Crypto Retreats After Briefly Extending Gains

|

| By Sam Blumenfeld |

expectations shift surrounding the Federal Reserve’s future interest rate policy.

The Fed’s minutes from its Jan. 31–Feb. 1 meeting showed that members are willing to continue hiking rates to quell inflation.

While the market was becoming increasingly optimistic that the Fed would pivot soon, consumer and producer inflation misses and a tight labor market are forcing the central bank to continue its heavy-handed approach.

Rates are now expected to peak above 5.25% in July.

In response, Bitcoin is down about 3% in today’s trading as it searches for support near $23,000. The market leader will log four consecutive red candles if today’s action holds, but BTC tracks a 39% gain since the beginning of the year.

Additionally, Bitcoin’s share of the crypto market has increased from 42% to 44% since the beginning of January.

Bitcoin dipped below its 21-day moving average today, but this is not overly concerning because the market was due for a pullback. Volatility is common for crypto, so it is completely healthy to see large run-ups turn into brief corrections.

Click here to see full-sized image.

It is also important to consider that the market is transitioning from the end of crypto winter, which could bring additional volatility in the coming months.

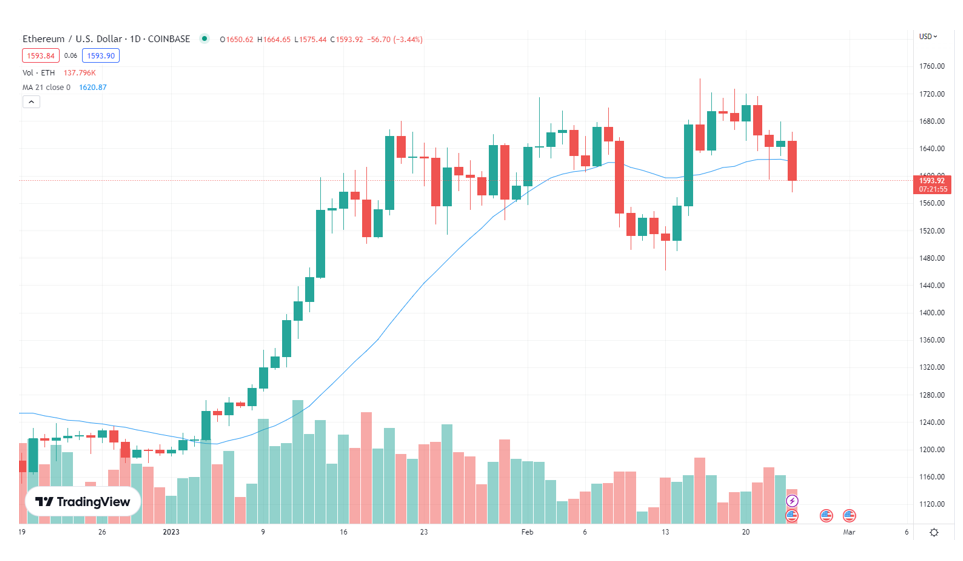

Looking at Ethereum (ETH, Tech/Adoption Grade “B”), it is down about 4% so far today as it hovers just below $1,600. The second-largest crypto by market cap is underperforming the market leader, but it has still gained 33% since the beginning of the year.

If Ethereum shows additional weakness in the coming days or weeks, it would likely lead to a pullback for other altcoins that follow its movements.

Like Bitcoin, Ethereum dipped below its 21-day moving average during today’s trading. The asset did not manage to extend its breakout, but it made strides by reaching its pre-FTX trading level during the recent rally.

In the meantime, investors can look forward to a series of exciting developments for Ethereum coming up.

Core developer Tim Beiko announced that the Shapella upgrade is expected to take place on Feb. 28, which should lead to unstaking ETH after March’s hotly anticipated Shanghai upgrade. The network could also implement sharding later this year, which should help scaling.

Click here to see full-sized image.

Notable News, Notes and Ratings

• Several “Buy”-rated cryptos were recently upgraded, but the total dropped from 23 to 20 due to multiple downgrades. No cryptos are currently rated “A-” or better after Bitcoin was downgraded to “B+.”

Like last week, eight cryptos are currently rated “B” or better.

1. Bitcoin (BTC, Overall Grade “B+”)

2. Polygon (MATIC, Overall Grade “B+”)

3. Chainlink (LINK, Overall Grade “B”)

4. Curve DAO Token (CRV, Overall Grade “B”)

5. Decentraland (MANA, Overall Grade “B”)

6. Ethereum (ETH, Overall Grade “B”)

7. Litecoin (LTC, Overall Grade “B”)

8. OKB (OKB, Overall Grade “B”)

• France began a pilot program for in-store crypto payments through a partnership between crypto exchange Binance and payment processor Ingenico. The program will initially offer the services for Ingenico Axium payment terminals throughout the country. The program could expand to other countries soon.

• A U.S. legislator proposed a bill that would prevent the Fed from directly issuing a digital dollar to individuals and block the central bank from enacting central bank digital currency-based monetary policy. Rep. Tom Emmer introduced the bill to protect U.S. citizens’ privacy rights.

• The Canadian Securities Administrators has enacted stricter crypto regulations. After FTX’s collapse, the CSA notified crypto asset trading platforms that they will have new requirements to prevent future insolvencies including asset segregation, leverage limits, transparency obligations and more.

• Organic use of Bitcoin Lightning Network growth points to increasing adoption and an improving use case. Bitcoin Lightning Network capacity just reached a new high of 5,000 Bitcoin, and liquidity is increasing. LN has no native token, but nodes can earn from providing liquidity and enabling transactions.

What’s Next

Crypto winter looks to be over, but the market will likely face volatility and choppy trading moving forward.

A lot will depend on the Fed’s policy decisions, but it is encouraging to see the market make strides despite the difficult macroeconomic environment.

In the meantime, positive adoption headlines continue laying the groundwork for more institutional involvement when conditions improve. Crypto’s outlook is constantly brightening, and the implementation of a sustainable regulatory framework should help the industry take the next step towards becoming mainstream.

Best,

Sam