Crypto Holds Strong Against Centralized Authorities

It seems there can be no peace in the crypto markets, in large part because it’s still heavily affected by what’s happening in the real world.

And let me tell you this – whatever is happening these days, it ain’t good. While the countries in the east — like Russian, Ukraine and the UAE — see the value of crypto in its intended purpose as a currency free of centralized control, the West is woefully misunderstanding it and sadly turning more authoritarian with each passing day.

Case in point: Canada:

In an effort to stifle a peaceful protest that’s impacting the country’s economy, Prime Minister Justin Trudeau decided it’s a good idea to freeze protestors’ bank accounts ... and force banks to report the accounts of those believed to be funding the protest. The Canadian government even went as far as to target crowdfunding sites and cryptocurrency processors.

This unprecedented overreach has shown just what authoritarian governments of the world can do, if given the means. In that context, central bank digital currencies (CBDCs) are a perfect tool for that type of tyranny. Thankfully, Canada doesn’t have its own CBDC yet, so there are still ways for its citizens to gain access to their funds.

Furthermore, these protestors still have access to their crypto — an asset type that is decentralized and censorship resistant. Alex Benfield has more details on the ordeal, so be sure to check out his article from yesterday.

So, the smear campaign against crypto continues unabated. But while Canada condemns it for assisting dissidents in accessing their money and billionaire Charlie Munger equated crypto to a venereal disease, his partner in crime Warren Buffett — who called Bitcoin “rat poison squared” — silently admitted he was full-on wrong with his assessment.

In the investment world, actions speak louder than words.

Still, even this progress shows Buffett fails to grasp the true crypto potential, getting only a second-hand exposure without owning any of the asset itself. Neither he nor Munger understand the space ... and they’re not even trying to.

Given their age and ego, none of this is likely to change — the only bothersome thing here is the fact that some still hold their opinions high and are swayed by the fear, uncertainty and doubt (FUD) they spread.

They’re not the only ones doing so, either. The Securities and Exchange Commission (SEC) has also been quite vigilant at obstructing crypto at every step. Its latest target: decentralized finance (DeFi):

But there is hope. Crypto has evolved — it’s not a small fringe industry anymore, and it doesn’t have to take the hits laying down.

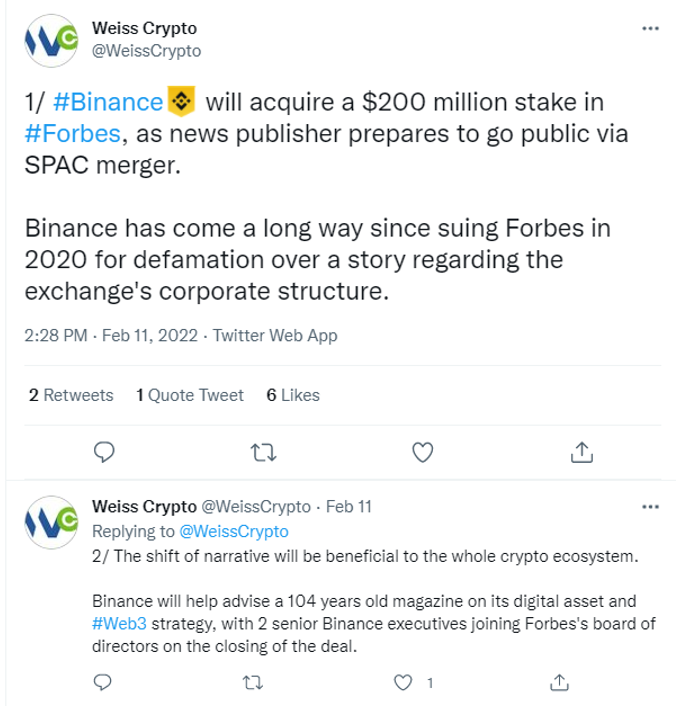

With this new influence, I’m hoping to finally see some newsworthy, objective, pro-crypto journalism coming out of Forbes. The fact that there is also a change in the company’s leadership means we might actually see it.

With Coinbase Global (COIN), it seems business is also picking up, as the company goes on a hiring spree:

We love Binance, but what we love even more is healthy competition. Seeing more companies wrestle for leadership means better service and more value for the customer. It also means better representation and increased adoption in the corporate world.

Speaking of adoption, another big player was pushed into the non-fungible token (NFT) sector by the fear of missing out:

First there was Twitter, recently announcing NFT portraits for its paying customers. Now, we’re seeing the mighty, ubiquitous YouTube make provisions necessary to integrate NFTs into its content.

There are fewer and fewer arguments for the NFT naysayers, and I sincerely hope you’re not one of them.

If you are, maybe this next piece of news will sway you:

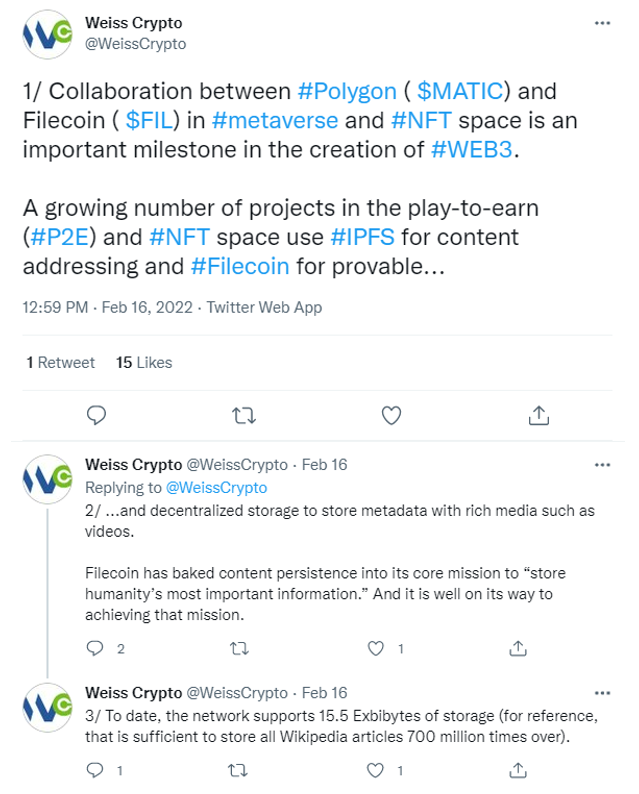

We’ve been fans of Polygon network for quite some time. Seeing it expand in this direction only solidifies the notion that the entire industry is recognizing the NFT space as something significant and noteworthy as an alliance with Filecoin opens up new possibilities for addressing one of the biggest complaints the NFT naysayers have: the inability to store the original digital asset directly on the blockchain.

And that about wraps up the week’s recap in crypto news. What can we expect going forward?

Well, we’ll likely see the situation on the Ukrainian border develop. It’s possible a diplomatic solution can be reached between Russian and Ukraine. It’s also possible that tensions continue to rise. Either way,– it’ll be interesting to see how the crypto markets respond.

Same goes for the worrisome situation over in Canada. A lot can change over the course of a few days.

Whether it is used to evade government control or to simply store value in volatile times, cryptos provide much-needed security and freedom that is often lacking in the traditional financial system. So, while crypto can often be volatile and has its risks, it also presents a unique investment and wealth building opportunity.

For this reason, it is important to stay up to date on the latest news and developments. So, keep your eyes peeled, and make sure not to miss any of our upcoming updates. But most importantly …

Stay safe and trade well,

Jurica Dujmovic