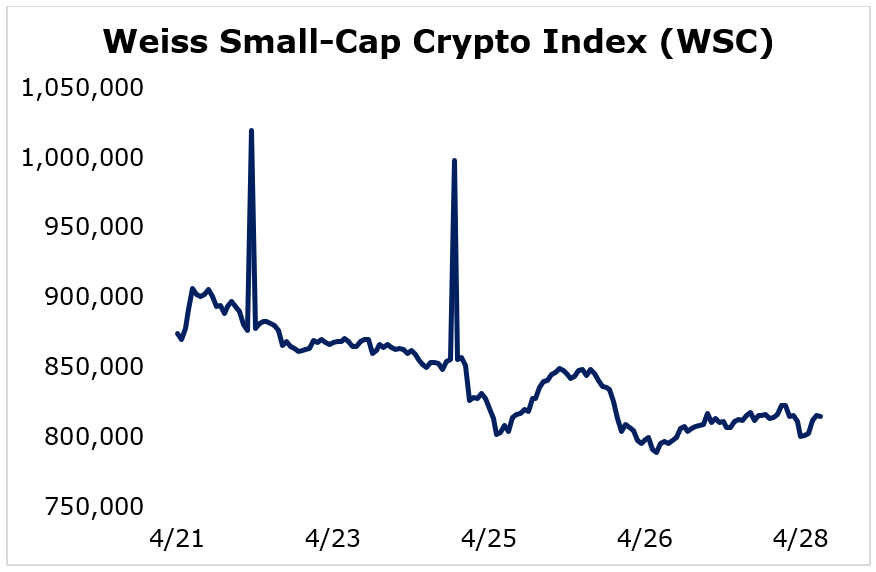

The small-caps experienced the most volatility again, but they managed to outperform the mid-cap cryptocurrencies. The Weiss Small-Cap Crypto Index (WSC) dropped 6.74%.

Bitcoin's outperformance vs. altcoins was reflected in its increase in market dominance, which jumped 50 basis points this week to 42.2%. Over the past several weeks, it's held in a tight range between 41.3% and 42.3%.

The crypto market will likely rely on the large-caps to set a new reverse downtrend this month.

Notable News, Notes and Tweets

- Pomp emphasizes how Bitcoin's hashrate just set a new all-time high.

- Fidelity will start allowing people to invest in Bitcoin with their retirement accounts.

- Goldman Sachs Group Inc. (GS) issued its first loan collateralized by Bitcoin, and other Wall Street banks could follow.

What's Next

Crypto adoption continues soaring, and this week's developments should pave the way for greater investment and economic activity in the space. Crypto-backed loans recognize digital assets as viable collateral, while adding access to crypto in 401k plans gives the opportunity to diversify across asset classes.

With inflation soaring to multidecade highs, the market is pricing in more decisive action from the Federal Reserve. The immediate direction of the crypto market will likely come down to how investors react to both the Fed's actions and the roadmap it sees moving forward.

Short-term reactions to tightening monetary policies won't challenge the industry's long-term viability, but it could bring more volatility.

Best,

Sam