|

| By Sam Blumenfeld |

Bitcoin (BTC, Tech/Adoption Grade “A-”) and other cryptos are experiencing an overdue pullback after a torrid run since the beginning of the year.

The market is continuing to react to the expectations of further rate hikes from the Federal Reserve, despite optimism that the cycle was nearing an end.

For now, Bitcoin is holding above support at $21,000. However, it could fall further as the crypto market continues correcting.

Bitcoin unsurprisingly fell below its 21-day moving average after losing momentum, but it is not a significant development as the market swings back and forth.

Bitcoin’s crypto market dominance has hovered around 43% since the beginning of January. It has mostly stayed between 39% and 48% over the past year, but it could increase as the next bull run begins.

Generally, funds flow into Bitcoin and other large caps during the early stages before ultimately trickling into mid-sized and smaller cryptocurrencies. As price action picks up, investors usually target outperformance during later stages.

Here is Bitcoin’s price in U.S. dollars via Coinbase Global (COIN):

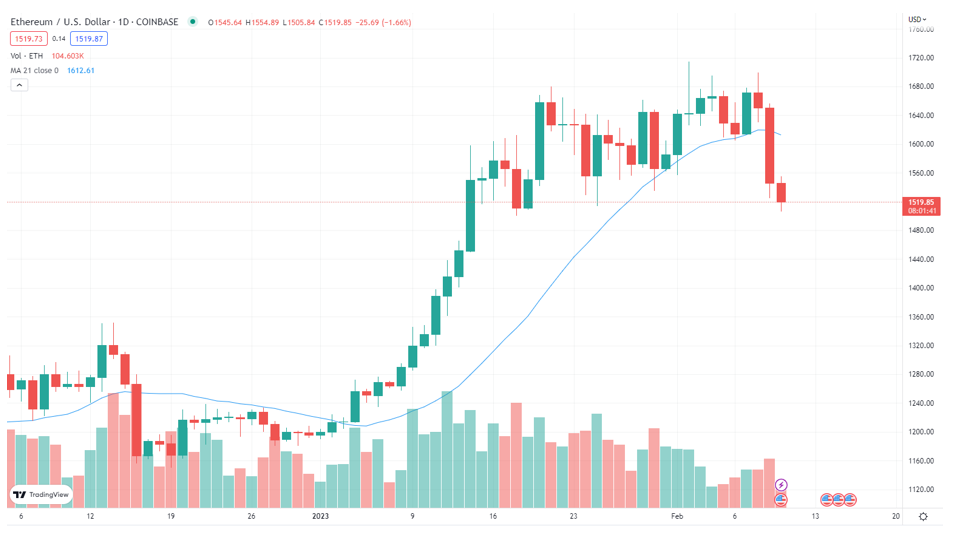

Meanwhile, Ethereum (ETH, Tech/Adoption Grade “B”) is trading about 2% lower today as it tries to keep itself above $1,500. The asset is down around 8% this week, but it still tracks an impressive 27% year-to-date gain.

Ethereum was unable to sustainably break through its pre-FTX trading level in November, but it is still significantly above its bear market low of $880. The pullback could continue dragging the second-largest crypto by market cap lower, but it should not be in any danger of establishing a new low.

Like Bitcoin, Ethereum dropped below its 21-day moving average of about $1,615. It will likely bring down other altcoins if it continues heading lower.

Still, investors have a lot to look forward to this year as it rolls out network upgrades, which should help reduce fees and improve scaling.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Notable News, Notes and Ratings

• Another week with multiple crypto upgrades brings the number of cryptos with a “B-” rating or better to 19. Of the 19 “Buy” rated cryptocurrencies, 10 were recently upgraded.

Seven cryptocurrencies are currently rated “B” or better, while Bitcoin remains the only crypto rated “B+” or better.

1. Bitcoin (BTC, Overall Grade “B+”)

2. Chainlink (LINK, Overall Grade “B”)

3. Decentraland (MANA, Overall Grade “B”)

4. Ethereum (ETH, Overall Grade “B”)

5. Litecoin (LTC, Overall Grade “B”)

6. OKB (OKB, Overall Grade “B”)

7. Polygon (MATIC, Overall Grade “B”)

• A state commission suggested that New Hampshire should make it easier to do business for crypto companies. Governor Chris Sununu’s appointed commission could allow the state to become a domestic leader by creating a legal framework with regulatory clarity for blockchain and crypto companies.

• Artificial intelligence could play a significant role in the future of crypto, according to Nansen AI CEO Alex Svanevik. AI is in the spotlight after the notable launch of OpenAI’s ChatGPT chatbot, and Svanevik believes AI will revolutionize the user experience for crypto products by improving access to information.

• German bank DekaBank will launch a tokenization platform utilizing blockchain technology. The initiative is not associated with cryptocurrencies, but it will utilize blockchain to tokenize stocks and bonds. The infrastructure is expected to be completed this year, with a release planned for 2024.

• The Russian government is subsidizing a mining plant in Siberia and will offer tax benefits for crypto mining investors. The state-owned mining facility will have 30,000 mining stations, which will be supported by 100 workers and 100 megawatts of power from Russia’s grid.

What’s Next

The crypto market was due for a pullback after its decisive move higher. Prices never go up in a straight line, and volatility is inevitable when considering the historical and potential returns of crypto assets.

Crypto should respond as expectations shift surrounding the Fed’s interest rate policy. If inflation continues cooling off, the central bank could light a fire under prices by pivoting.

It is not a given with such a strong labor market, but the economy is looking resilient as investors hope to avoid a deeper recession with a soft landing.

Regardless, crypto’s fundamentals continue improving as more individuals, institutions and governments hunt for exposure. Macro conditions are uncertain for now, but crypto keeps setting the stage for its next major run.

Best,

Sam