|

| By Mark Gough |

These days, tokenization has become part of most crypto market conversations.

And Coinbase just boldly moved to meet this moment.

This U.S.-based crypto exchange launched in 2012 to make crypto trading possible.

And now, it’s expanding its suite of products that cross over into the traditional finance world.

On Sept. 22, Coinbase Derivatives will launch the Mag7 + Crypto Equity Index Futures.

It’s the first U.S. futures contract to combine Big Tech stocks and crypto ETFs into a single instrument.

Rather than just another product rollout, this feels like a preview of where markets are headed.

That is, toward multi-asset tools.

Ones that erase the old walls between equities, digital assets, and eventually tokenized real-world assets.

Coinbase is not alone.

Today, Ondo Global Markets launched its platform …

This platform gives non-U.S. investors 24/7 access to tokenized U.S. stocks, ETFs and other securities.

These moves by Coinbase and Ondo highlight just how fast tokenization is moving from theory to practice.

Here’s Why These Moves Matter

For decades, Wall Street has built products around single asset classes.

Equity index futures gave investors exposure to stocks.

Oil futures let traders bet on energy.

And Bitcoin futures, introduced in 2017, opened the door to crypto.

But these markets were always in separate lanes. You could hedge your tech exposure in one contract and crypto exposure in another, but never both.

Coinbase’s new futures contract is the first to break that mold.

Combining growth equities and crypto ETFs in one basket reflects what investors already see …

These are no separate themes anymore.

They are part of the same wave of innovation reshaping the global economy.

This comes just as tokenization stops being a buzzword and starts becoming part of investors’ regular vernacular.

BlackRock, Fidelity and other giants are actively preparing tokenized funds, treasuries and money markets.

Coinbase’s futures don’t tokenize assets directly.

But they mimic the same structure: bundling multiple exposures into one efficient trade.

It’s a small but significant step toward the financial system tokenization …

And its promises to become borderless, multi-asset and always on.

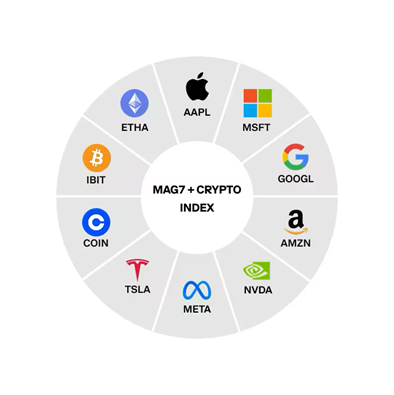

Inside the Mag7 + Crypto Index

The Mag7 + Crypto Index gives equal weight to Big Tech and crypto ETFs.

The index behind these futures is built on 10 equally weighted components, each carrying 10%:

- The “Magnificent 7” tech stocks: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla.

- Coinbase (COIN) stock.

- Crypto ETFs: The iShares Bitcoin Trust (IBIT) and the iShares Ethereum Trust (ETHA).

The equal-weight structure is important.

In the S&P 500, mega-cap stocks dominate.

Here, Bitcoin and Ethereum carry the same weight as Apple or Nvidia.

This contract feels less like a traditional equity tracker and more like a balanced innovation basket.

The index will be rebalanced quarterly, with MarketVector as the official provider.

How Coinbase’s Index Futures Work

The Mag7 + Crypto Index contracts are designed for broad accessibility:

- Cash-settled, with monthly expirations.

- Size: $1 × the index’s value (e.g., the index at 3,000 = $3,000 notional).

- Access: Launching first on Coinbase Derivatives’ partner platforms, with retail availability expected later.

The smaller contract size lowers the barrier to entry.

This signals that Coinbase is not only targeting institutions …

It clearly wants retail traders to participate in this new multi-asset futures market.

Ondo’s Tokenized Market Push

While Coinbase bundles tech and crypto into one futures product, Ondo takes a different angle.

Its new Ondo Global Markets platform offers instant, 24/7 access to tokenized U.S. stocks, ETFs and other securities.

Again, this is for investors outside the U.S.

Ondo’s pitch is twofold:

- Deliver the liquidity and protections of traditional markets.

- Settle and trade through blockchain rails.

In other words, securities trading has the same around-the-clock accessibility investors expect from crypto.

Coinbase and Ondo together highlight two key paths of tokenization:

- Coinbase shows how assets can be bundled into multi-asset contracts.

- Ondo shows how the assets — from stocks to ETFs — can migrate onto tokenized rails.

Different approaches, same destination: a global financial system that is borderless, bundled, and always on.

3 Reasons Why Coinbase & Ondo Seized This Moment

The timing is no coincidence.

- Institutional flows are rising: With U.S. Bitcoin and Ethereum ETFs approved this year, investor comfort with crypto has never been higher.

- The Mag-7 remain market movers: Pairing them with crypto captures investor appetite for an “innovation economy” basket.

- The macro backdrop is ideal: With Fed interest-rate cuts expected soon, growth assets from Big Tech to Bitcoin stand ready to benefit.

When central bank liquidity goes up, Bitcoin tends to go up by a lot more.

And with the first U.S. rate cut in a year potentially being announced on Wednesday, Sept. 17 …

That could mark an even more pivotal inflection point for altcoins. (That is, cryptos that are not Bitcoin.)

I recently spoke with Dr. Martin Weiss about why I believe smaller-cap altcoins are truly on the launchpad right now.

You can listen in on that timely conversation right here.

Be sure to do so straightaway, because the window of opportunity to catch select altcoins could close before Jerome Powell delivers the post-meeting press conference.

What Comes Next

Coinbase and Ondo are racing to establish themselves as leaders in the multi-asset era.

If their new products succeed, those could unlock a new generation of hybrid financial tools:

- Futures tying crypto to commodities like gold or oil.

- Tokenized baskets mixing stocks and stablecoins.

- Indexes blending treasuries, real estate, and digital assets.

Each step moves markets closer to a reality where everything is tokenized, bundled and tradeable across borders 24/7.

Bottom Line

Coinbase’s Mag7 + Crypto Futures and Ondo’s tokenized securities platform may appear to be different stories.

Still, they point to the same trend: the convergence of traditional and digital markets is accelerating rapidly.

This month will likely be remembered as more than a futures launch date.

September should also mark a turning point in how investors access innovation.

The future of markets is bundled, tokenized, borderless — and it’s already starting to take shape.

Best,

Mark Gough

P.S. The Fed getting ready to flood the system with money.

When all that fresh liquidity hits the markets, history shows it’s the smaller cryptos that can explode in value the most.

I’m talking gains as large as 1,204% … 2,324% … and even 17,862%.

Dr. Martin Weiss and I recently discussed how specific coins could blow past Bitcoin and even Ethereum when this altcoin season officially kicks off.

To listen in on our conversation … and see how you can get the names delivered to your inbox … click this link here.