|

| By Sam Blumenfeld |

This week, Bitcoin (BTC, Tech/Adoption Grade “A-”) and the broad crypto market are extending gains after the Federal Reserve raised interest rates by 25 basis points.

While the move was priced in, it was Fed Chair Jerome Powell’s statement that it was “certainly possible” for the benchmark rate to stay below 5% that ignited a rally.

The U.S. economy got more good news this morning after the January jobs report showed it added 517,000 nonfarm payrolls last month. That crushed economists’ estimate of 187,000 jobs and brought unemployment to a 53-year low of 3.4%.

At first, stocks and crypto did not enjoy this news because of the fear that the Fed could use it to justify keeping rates higher for longer. However, a greater possibility of a soft landing for the U.S. economy kept investors hopeful.

Today, Bitcoin is up about a percentage point as it hovers around $23,500, well above its 21-day moving average. The market leader continues making strides with a 43% year-to-date gain, but it could see a pullback soon according to our Crypto Timing Model.

Even though a pullback is likely coming soon, remember there is no reason to panic. Corrections are common and healthy in crypto.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (COIN):

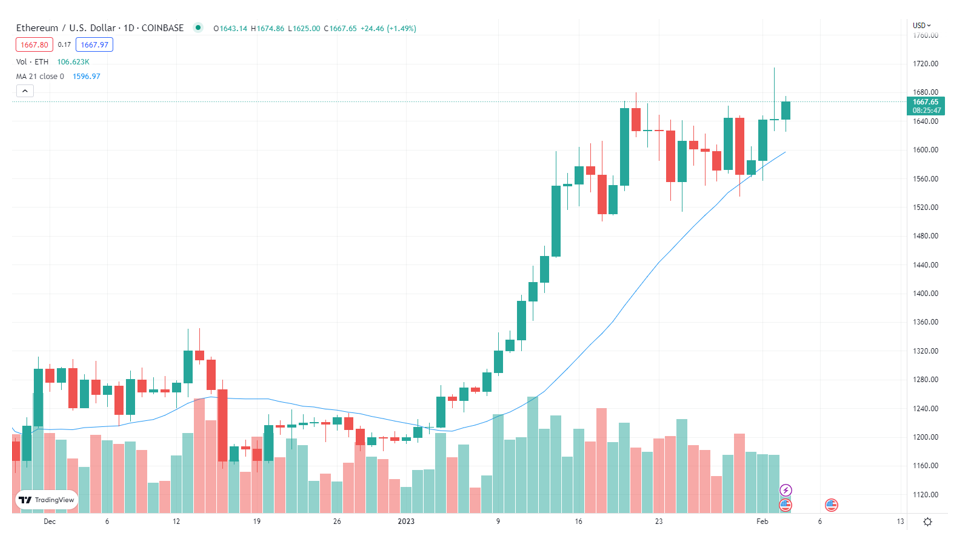

Meanwhile, Ethereum (ETH, Tech/Adoption Grade “B”) is up about 2% in today’s trading as it looks to challenge $1,700 again. ETH has narrowed the gap to Bitcoin in year-to-date performance with a 39% move, but it has shown greater volatility than the market leader.

Ethereum is sitting close to where it was before FTX collapsed in November, but it could break through with another strong trading day.

The second-largest cryptocurrency by market capitalization could face resistance at this level, and a broader pullback would make the environment more difficult.

For now, Ethereum trades above its 21-day MA. But it tested that level for three straight days leading up to the Fed’s interest rate decision and the following rally.

Even so, if a pullback occurred, Ethereum is trading nearly double its bear market low of $880.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Notable News, Notes and Ratings

- Another series of crypto upgrades brings the number of cryptos with a “B-” rating or better to 17, adding two more cryptos into “buy” territory. Of these, 12 were recently upgraded.

While five cryptos were rated “B” or better, Bitcoin remains the only crypto rated “B+” or better.

1. Bitcoin (BTC, Overall Grade “B+”)

2. Chainlink (LINK, Overall Grade “B”)

3. Ethereum (ETH, Overall Grade “B”)

4. OKB (OKB, Overall Grade “B”)

5. Polygon (MATIC, Overall Grade “B”)

- The Senate Banking Committee will prioritize crypto regulations in the new Congress. Senator Tim Scott, Republican ranking member of the committee, is looking to create a bipartisan regulatory framework to combat bad actors in the space.

- Japanese Prime Minister Fumio Kishida could look to decentralized autonomous organizations and non-fungible tokens to highlight innovation in Japan through its “Cool Japan” initiative. Kishida claimed there were “various possibilities for using web3” in the country.

- An economist and former member of the Monetary Policy Committee at the People’s Bank of China called leaders to express concerns about the country banning crypto. He argued that while the country could see short-term benefits, it could lose out on long-term opportunities.

- A Finnish company launched the first approved euro-backed stablecoin in Europe, which should offer lower transaction fees than traditional banking and payment processing. The stablecoin is fully reserved, meaning each token is backed by at least one euro.

What’s Next

The crypto market has enjoyed a substantial rally since the beginning of the year, with the market leaders up about 40%. A pullback is in the cards, but it is promising to see risk assets responding favorably to current macro conditions.

Another piece of good news is that macro conditions appear to be improving. Inflation appears to be tapering off for now, and a strong labor market could help the U.S. economy achieve a soft landing.

Meanwhile, crypto will still have to deal with an evolving regulatory framework. A report found that enforcement actions significantly increased in 2022, with the Securities and Exchange Commission carrying the most and raising $242 million from fines.

Regulations are inevitable on the road to expanding adoption to mainstream levels, and they lay the groundwork to increase institutional confidence in the space. Greater involvement from institutions and an improving economic picture should help drive the next bull run.

These regulations are a hot topic for crypto investors. We’ll be keeping an eye on them will give our insight as they come up.

Best,

Sam