|

| By Sam Blumenfeld |

Bitcoin (BTC, Tech/Adoption Grade “A-”) and the broad market have benefitted from the Federal Reserve’s decision to raise interest rates by 25 basis points instead of a more decisive 50 basis points. Cryptocurrencies, along with technology stocks and other risk assets, have rebounded over the past several days in response.

Bitcoin will need to eclipse the strong resistance level of $45,000 if it hopes to stage a larger comeback rally. BTC struggled in its last three attempts, creating the triple-top pattern that sent the asset barreling lower. A daily close above $44,500 would set the stage for a stronger positive move.

The No. 1 crypto by market cap is down 1% so far today. But despite the minor pullback, it’s trading above its 21-day moving average of $40,100 after testing the level and bouncing off it earlier today. That’s a positive sign, but it will be important for Bitcoin to jump again if the level is retested. If not, it could lose the short-term momentum that it gathered.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (COIN):

Ethereum (ETH, Tech/Adoption Grade “A”), on the other hand, is up 1% and has logged five consecutive green candles, including today’s trading. That’s its best stretch since the middle of its February relief rally.

Like BTC, ETH is trading above its 21-day moving average. But it’s not just following Bitcoin anymore: It outperformed BTC over the past seven days, with a 13% gain vs. BTC’s 6% move.

Altcoins usually rely on Ethereum’s movements for direction, so it’ll be critical for much of the broad market that ETH manages to continue gathering steam.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Index Roundup

It was a mixed week of trading for the crypto market, but it finished with a relatively small change overall.

The Weiss 50 Crypto Index (W50) slipped 4.41%, as the market tried to make a run at the end of the week, offsetting earlier losses.

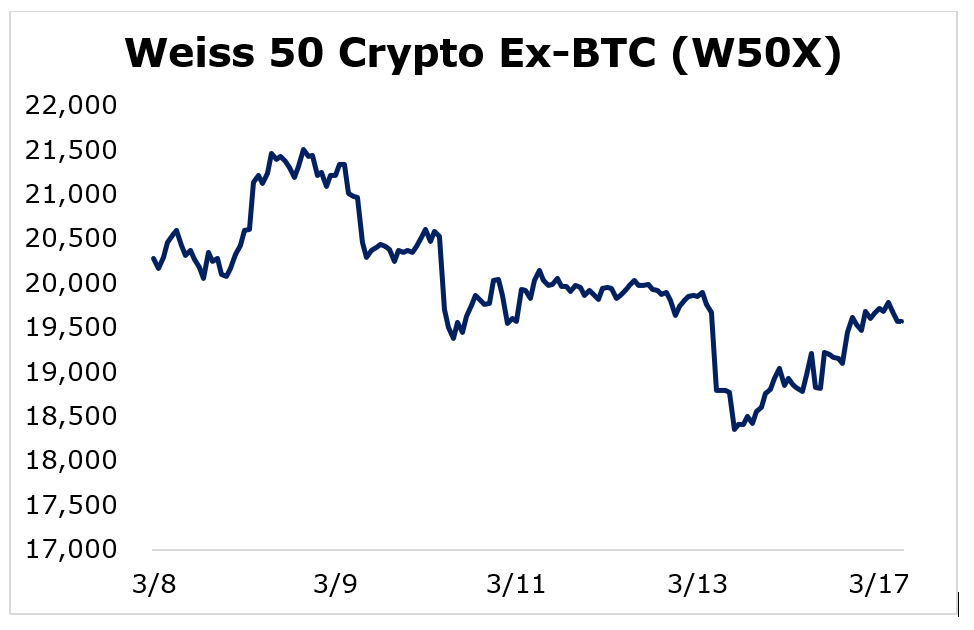

The Weiss 50 Crypto Ex-BTC Index (W50X) slid 3.48%, showing that Bitcoin largely matched the broader market’s performance but underperformed slightly.

Breaking things down by market capitalization, we see that trading over the week ended with little change across the board.

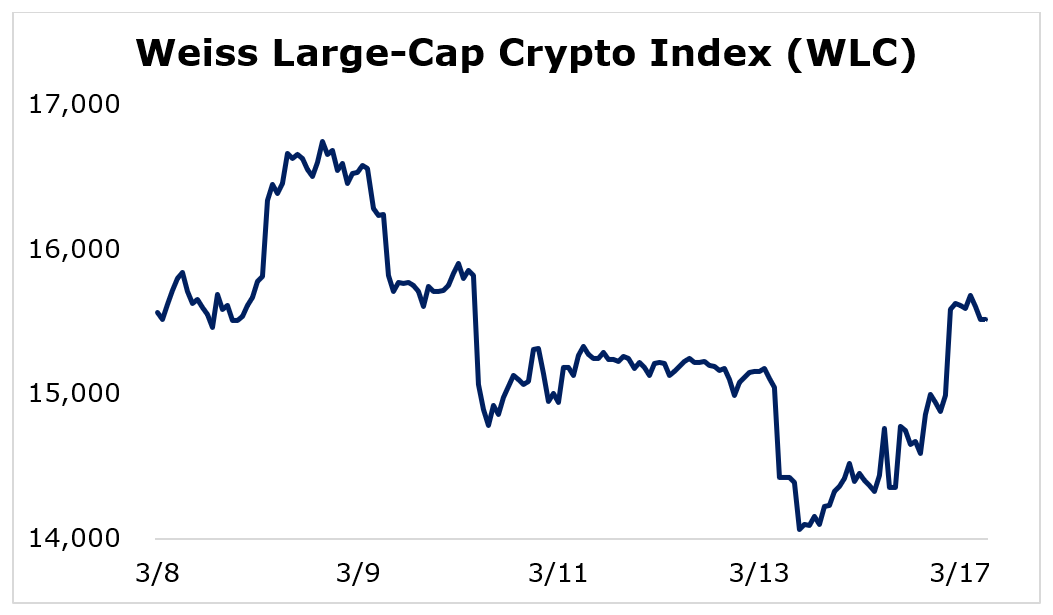

The large-caps finished the week almost entirely unchanged, as the Weiss Large-Cap Crypto Index (WLC) decreased 0.30%.

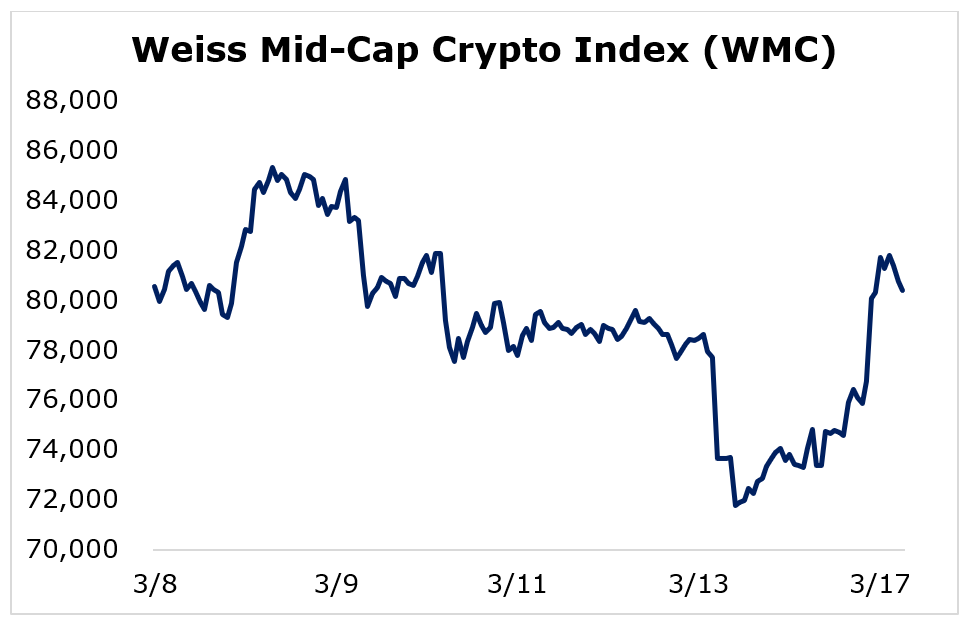

The mid-caps performed almost exactly in line with the largest cryptocurrencies, with the Weiss Mid-Cap Crypto Index (WMC) dropping just slightly less at 0.21%.

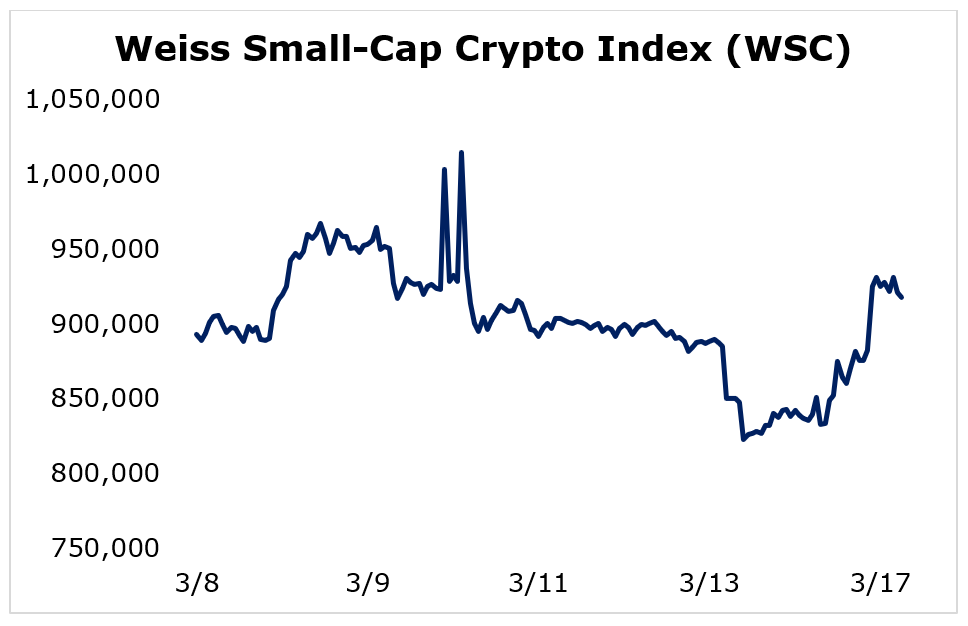

The biggest standout was our small-cap index. Not only did it move the most, but it even managed to record the only gain as our Weiss Small-Cap Crypto Index (WSC) increased 2.77%.

Overall, trading was muted but showed some positive signs. Whether this continues will be important over the next couple of weeks to gauge the health of the crypto market’s recovery.

Notable News, Notes and Tweets

- Pomp disapproves of the government’s claim that increasing spending will help curb inflation.

- Michael Saylor highlights that Bitcoin is building momentum as a monetary alternative.

- Miners prioritizing holding Bitcoin are significantly expanding their hash rates.

What’s Next

The crypto market is fighting uncertainty caused by Russia’s invasion of Ukraine and high inflation. But, it was a positive development for crypto prices when the Federal Reserve chose the gentler approach of raising interest rates by a quarter of a point instead of an aggressive shock-and-awe method.

The market certainly isn’t out of the woods, but the long-term case for broadening crypto adoption is becoming more and more compelling. One thing is clear: Despite soaring consumer prices reaching multidecade highs, the government isn’t willing to entertain the idea of cutting its enormous spending.

Faced with this reality, institutions and retail investors are using crypto as a hedge against the traditional monetary system.

Best,

Sam