Crypto Momentum Builds as Bitcoin, Ethereum Lead the Charge

|

| By Mark Gough |

The cryptocurrency market has experienced a powerful resurgence since its lows in April.

Bitcoin (BTC, “A”) and Ethereum (ETH, “A-”) — the two titans of the digital asset world — have led the charge, reigniting investor confidence and attracting new institutional attention.

But what’s fueling this bullish momentum? And, more importantly, will it last?

Let’s examine the key developments, market signals and macroeconomic factors that are shaping the current trend.

Major Headlines Fuel the Rally

The news cycle has turned decisively bullish to create a backdrop of optimism and forward-looking excitement.

Some of the most impactful developments include:

Headline 1: Expanding Bitcoin Access in Retirement Accounts

While Fidelity has offered limited access to Bitcoin in 401(k) plans since 2022, broader adoption across retirement platforms has remained sluggish.

That was largely due to regulatory caution. But with a renewed focus in new regulations and improved regulatory clarity, that may be changing.

In late May 2025, the U.S. Department of Labor officially rescinded its 2022 guidance, which had strongly discouraged plan sponsors from including cryptocurrencies in retirement plans.

The original advisory urged “extreme care,” citing the volatility of crypto and concerns about its suitability for long-term savings.

The DOL’s new position is notably neutral, neither endorsing nor opposing crypto in 401(k) plans.

Instead, it returns to a more traditional stance of allowing fiduciaries discretion, provided they meet their obligations under ERISA: prudence, loyalty and diversification.

This reversal is being seen as a potential game-changer.

By removing a major legal overhang, it opens the door for more providers to consider Bitcoin and other digital assets as part of long-term investment strategies.

While actual adoption will depend on fiduciary risk assessments and employer demand, the shift could eventually unlock billions in retirement capital for crypto.

Headline 2: Corporate Adoption Accelerates

Big business is going crypto, and the latest headlines underscore just how serious that commitment is becoming.

- Trump Media and Technology Group recently struck a $2.5 billion deal to acquire Bitcoin for its corporate treasury. The bold move marks one of the most significant planned BTC allocations by a publicly associated entity.

- GameStop, once the poster child of meme stock mania, is now making waves in the cryptocurrency space. The company confirmed it had added 4,710 BTC — valued at roughly $500 million — to its balance sheet.

Moves like this send a loud signal to institutional and retail investors alike: Major corporations are no longer treating Bitcoin as an experiment.

It’s now a key component of a serious financial strategy.

Headline 3: Ethereum Institutional Interest Surges with Regulatory Clarity on ETH Staking

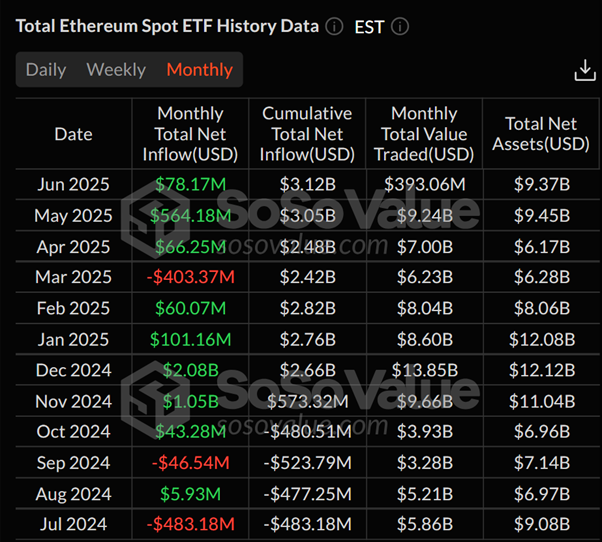

Ethereum is also enjoying an intense wave of institutional interest, particularly through exchange-traded funds.

In just one week, ETH ETFs saw inflows of $321 million — the strongest performance of the year so far.

Adding fuel to Ethereum’s rally, the U.S. Securities and Exchange Commission (SEC) has clarified that Ethereum staking does not constitute a securities offering.

This removes one of the most significant regulatory uncertainties hanging over ETH. And it allows institutions and ETH ETFs to engage with staking products with greater confidence.

In response — and inspired by Michael Saylor’s proven playbook at MicroStrategy with Bitcoin — we’ve seen major corporations begin to explore treasury strategies with Ethereum.

Sharplink Gaming, for example, recently raised $425 million to form an Ethereum Strategy.

This surge in demand comes right as Ethereum cements its place as the infrastructure layer for DeFi, NFTs and web3 innovation. With its staking yield and upcoming scalability improvements, institutions see ETH not just as an asset but as a platform with enduring utility.

Taken together, these developments aren’t just good headlines. They represent structural shifts driving the current bullish momentum.

Structure Over Sentiment

While the developments above create a bullish backdrop, we still need to confirm the market has the fundamental strength to make sure of it.

And my analysis says it does.

Bitcoin has rallied approximately 50% from its April lows to reclaim a dominant position in the market. At the time of writing, BTC is trading near $105,000, consolidating just above a key support range.

The critical support zone lies between $98,000 and $94,000. Maintaining this area is essential for preserving the bullish market structure.

The message for investors? Optimism is justified, but discipline is essential.

Strong trends can shift quickly. That’s why key technical support levels should be your compass — not headlines.

Ethereum & BTC Dominance: The Key to Altcoin Momentum

Despite lagging for most of this bull market, Ethereum has outpaced Bitcoin in terms of raw percentage gains since April, climbing over 100% from its recent lows.

Now, ETH is currently consolidating near its yearly highs, bolstered by rising ETF inflows and increased institutional accumulation.

And that is important for any investor looking at the broader altcoin market.

If Ethereum continues to lead and Bitcoin's dominance — which is butting against resistance at 64.5% — begins to retreat, capital could shift into altcoins and ignite a broader rally across the market.

Related Story: Look to Bitcoin’s Dominance Reversal to Reveal When Altseason Will Start

In essence, BTC.D is a real-time barometer of capital flow, and savvy traders closely monitor it to anticipate market shifts.

Final Thoughts: Stay Smart Amid Strength

The crypto market’s structure appears robust.

It is supported by institutional momentum, regulatory clarity, and macroeconomic liquidity. But savvy investors know that discipline beats hype, and headlines can be misleading.

To make the most of this bull run while keeping downside risk in check, you’ll want to …

- Focus on structure: Watch support levels and don’t chase parabolic moves.

- Monitor BTC Dominance: It’s your early signal that liquidity will likely rotate into altcoins.

- Manage exposure: Volatility remains a feature, not a bug, in crypto.

As a bonus, you should also check out our Crypto All-Access Summit.

In it, Juan Villaverde breaks down the different strategies you can use to make the most of this bull market.

But it won’t be online for long, so I suggest you watch it now.

Best

Mark Gough