Crypto Extends Rally Amid Interest Rate Uncertainty

By Sam Blumenfeld

|

- Bitcoin (BTC, Tech/Adoption Grade “A-”) is flat today, but it’s trying to extend the rebound that’s taken it back from $33,000 to $43,500.

- Ethereum (ETH, Tech/Adoption Grade “A”) is up 1%, and it’s back above $3,100.

- Bitcoin’s crypto market dominance increased 70 basis points to 42.7% as it looks to continue the breakout past its recent 40%-42% range.

Bitcoin is up over 30% from its Jan. 24 low of $33,000, but the road to its former highs will likely get tougher from here as we expect stiff resistance at $46,000 and the psychologically important $50,000 level.

The market leader attempted to overtake $46,000 yesterday, but it faced strong selling pressure. It didn’t help that St. Louis Fed President James Bullard called for an interest rate increase of 100 basis points by July 1. The comment put a damper on the rally as investors rotated out of technology stocks and risk assets.

Despite the drop to $43,500, Bitcoin is still trading significantly above its 21-day moving average near $39,000. A slide below its 21-day moving average could spell the end of a relief rally under these choppy market conditions.

We think that outcome is less likely at the moment considering how overdue this rally is after three months of constant selling pressure.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (Nasdaq: COIN):

ETH is back above the critical $3,000 price level after bouncing 44% from its late-January low near $2,160. Ethereum would likely face substantial resistance at both $3,400 and $3,800 if it can extend its climb.

Like Bitcoin, Ethereum is also trading above its 21-day moving average of $2,775 and will need to stay above this level to maintain its momentum.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Index Roundup

The broader crypto market finished the week higher and continued its comeback, as cryptocurrencies of all sizes experienced gains.

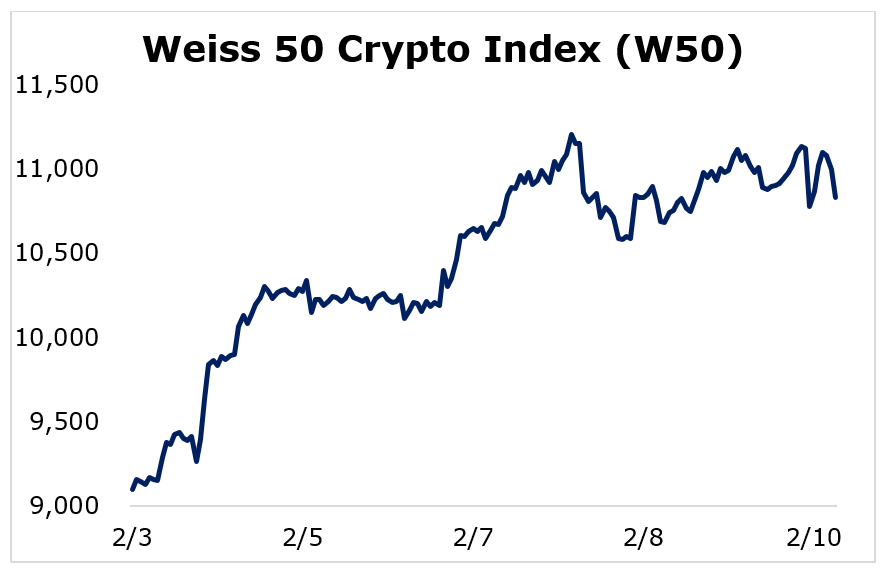

The Weiss 50 Crypto Index (W50) jumped 19.04% as the rally closes out its first full week of upward momentum.

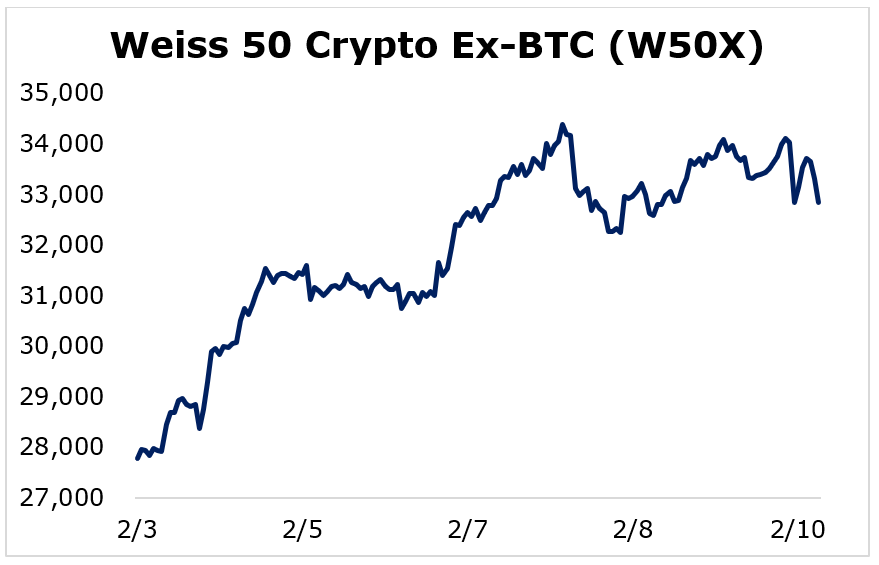

The Weiss 50 Crypto Ex-BTC Index (W50X) gained 18.21%, showing that Bitcoin performed mostly in-line with altcoins.

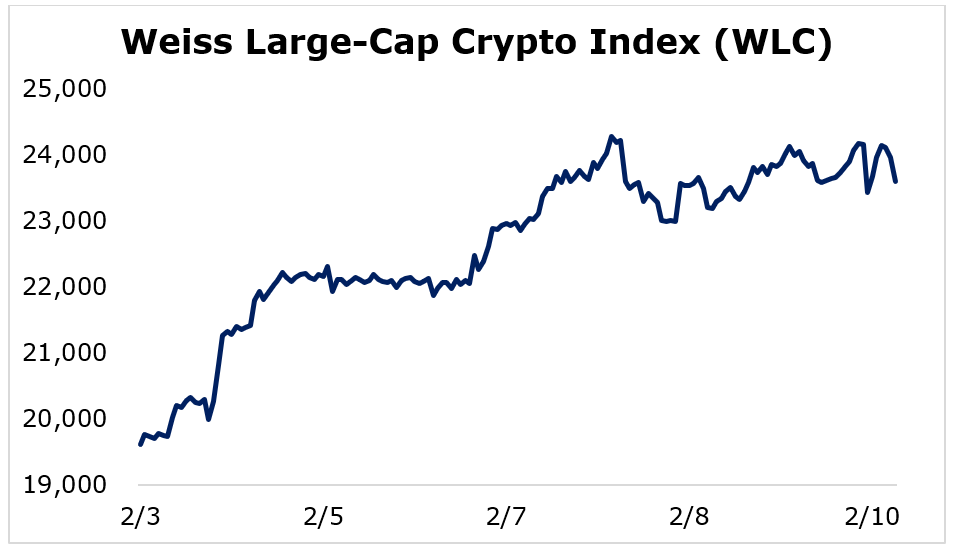

Breaking down this week’s performance by market capitalization, we see that the large caps lead the way while trying to establish momentum for a positive market direction. The Weiss Large-Cap Crypto Index (WLC) soared 20.30%.

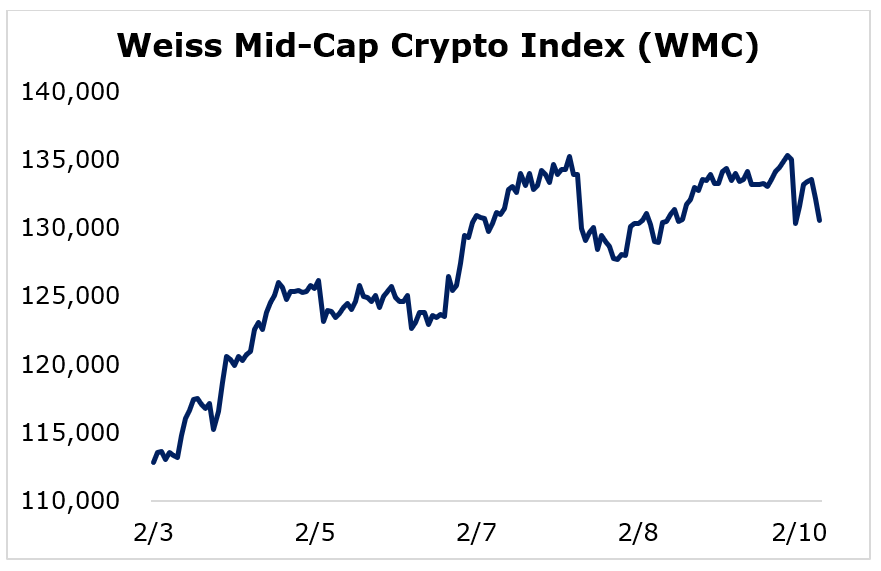

Mid-sized cryptocurrencies lagged the rest of the market, but their performance was still strong with the Weiss Mid-Cap Crypto Index (WMC) clocking an increase of 15.77%.

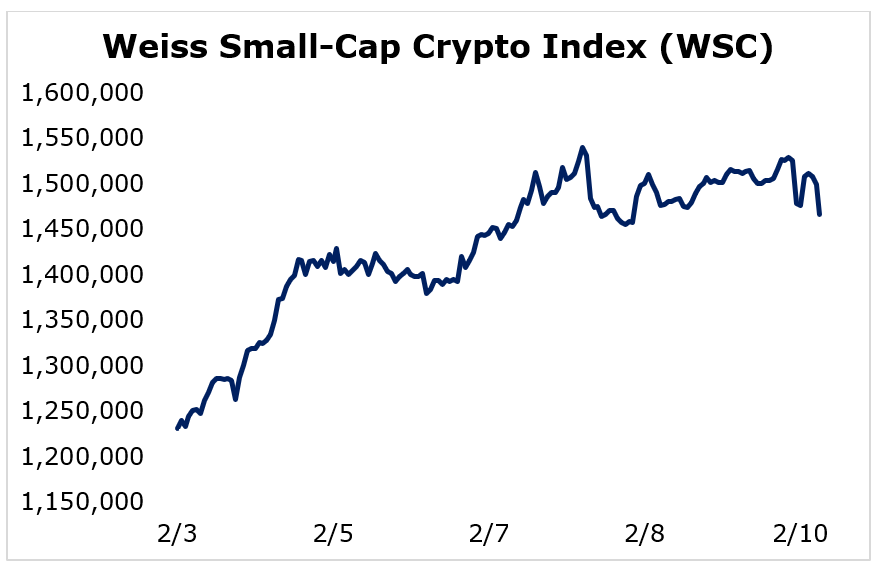

The small-caps narrowly missed making the biggest move, as the Weiss Small-Cap Crypto Index (WSC) increased 19.04%.

While more established cryptos lead the charge this week, the bullish sentiment was clearly felt across the board. But the next few weeks will be important as we determine how well the market can fight against a slide back to January’s lows.

Notable News, Notes and Tweets

- Crypto whales with over 1,000 BTC have resumed accumulating their positions during this rebound.

- Binance is investing $200 million in Forbes to make crypto information more available to readers.

- Super Bowl viewers can expect to see several crypto-related ads from exchanges and other companies.

What’s Next

Crypto is becoming more mainstream. Exchanges and other crypto companies — recognizing that more people are looking to enter the market — are going to try to capitalize on that interest by spending $6.5 million per 30 second ad during the Super Bowl.

Still, investors should be cautious given the swinging sentiment and uncertainty of this market cycle stage.

The broader crypto market has tried to decouple from technology stocks, but macroeconomic news continues to impact trading for both crypto and traditional equity markets.

The approach that the Federal Reserve takes to raise interest rates will certainly have an impact on crypto’s movements, but that won’t last forever.

In the meantime, investors will likely see higher volatility until the dust settles. So, trade wisely, and keep checking in with our Weiss Crypto Daily content for the latest on crypto.

Best,

Sam