|

| By Mark Gough |

If you’ve been watching your portfolio this week, you already know …

Things just got exciting!

Bitcoin (BTC, “A-”) blasted through $117,000 right as we flip the calendar into October — historically crypto’s best-performing month.

Perfect timing? You bet.

The Fed Just Handed Us a Gift

The U.S. economy is wobbling.

Normally, that’s a big red flag.

But in crypto, that weakness is rocket fuel.

Yesterday’s ADP jobs report showed private payrolls dropped by 32,000 in September. That’s the steepest decline in two and a half years.

Translation: The Federal Reserve has no choice but to keep cutting interest rates.

Futures now price in a 99% chance of another quarter-point cut in October.

Lower rates mean investors chase yield. And right now, crypto is one of the few places delivering.

Meanwhile, Bitcoin is trading like “digital gold,” rallying on the news. Fittingly, gold itself just set a new record at $3,921.

Both assets are riding the same safe-haven bid.

The Smart Money Read September’s Flipped Script

Bitcoin closed September up 5.16%, the third-best September on record.

That’s in spite of its correction from August’s high.

And analysts are eager to see what October brings. The month has historically delivered average gains of over 21% on BTC, earning it the nickname “Uptober.”

Institutions clearly got the memo.

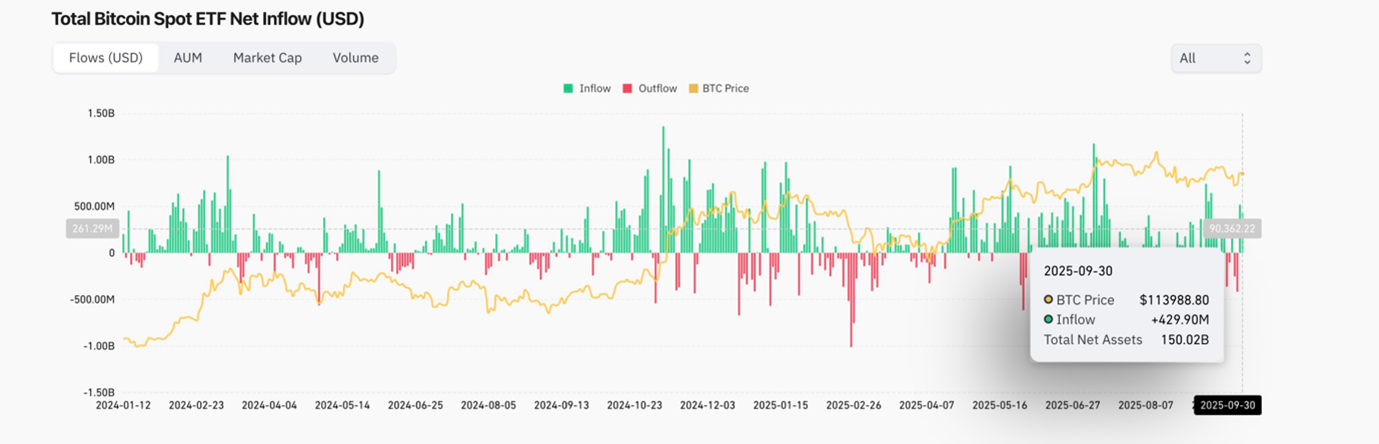

In just the last two days of September, spot Bitcoin ETFs saw $950 million in inflows, erasing the $900 million in outflows from earlier that week.

Ethereum ETFs also lit up: $127 million in a single day, zero redemptions.

And the interest goes beyond just ETFs.

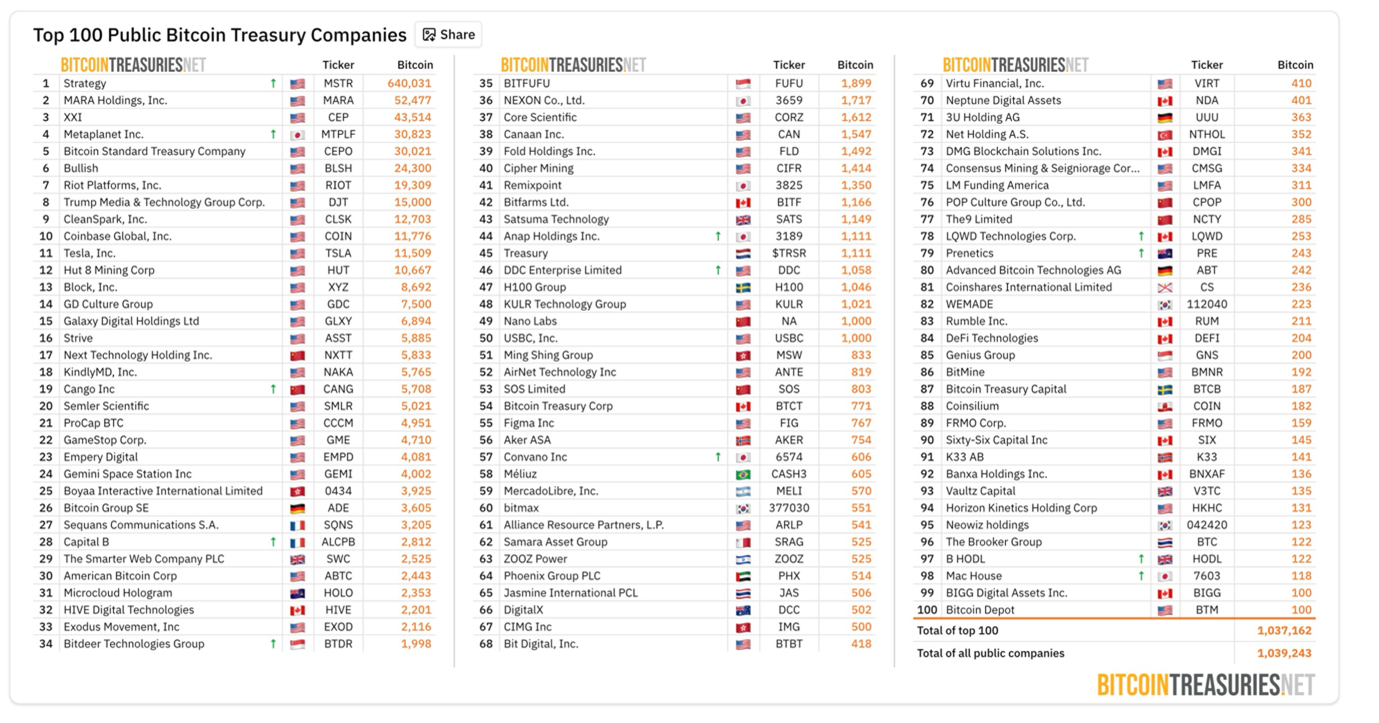

Think MicroStrategy is the only corporate whale in Bitcoin?

Think again. And say hi to Metaplanet.

The Japanese firm just dropped $616 million to buy 5,268 BTC at $116,870 apiece, lifting its total stack to 30,823 BTC.

That makes it the fourth-largest corporate Bitcoin holder worldwide.

Metaplanet’s treasury is now worth $3.33 billion, up 497% year to date. And it recently doubled its full-year revenue forecast, too.

Call it corporate FOMO, Japanese edition.

But U.S. firms haven’t been idle.

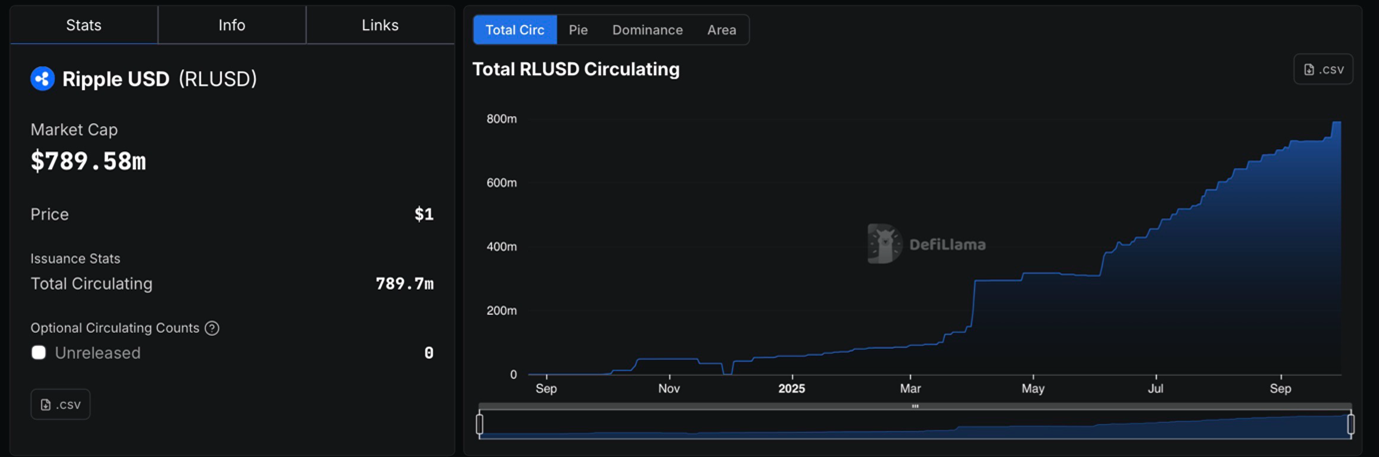

Securitize, BlackRock and VanEck all partnered with Ripple — the company behind XRP (XRP, “B-”) — to integrate its RLUSD stablecoin into tokenized money-market funds.

This creates a 24/7 off-ramp for tokenized treasuries. In short, it gives institutions a smoother path between fiat and stablecoins.

Since launch, RLUSD has already hit $700 million in circulation, fully backed and regulated under NYDFS.

XRP reacted instantly, rising 3.5% to $2.94.

Trump’s Crypto Venture Levels Up

The Trump family’s crypto play, World Liberty Financial, isn’t slowing down, either.

At TOKEN2049 in Singapore, CEO Zach Witkoff confirmed plans to launch a crypto debit card pilot by early 2026.

The goal? Make crypto as easy to spend as cash.

Meanwhile, Donald Trump Jr. is pumping USD1, World Liberty’s stablecoin. He calls it the “fastest growing stablecoin ever.”

No matter your feelings toward the First Family, this is the kind of mainstream push that expands adoption …

And raises prices.

Altcoin Season Watch: Is It Here?

Macro analyst Noelle Acheson says Q4 could be the official start of the next bull cycle.

With rate cuts coming and institutional flows accelerating, she’s calling for altcoin season.

That’s when liquidity spills over from BTC and ETH into the altcoin sector. That liquidity rush can create massive upside action for select alts, with their gains leaving those of market leaders in the dust.

And the numbers back up this outlook.

The total crypto market cap sits at $4 trillion, with $164 billion in daily trading volume.

Momentum is here, and October is historically the ignition point.

Final Take

On the first day of October, we have …

- Additional rate cuts likely ahead

- Record ETF inflows

- Corporate FOMO from Japan

- Institutions pushing stablecoins and broad crypto adoption

- And Bitcoin acting like digital gold through a U.S. government shutdown

The month has barely started. And already, the bullish case has been built.

This Uptober is already shaping up to be one for the record books.

And on Tuesday, Oct. 7 at 2 p.m. Eastern, my colleague Juan Villaverde will show you how you can use his upgraded Crypto Timing Model 2.0 to make the most of it and the rest of 2025.

Testing on this upgrade shows it has the power to generate AVERAGE gains of 6,630% for each crypto asset.

All by helping you target the best moments to act.

To hear how it all works, be sure to save your seat for his presentation now.

Buckle up. We’ve got a wild ride ahead of us.

Best,

Mark Gough