- Bitcoin (BTC, Tech/Adoption Grade “A-”) is almost entirely unchanged, and it trades near $37,000.

- Ethereum (ETH, Tech/Adoption Grade “A”) is up 1%, as it looks to jump above $2,500.

- Bitcoin’s market dominance increased over two percentage points this week to 43%. It’s broken through the upper end of its recent 40%–42% range.

The crypto market is dealing with additional uncertainty after reports that the Biden Administration is planning to take executive action against cryptocurrencies. The White House claims it’s an issue of “national security.” However, Bitcoin and other digital assets are holding their ground despite weakening sentiment.

The broader crypto market is looking increasingly oversold, so it’s a good sign to see that this additional pressure isn’t significantly impacting prices. Bitcoin is down 46% from its $69,000 all-time high established in early November and hasn’t seen a significant relief bounce. That’s rare, and it wouldn’t be surprising to see one soon.

Still, Bitcoin is trading below its 21-day moving average, which has fallen to about $40,000. It’ll be important to hear more from the White House about how it plans to regulate cryptocurrencies. Until then, the market could face additional headwinds from regulatory fears and the Federal Reserve’s intentions to raise interest rates.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (Nasdaq: COIN):

Ethereum is struggling — down about 50% from its all-time high — but has recorded green daily candles in four of the past six days. And it’s important to keep perspective: The asset is still up nearly 80% from a year ago.

Moving forward, if sentiment improves, Ethereum has plenty of positive catalysts including its switch to proof-of-stake validation. The Phase 1 update should launch later this year.

In the meantime, ETH continues to burn miner’s fees to deflate supply. Nearly 1.7 million ETH has been burned to date, which translates to nearly $4.2 billion in tokens removed from supply since last August.

For now, though, Ethereum is trading significantly below its 21-day moving average. It would need to surpass $2,900 to regain its short-term momentum. In these market conditions, that could be difficult.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Index Roundup

The crypto market struggled this week, but the damage was mostly done early on. Crypto assets sold off following the news that Russia was banning mining, but the market has traded sideways since then.

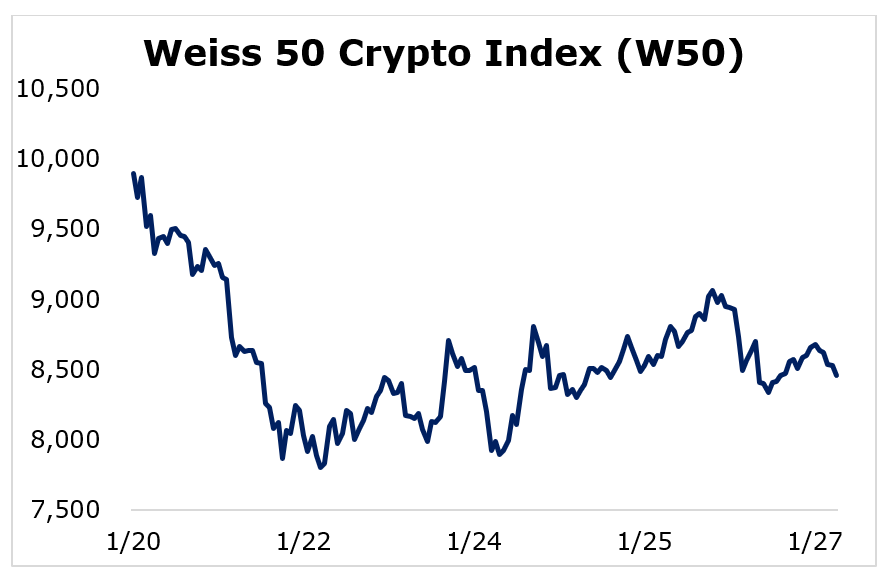

The Weiss 50 Crypto Index (W50) dropped 14.6%, as few names were spared from the sell-off.

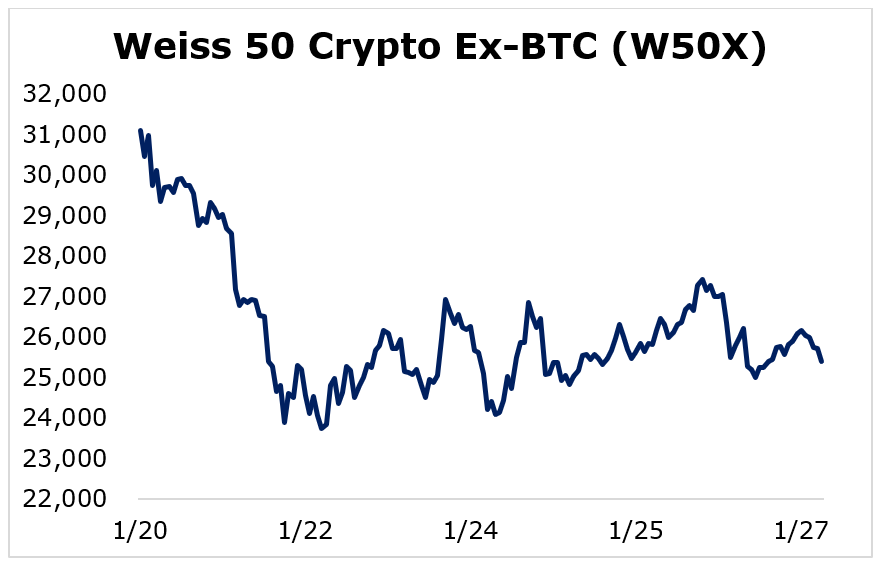

The Weiss 50 Crypto Ex-BTC Index (W50X) fell 18.39%, showing that Bitcoin managed to outperform altcoins during the turmoil.

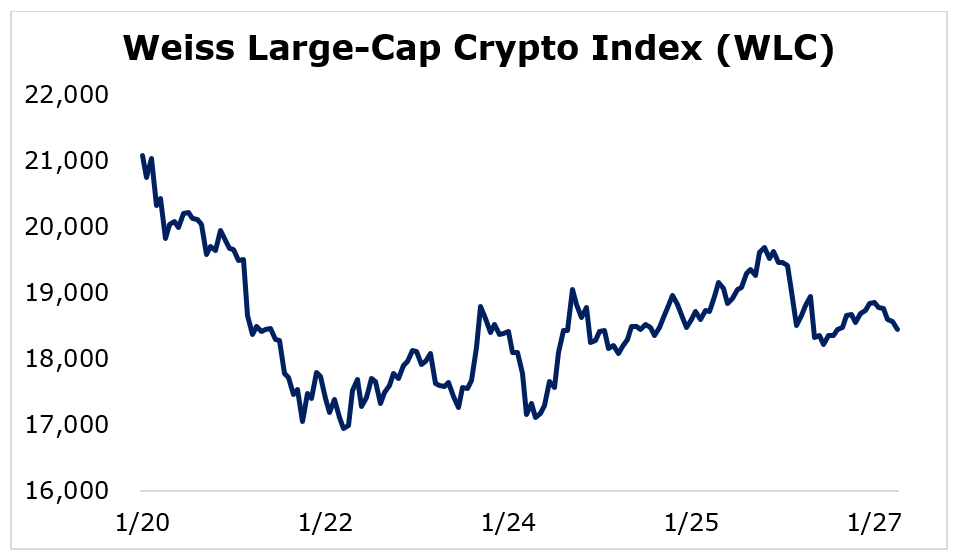

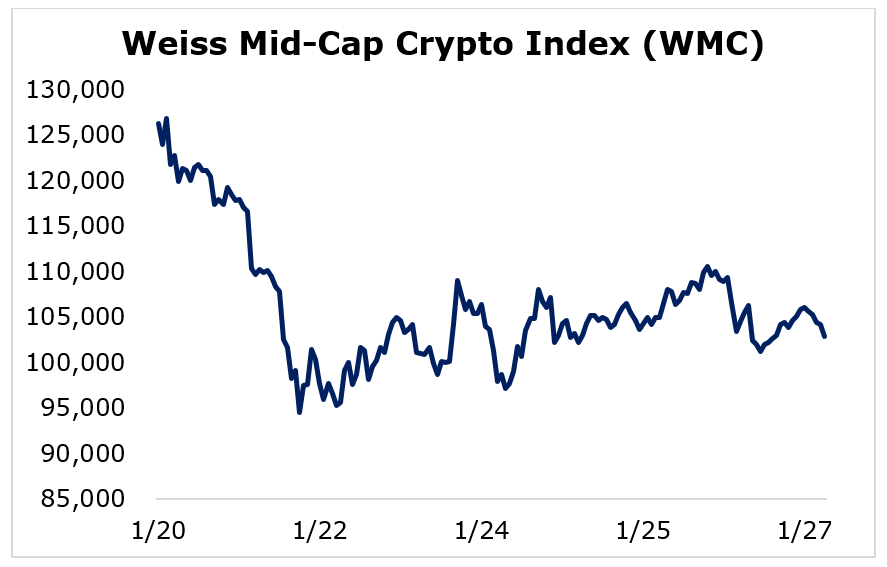

Breaking down this week’s performance by market capitalization, we see that the large-caps outperformed the smaller and mid-sized altcoins, which traded together.

The largest cryptocurrencies held their value better than the less-established projects, as the Weiss Large-Cap Crypto Index (WLC) decreased 12.49%.

The Weiss Mid-Cap Crypto Index (WMC) tumbled 18.50%, as more speculative altcoins struggled.

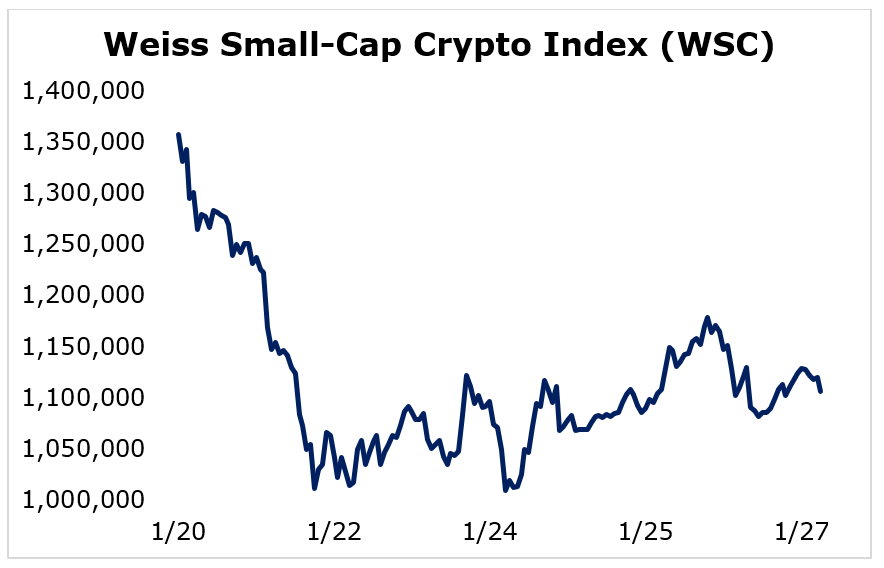

The Weiss Small-Cap Crypto Index (WSC) declined 18.54%, as small-cap cryptocurrencies followed the mid-caps.

After the sell-off early in the week, volatility decreased across the broad market.

Notable News, Notes and Tweets

- Bitcoin mining now makes up less than 0.08% of global carbon dioxide emissions.

- After the Federal Reserve’s statement on interest rates, investors took $670 million of Bitcoin off of exchanges.

- The Securities and Exchange Commission (SEC) has denied Fidelity’s spot exchange-traded fund (ETF) proposal.

What’s Next

The crypto market will likely continue facing short- to medium-term challenges as funds flow into “safer” investments. But we expect to see the impacts of the Federal Reserve’s hawkishness and threats of regulation fading as crypto’s correlation to tech stocks and traditional financial assets decreases.

While some investors are panicking about the White House’s statement on cryptocurrencies, regulations are inevitable. Regulating the crypto industry will add legitimacy to the space and promote long-term adoption.

As adoption grows, the call for regulations grows with it. Just like with the news of China and Russia banning crypto mining, regulatory fears should fade. It could be a choppy ride, but long-term investors should be rewarded.

Best,

Sam