|

| By Bob Czeschin |

It’s not just getting colder outside. We’re also feeling the wintertime chill in crypto land, too.

Over the weekend, Bitcoin (BTC, “A-”) tested cycle lows in the low $80,000s. That’s down about a third from its all-time highs — more than enough to put investors in a gloomy mood.

If you’re in the same boat, I strongly encourage you to take a look at what our cycles expert Juan Villaverde wrote recently.

The TL;DR? The data suggests this crypto winter will be mild in comparison to previous cycles. Far short of the days when Bitcoin fell 50% to 80%.

Then, as the saying goes, this too shall pass.

Indeed, the outlines of a robust long-term rebound are already starting to take shape — in a capital few investors would normally look to.

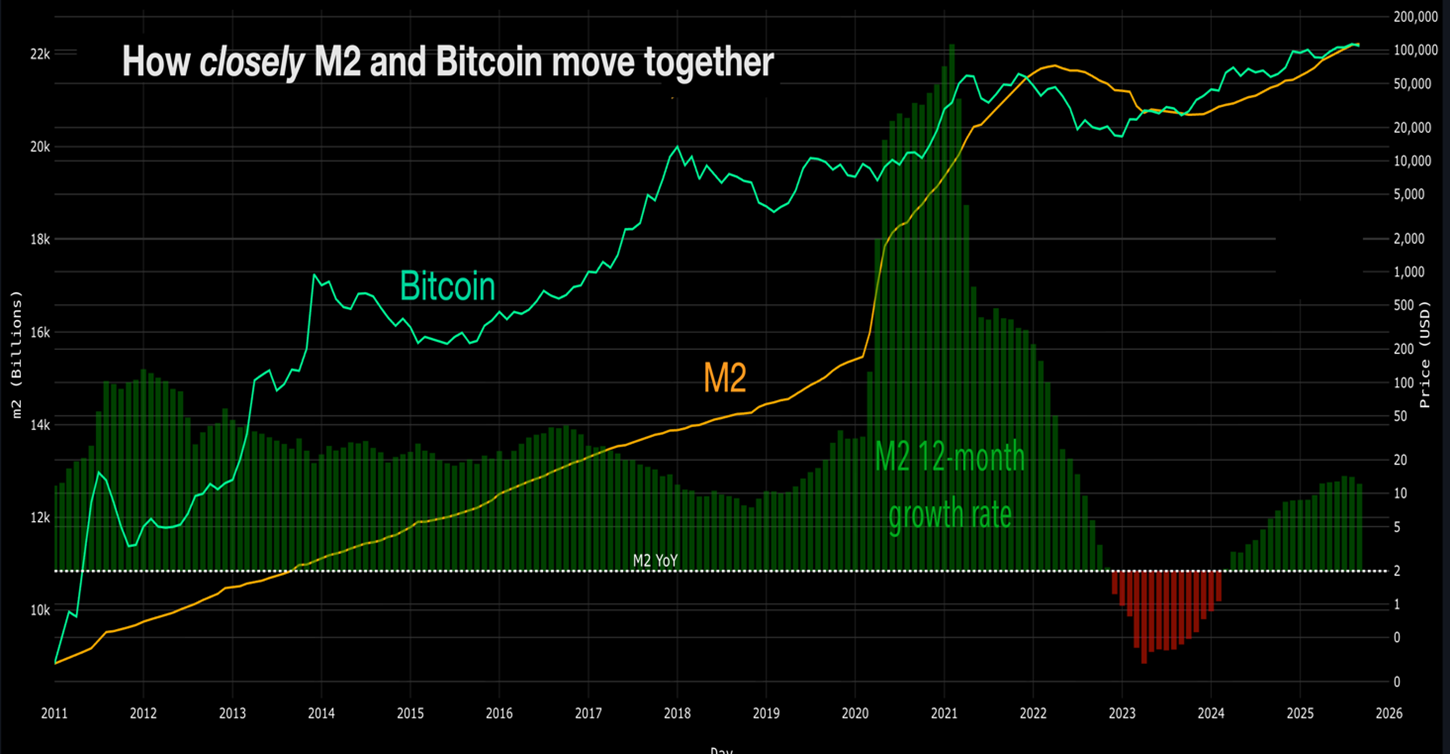

One of the elemental axioms of crypto is that liquidity — the total money and credit sloshing around inside the financial system — drives crypto prices.

Accordingly, a growing M2 (broad money supply) normally correlates very well with rising crypto prices.

This makes intuitive sense because of Bitcoin’s hard cap on the maximum number of coins that can ever be minted.

But under today’s fiat-money regimes, nothing limits how much new currency central banks can print.

This is what makes Bitcoin so exquisitely sensitive to liquidity. Like gold, there’s no making any more of it. So, the more money in circulation, the higher prices go — with no upside limit. (And vice versa.)

However, there are multiple measures of liquidity. And as important as U.S. liquidity is, crypto is far from uniquely American.

China boasts the world’s second-largest economy. And despite on-again, off-again ambivalence about crypto in Beijing’s halls of power, China has been a major player since the early days of the crypto revolution.

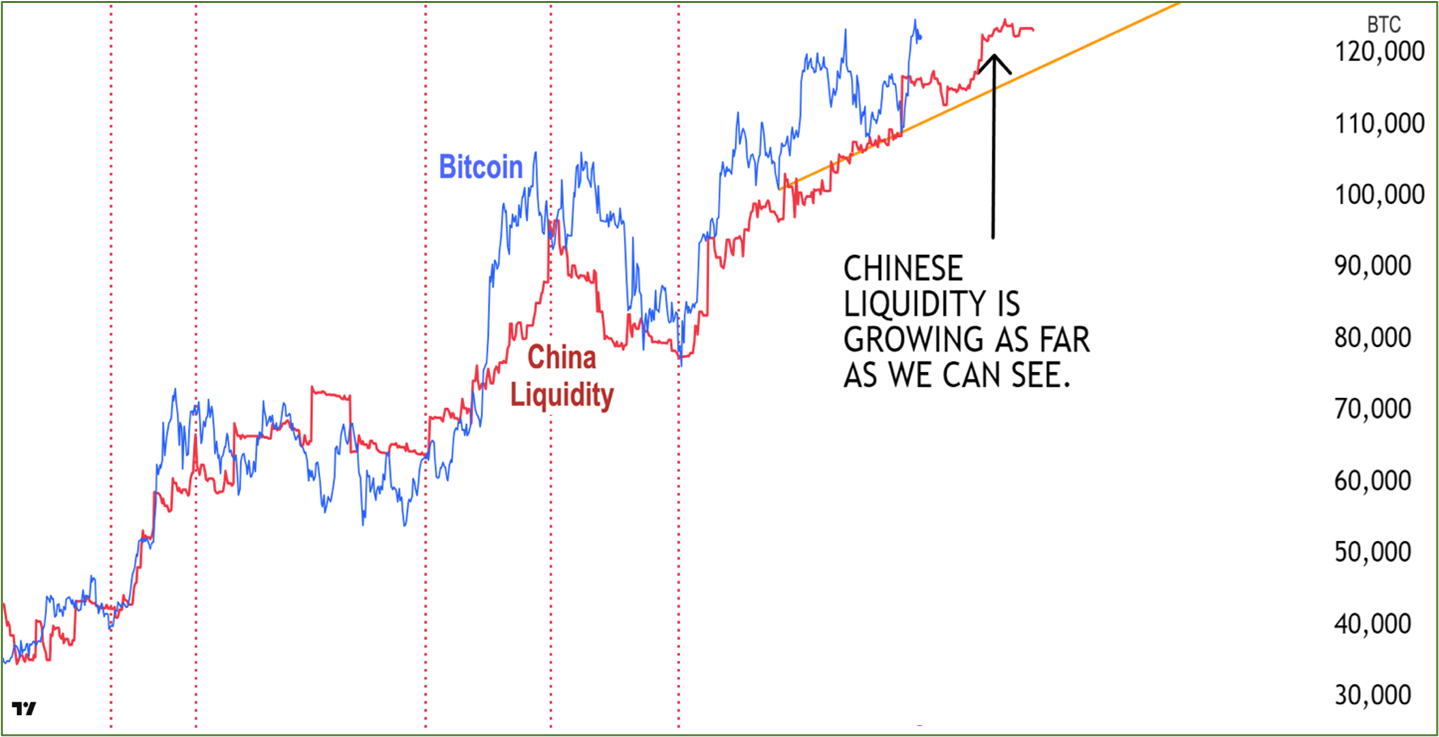

Indeed, Juan’s recent updates for his Weiss Crypto Investor Members has shown the volume of money and credit sloshing around the Chinese monetary system has a profound impact on Bitcoin.

Specifically, Chinese liquidity leads the price of Bitcoin by about 81 days. And amazingly, the standard tests of statistical validity of this relationship clocked in at 99.99999999%.

(That’s eight 9s following the decimal point!)

How Chinese Money Anticipates Bitcoin

The red vertical dotted lines (above) mark key inflexion points in Chinese liquidity. Note how nicely they align with key turning points in Bitcoin’s price path.

China’s Printing Press is About to Work Overtime

The correlation between Chinese liquidity and BTC is good news. That’s because Beijing is pushing through a raft of measures to give the faltering Chinese economy a shot in the arm …

Most of which will ultimately be financed by printing vast sums of new money.

Like the new approach to tackling the country’s four-year decline in new home sales.

In October, new home sales by China’s top 100 builders plunged 41.9% year on year — the steepest monthly decline in 18 months. This was such bad news that the government halted any further release of new property sales data.

And Fitch Ratings recently warned that new home sales could drop a further 15% to 20%.

Previous efforts to stabilize the property sector — such as lower minimum down-payments requirements — have not worked. So, Beijing is now gearing up to double and triple down. New measures will likely include:

- Substantial mortgage subsidies for first-time homebuyers nationwide,

- Bigger tax breaks rebates for mortgage borrowers and

- Lower stamp duties, title transfer fees and other transaction costs.

China is also facing a struggling manufacturing sector.

Factory activity just fell for the eighth consecutive month. The official manufacturing purchasing managers’ index for November came in at 49.2. (Any reading under 50 indicates contraction.)

There are many reasons for this, from President Trump’s tariffs to the lingering effects of Beijing’s draconian COVID shutdowns.

But the profoundest one is demographic: China’s working age population peaked in the early 2010s and has been falling ever since.

That means its once formidable competitive advantage — abundant labor at rock bottom prices — is melting away like an ice sculpture under the summer sun.

In the long run, this is a more serious problem than an imploding property market and tottering domestic banks. For sure, it will be vastly more expensive to try to fix.

But Beijing is certain to try. And now, the chief restraint on wholesale money printing by the People’s Bank of China … has been lifted.

China’s Printing Catch-22

Massive money printing injects liquidity into a market in need. But unchecked, this helpful solution can become a death sentence for fiat currency.

That’s why the yuan fell out of bed following initial announcement of President Trump’s tariffs.

The currency markets thought Beijing would fight back by driving the yuan down to at least partially offset the cost of the tariffs.

But that only shows how little they understand about China.

Beijing’s grand ambition is for the yuan to overtake the U.S. dollar as the world reserve currency. That’s why the Chinese have been quietly scooping up vast amounts of gold every year for decades. And dumping dollars to pay for it.

To be seen trashing their own currency in a tariff tiff with Trump … would likely be a fatal blow to this grand multigenerational ambition.

Which is why it didn’t happen.

Not only did the yuan not go down. As you can see (above), it went up!

Apart from the kerfuffle surrounding “Liberation Day,” the yuan has basically been going up — and the dollar falling! — ever since Trump took the oath of office on Jan. 20.

And this is what really opens the door to another giant round of Chinese money-printing. Maybe even more than one.

Indeed, as long as the yuan goes no lower than where it began in 2025, I think Beijing can probably print with abandon — without imperiling its long-term, hoped-for future for the yuan.

Obviously, such a scenario would be rocket fuel for Bitcoin.

So, whatever you do, don’t give up on crypto. It won’t take long for winter to melt into spring.

And happily, support is not far off, according to Juan.

If you’re interested in seeing firsthand how Juan recommends his Weiss Crypto Investor Members navigate this tricky market, and how he intends to guide them through the transition back into risk-on mode, I encourage you to click here.

Best,

Bob Czeschin