Crypto’s Strongest Sectors Stand Out in the Recent Rally

|

| By Bruce Ng |

Roughly three weeks ago, crypto saw another notable correction. And now that the market has started to recover, I see an opportunity.

One that could help you identify projects with the potential to outperform.

Let me explain …

Bitcoin (BTC, “A”) dumped from roughly $60,000 on Aug. 4 to $49,000 on Aug. 5. That’s the lowest it has been since February this year.

And it dragged altcoins down with it in a brutal way.

The correction is marked by the yellow arrow above. But look all the way to the right of the chart and you can see last week’s rally reflected, as well. That surge saw BTC climb back up to $65,000.

We’re still in choppy territory and are likely to continue seeing pockets of volatility until the next bull run gets under way.

But rather than sit on our hands, we can use this latest rally to get a hint to which market sectors will outperform when that time comes.

That’s because the best rebounders now are quite likely to outperform the market should we get back to up-only territory.

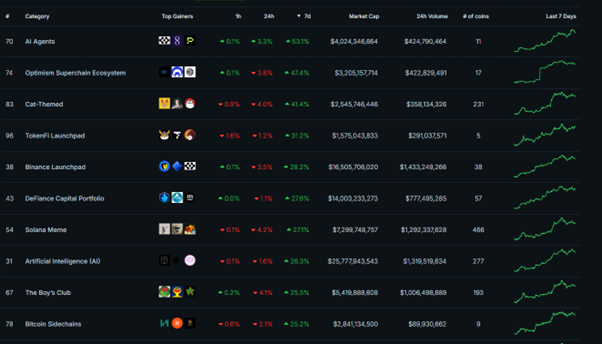

So, let’s look at the top performers over the past seven days, according to Coingecko.com:

Let’s go through what each of these are:

1. AI Agents: This category consists of a subset of AI coins dealing with AI agents. These are AI-powered dynamos designed to operate in the real world. They gather data, solve complex problems and make decisions based on their observations. (I wrote more about AI agents and how they make smart contracts even smarter here). This category piggybacks on the AI narrative.

2. Optimism Superchain Ecosystem: These coins are a mix of DeFi platforms and gaming coins inside the Optimism Layer-2 ecosystem.

3. Cat-Themed: These are memecoins that have cats as their theme. You can learn more about them here.

4. TokenFi Launchpad: This category consists of four coins, of which the top gainer is the memecoin Floki (FLOKI, Not Yet Rated) coin.

5. Binance Launchpad: These are coins launched through Binance’s incubator known as the Launchpad. They consist of a mix of old, high market cap coins.

6. Defiance Capital Portfolio: Same as the above. It’s a mixed bag of the Venture Capital firm Defiance’s portfolio.

7. Solana Meme: This is a list of all memecoins on Solana.

8. Artificial Intelligence (AI): This is the mother category of AI agents. It hasn’t performed as well as the AI agents subcategory because of the strong performance of two AI agent coins, SingularityNet (AGIX, Not Yet Rated) and Fetch.AI (FET, “C”).

9. The Boy’s Club: This also consists of a list of memecoins.

10. Bitcoin Sidechains: This list is comprised of Bitcoin scaling solutions.

Now, that may seem like a lot of information to sort through. But we can simplify it.

Taking in this list as a whole, we can see that most of the top performers in this rally above fall into two broad categories: Memecoins and AI.

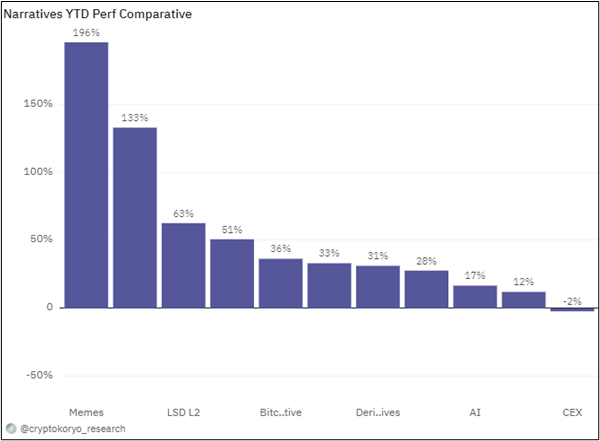

But that’s just for this rally. Let’s zoom out to take a look at their performances YTD:

Already, you can see one overlap. Memecoins take the top spot in terms of performance year to date. Combined with its performance in this rally, it’s clear that memecoins are still the top sector this cycle.

But here’s where performance diverges. Real-world assets and Layer-2 plays come in second and third, respectively. AI’s performance in 2024 has it all the way down in ninth place.

As an investor, this tells me to keep a close eye on my top AI picks. They’ve lagged so far this year, so the outperformance in this rally is notable. If that outperformance continues from here, some of those projects could see substantial gains in the big bull run.

Now, for the caveat: Past performance is not indicative of what the sector will do in the future. Investors should still move forward with healthy caution, especially in a market as volatile as this one has been.

But if you have a higher risk tolerance, you may consider looking for your next pick in the memecoin or AI sectors.

Best,

Dr. Bruce Ng