Crypto Holds Steady as It Faces an Important Test

|

| By Jurica Dujmovic |

This week, price action finally began reflecting the value of crypto in crisis situations as the conflict in Europe continues to escalate. Bitcoin rose roughly 18% on Monday — the largest single-day rally in over a year — and has held near $43,000 since.

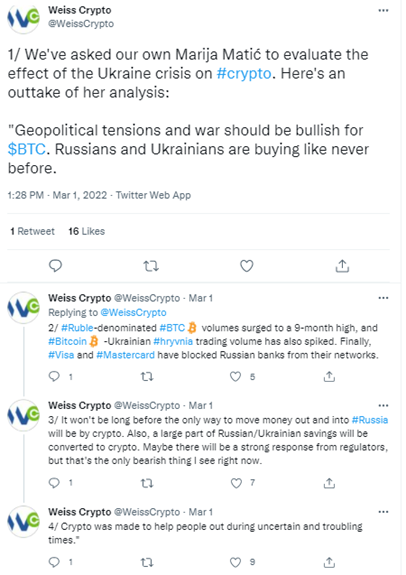

That’s because, in the words of our own Marija Matić, crypto was created for tough times like these …

Indeed, for an average Russian, the imposed sanctions are a burden that greatly affect their daily lives. And crypto is a means of maintaining some normality and quality of life in a tumultuous time.

Still, governments around the world are determined to put enormous economic pressure on Russia — removing its ability to trade in equities and attempting to remove its ability to trade on centralized crypto exchanges.

Seemingly, this was met with public resistance from multiple exchanges:

However, reality is quite different. Although several exchanges used this opportunity to wave the crypto banner and claim they won’t buckle under the pressure — including Binance and Coinbase — our Russian followers tell us a different story. They say they were unable to create accounts on either Binance or Coinbase.

The latest exchange to publicly resist attempts at freezing Russian-held accounts is Kraken:

I’ll let you know next week if this, too, is a just a publicity stunt, or an actual effort to stay true to the tenets of crypto — that this space supersedes national interests to act as a tool for financial independence for the common people.

But even without the convenience of centralized exchanges, Russians are still flocking to crypto for the safety of its decentralized, censorship-resistant environment. Volume on exchanges reveals that Bitcoin pairs with rubles are at an all-time high.

And for those concerned that the Russian government could use crypto as a means to work around the sanctions, that’s unlikely.

Why? There simply isn’t enough liquidity to support a government, according to crypto lawyer Jake Chervinsky. Our Weiss Crypto analysts agree. However, there is enough liquidity for average citizens to meet their basic needs.

This, however, holds true only if Russians rely on each other and create among themselves a parallel crypto market on which they can exchange crypto for goods and services … and even find outlets through which they can trade and maintain the connection with the outside world.

But it’s not just Russian citizens; Ukrainians are also turning to crypto for aid. Roughly $35 million worth of crypto has been donated from around the world — from individuals and organizations donating what they can, rather than organized aid from other centralized governments.

Consider, for a moment, if those relief funds needed to go through the banks. Banks that have an obligation to their business, not to charity. Those donations would have been taxed, and transfers could have taken days. With crypto, donations were sent instantaneously, with only gas fees needing to be paid.

And of course, since crypto allows you true custody of your assets, it’s invaluable for those who have been forced to flee their homes — allowing them to bring their wealth — their means of supporting themselves, with them. It’s security in an insecure moment.

Decentralization, personal freedom, independence and financial freedom are foundations of crypto. As one of the first major global conflicts in crypto’s history, it’ll be the first true test of crypto’s use and resilience.

Remember, today it’s Russian and Ukrainian civilians. Tomorrow you could be the one unable to access your assets due to your government’s shortcomings.

That’s why we’re eternally grateful for the communities and institutions that understand crypto, that are in it not just to make money, but also to make a better future.

You guys get it. Here’s hoping next week brings good news of peace, good price action and the end of suffering.

Until then, stay safe and trade well.

Jurica Dujmovic