|

| By Sam Blumenfeld |

Bitcoin (BTC, Tech/Adoption Grade “A-”) and the broader crypto market have managed to tread water since the overdue pullback brought BTC down from $48,000 to $40,000.

Why? Well, despite plenty of reasons for bullishness, Bitcoin is still highly correlated to tech stocks and other risk assets. And in the face of interest-rate hikes, 40-year-high inflation and escalating geopolitical tensions, investors are definitely in “risk-off” mode.

This is the other side of the double-edged sword of having the influx of institutional investors in 2021. While they certainly boosted Bitcoin’s momentum last year, these investors don’t understand crypto, so they lump it in with risk assets when it should be seen as a hedge against macroeconomic concerns.

So, Bitcoin is back to consolidating. It’s 14% over the past three months, but has pulled back 18% since its March 28 peak.

If Bitcoin can close above key support at $40,000 with confidence, it could look to make another run back toward its recent highs.

On the other hand, BTC has not closed below $39,500 since mid-March, so a close below this level could signal more short-term weakness.

Here’s Bitcoin’s price in U.S. dollars via Coinbase (COIN):

Like Bitcoin, Ethereum (ETH, Tech/Adoption Grade “A”) has consolidated since its drop below $3,000 on April 11, trading near the $3,000 level ever since.

And like BTC, it’s in danger of its first close below key support — $2,980, which it hasn’t fallen below since March 22. And as Ethereum is trading below its 21-day moving average of $3,180 since it failed to reclaim that level early in yesterday’s trading, there’s bearish sentiment swirling today.

Investors were hoping for a positive catalyst coming soon from Ethereum’s shift to proof-of-stake (PoS) consensus, but a developer moved back its expected June timeline to later this year.

But there is still fundamental bullishness in ETH, especially as it becomes more deflationary as miner fees are burned. To date, over 2 million ETH have been burned, translating to about $6.4 billion removed from circulation.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Index Roundup

The crypto market finished the seven day-trading week largely unchanged.

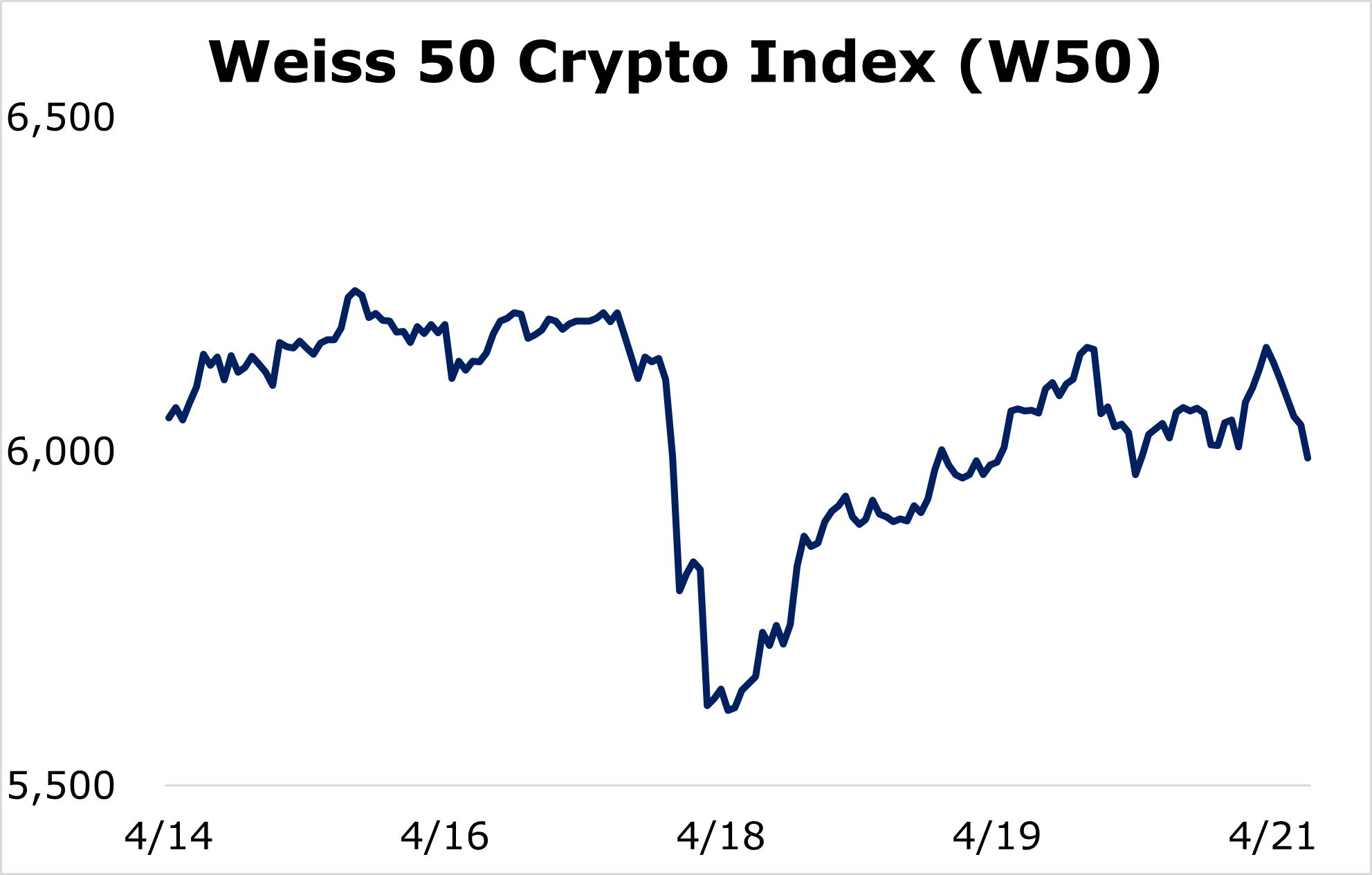

The Weiss 50 Crypto Index (W50) lost 0.99%, which is fairly negligible considering the volatility of the crypto space.

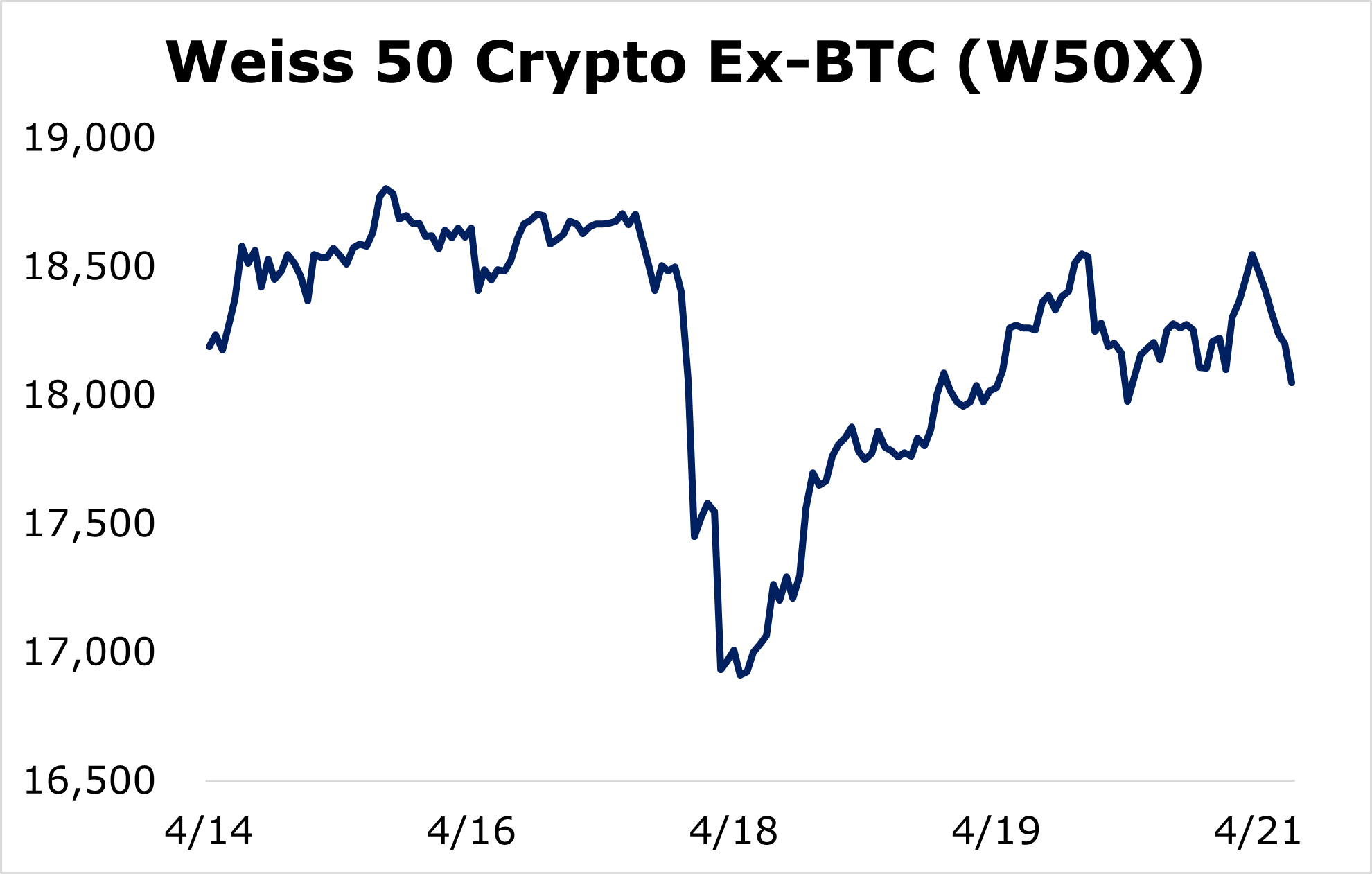

The Weiss 50 Crypto Ex-BTC Index (W50X) dipped 0.76%, showing that Bitcoin mostly traded in tandem with the broader market.

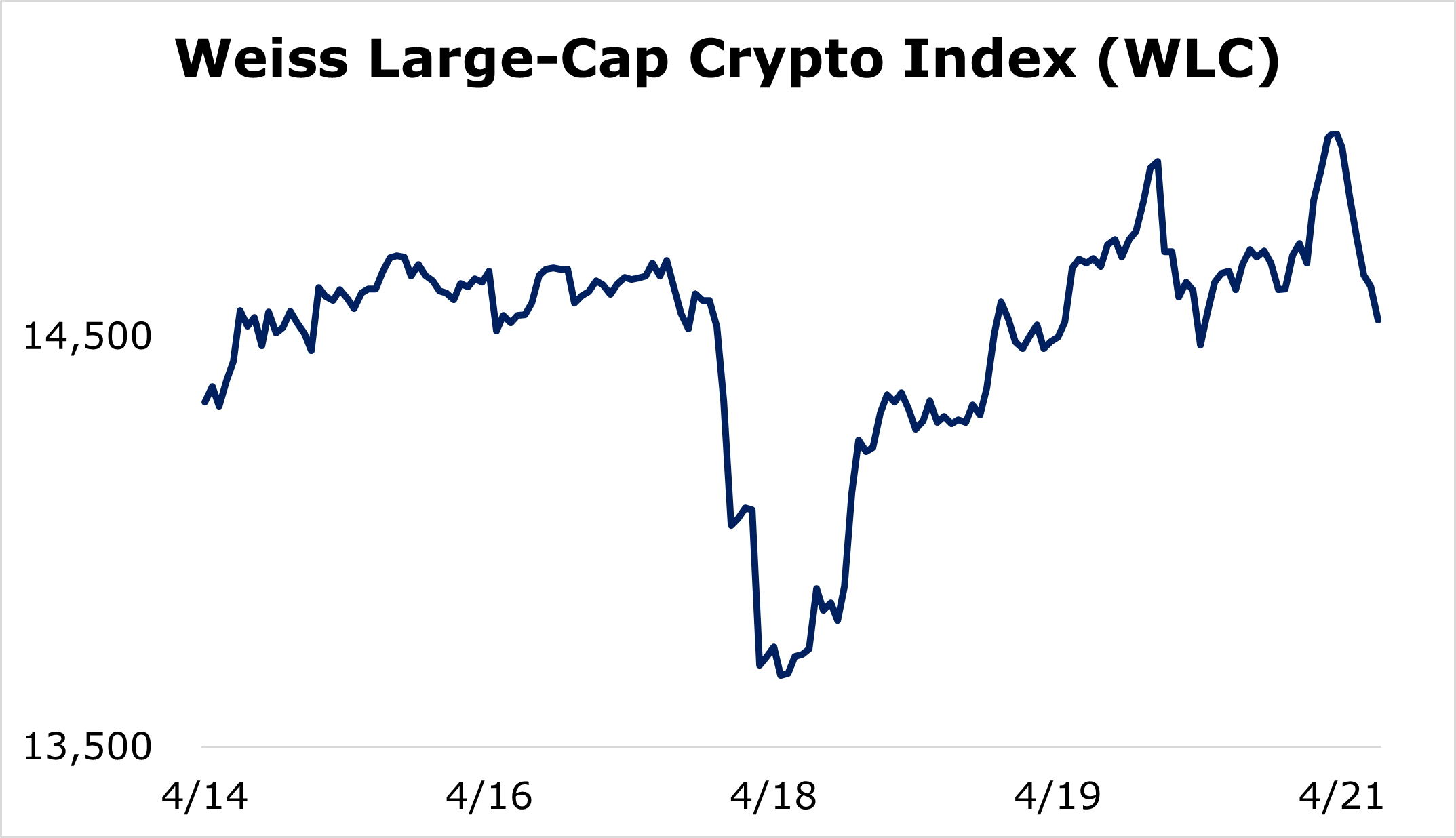

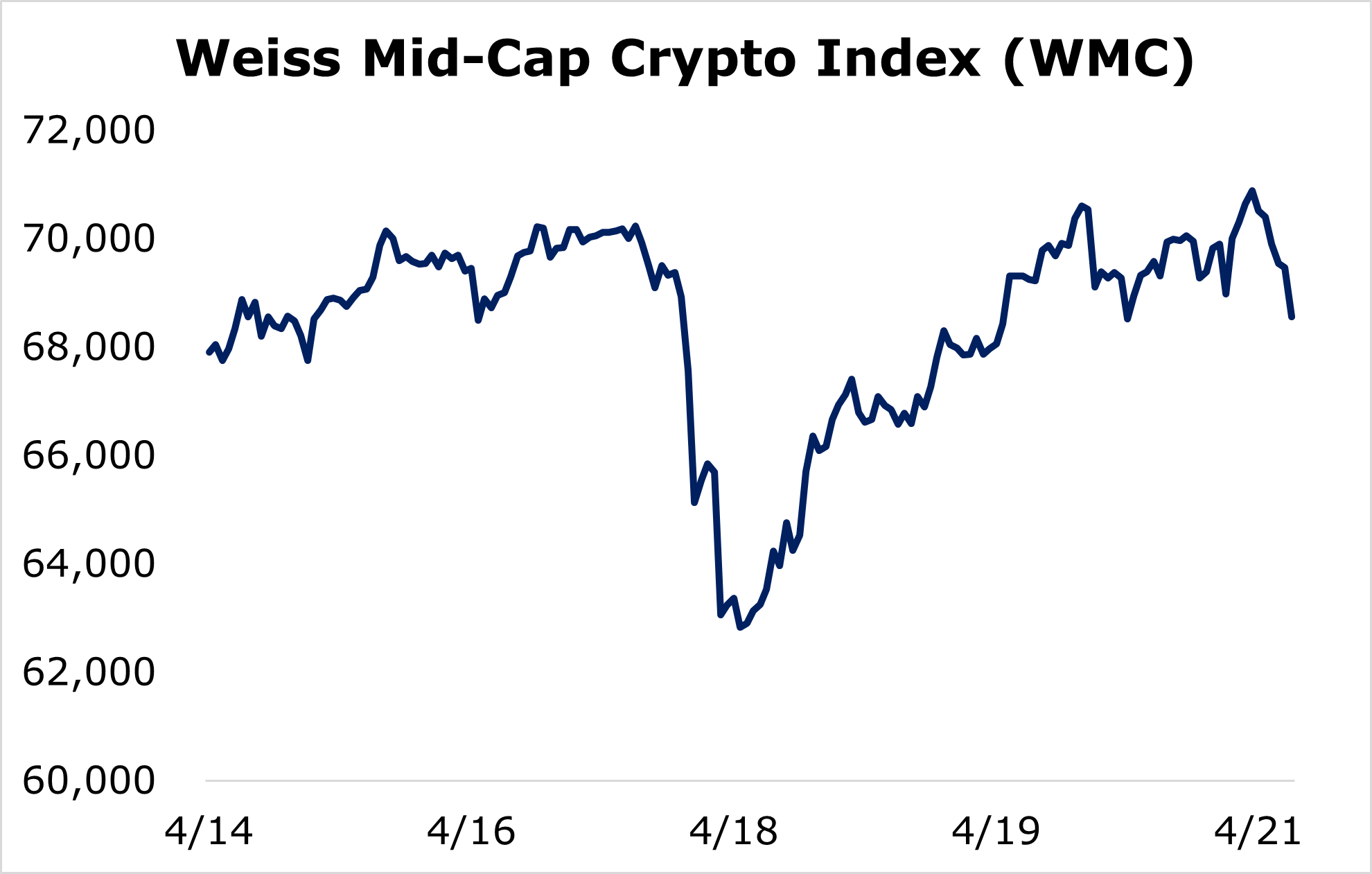

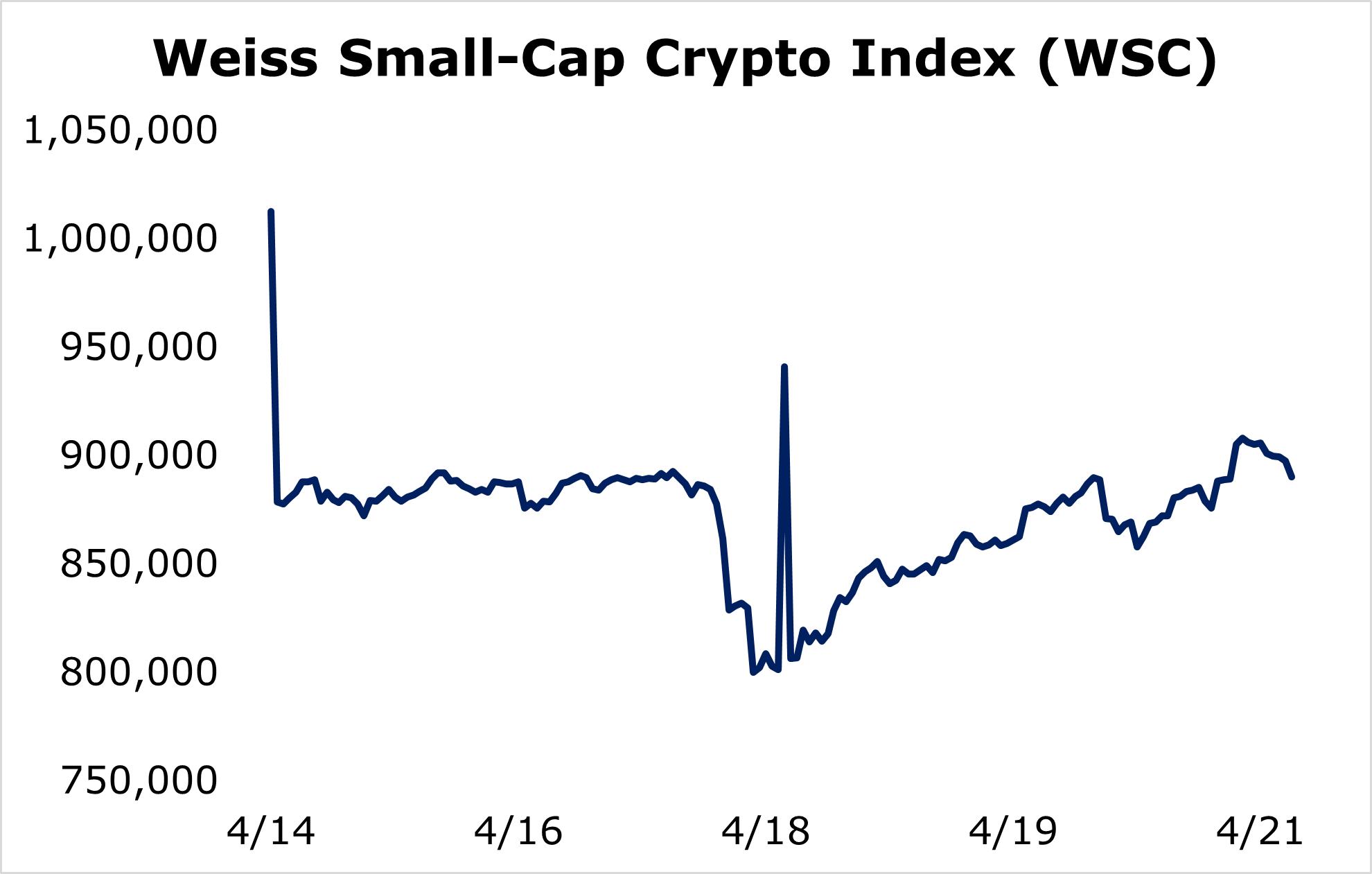

Breaking down this week’s performance by market capitalization, we see that large and mid-cap cryptocurrencies mostly traded together, while the small-caps suffered from early-week volatility.

The large-caps logged the biggest win, but the gains were minimal. The Weiss Large-Cap Crypto Index (WLC) rose 1.39%.

Mid-cap cryptocurrencies mostly followed large-cap performance, with the Weiss Mid-Cap Crypto Index (WMC) increasing 0.98%.

Small-cap cryptocurrencies suffered a steep initial pullback, but they were able to stabilize afterward. The Weiss Small-Cap Crypto Index (WSC) decreased 12.11%.

This week’s price action reflected the crypto market’s consolidation since it established a short-term bottom. Excluding the small-cap drop at the beginning of the week, each of the Weiss Crypto Indexes held their ground despite mid-week volatility.

Notable News, Notes and Tweets

- Pomp highlights the vulnerability of the U.S. Dollar after Israel shakes up its currency reserve allocations.

- An executive behind the self-hosted wallet maker Trezor claimed that governments are unable to fully ban noncustodial wallets.

- Bahamian Prime Minister Philip Davis wants to let residents pay taxes with digital assets, as he promotes “a vision to transform The Bahamas into the leading digital assets hub in the Caribbean.”

What’s Next

The crypto market is still trying to regain its footing after tumbling since the beginning of April. Cryptocurrencies continue consolidating since the sharp pullback but establishing support at current levels would go a long way toward rebuilding the momentum needed to extend the mid-March rally.

Bullish investors face several obstacles, including a potential 50-basis-point interest rate hike after the Fed’s next meeting in May and escalating conflicts in Ukraine, but these challenges will not dent the industry’s long-term prospects.

Short-term price action will likely remain choppy, but crypto adoption is making strides every day.

How can you best ride that adoption wave?

Well, my colleague Chris Coney has a few ideas in the world of decentralized finance (DeFi). And he believes DeFi 2.0 will be the future of finance as opportunities in the traditional finance (TradFi) world fade away.

And he reveals a few of those opportunities in his DeFi MasterClass. You can learn more here.

Best,

Sam