|

| By Alex Benfield |

This week was a lesson in how fast the tables can turn.

Just last week, we witnessed three of the cryptocurrency industry’s biggest banks go down. And yet today, Bitcoin (BTC, Tech/Adoption Grade “A-”) is posting its highest prices of the year.

Last Friday, Juan and I gave you a breakdown of what transpired with Silvergate and the start of the worry with Silicon Valley Bank. A lot has transpired since then, including a (somewhat) reassuring bailout fund from the Federal Deposit Insurance Corporation intended to stave off worries of further contagion and bank runs.

However, we are starting to realize that this is likely just the beginning of a larger problem.

But first, I will let Juan give some further explanation for how this all happened and what he thinks might transpire moving forward.

The Flight of Icarus

Since the start of the year, our Crypto Timing Model has been saying the best performance for crypto markets in 2023 would most likely occur during the second quarter.

And the catalyst for it would likely be a Federal Reserve pivot.

Then, a few weeks ago, after the last rate hike, I said the Fed was probably done raising interest rates. My reasoning was that it had already gone too far too fast, making a reckoning inevitable.

Well, the reckoning began last week.

Silvergate, a small, crypto-friendly, California-based bank, reportedly came under coordinated assault by anti-crypto elements in the U.S. government.

They zeroed in on its depositors with a drumbeat of unfounded allegations of bad banking practices and malicious gossip. This included a sitting U.S. senator accusing the bank of illegal acts on social media.

The attacks worked. Depositors thronged the bank in a mad frenzy to get their money out before the roof caved in. Running out of cash, Silvergate was forced to wind down operations last week.

But there were also unintended consequences. Once released, this genie would not go back into its bottle, and more banks failed in the wake of Silvergate.

You probably know all this already. It has been all over the news.

Here’s what you may not know:

No bank ever has enough cash on hand to redeemall deposits at once.

Banks take deposits and lend out to what they see as profitable opportunities. In theory, they pay depositors a small fee, earn a bigger fee from their lending activities and keep the spread.

Because of this, no fractional reserve bank, no matter how well run, will ever have enough cash on hand to meet all withdrawals. This is just how fractional reserve banking works.

If depositors exit a bank en masse — and no government assistance is provided — the bank will fail. Period.

So, neither Silvergate nor SVB wase badly run. What made them vulnerable was the Fed’s interest rate policy.

Most Silvergate and SVB assets were invested in U.S. Treasurys and agency mortgage-backed securities … which the Fed officially considers risk-free.

In the aftermath of the 2008 crisis, the Fed and other bank regulators screamed: “Stop risky behavior! Own riskless assets.” The banks complied.

But what followed 2008 was more than a decade of near-zero interest rates — which drove bond prices higher and higher. (Remember, the lower the yield, the higher the price and vice versa.)

Encouraged by the Fed, banks were told they no longer needed to keep any cash collateral when purchasing sovereign bonds because “they are risk-free, it shouldn’t be necessary to keep a cash cushion in case prices fall.”

Looking back on this now, it is hard to imagine how so many bankers could have believed this. Nonetheless, this was prevailing wisdom at the time.

Then came 2022.

Inflation became a political issue. The Biden administration ordered the Fed to wage war on inflation. Ever obedient to its political masters, the Fed responded with the most aggressive rate hikes in U.S. financial history.

The speed and magnitude of these rate hikes caused sovereign bond markets around the world to collapse. Tumbling prices caused massive mark-to-market losses on bank investment portfolios.

If banks are forced to sell to meet depositors’ demands, their balance sheets start taking on heavy losses. And before long, you’re insolvent.

This is exactly what happened to Silvergate, SVB and a few others.

Without Government Intervention, a Death Spiral Looms

But regulators have now stepped in. They are guarantying deposits at any bank that fails.

That should stop the bleeding … for now.

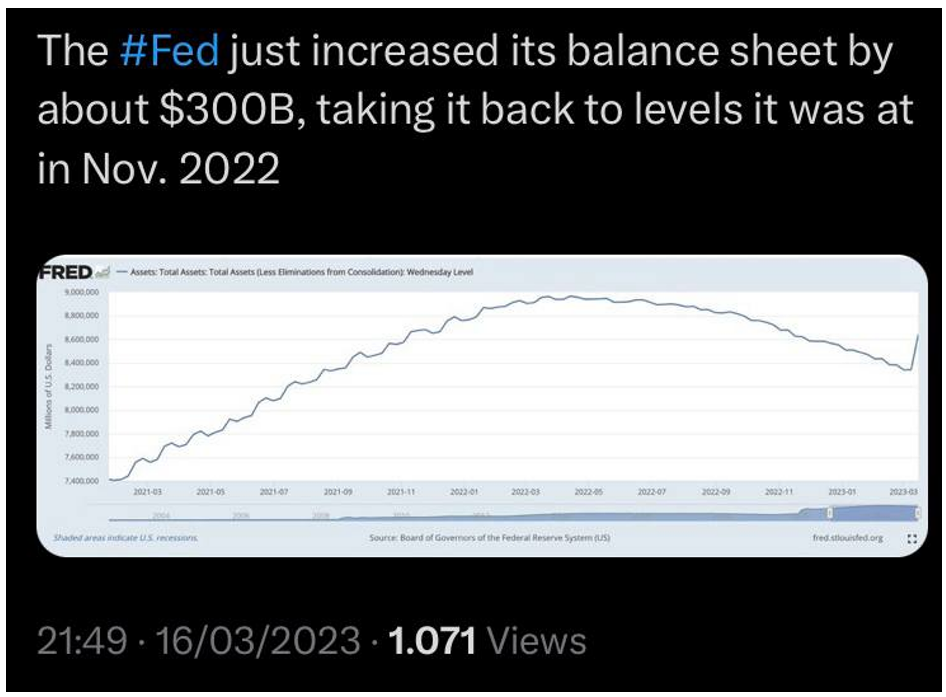

Furthermore, the Fed is back at it again: It’s offering unlimited money to any bank that has U.S. Treasurys on hand. Already, its balance sheet has increased to levels not seen since November 2022, reversing months of quantitative tightening.

Juan’s Prediction

The Fed will be forced to slash interest rates. They may even be forced to buy the bonds, at 100 cents on the dollar, from ailing financial institutions.

We are reaching the endgame of a sovereign debt bubble. Unless the central bank buys back all debt, at par — that is, without mark-to-market losses — the system collapses.

And at that point, crypto will be the world’s only still-functioning monetary system.

So, how will these recent events affect the crypto market?

I will let Alex delve into that …

This Week in Crypto

Bitcoin has had quite the eventful week. It retested support near the $20,000 level late last week as the banking crisis was just getting started.

But BTC has come roaring back and has now posted its highest prices of the year … and the highest levels since June 2022.

This appears to be the beginning of a larger move as Bitcoin has now cleared above its 200-week moving average for the first time since August 2022.

With this strong move, Bitcoin appears to be stepping into its role as a store-of-value asset that offers opting out of the current financial system.

Meanwhile, Ethereum (ETH, Tech/Adoption Grade “B”) is also trading at its highest levels of the year and is attempting to close above $1,700 today.

Should ETH manage to flip $1,650 from resistance to support, it could make a run to $2,000. Things could pop off very soon.

Click here to see full-sized image.

My best guess as to why ETH has been lagging BTC over the past week is that we have seen a lot of crypto newcomers enter the market in the past seven days, as shown by new addresses created on the Bitcoin blockchain.

Generally, new market entrants tend to start with Bitcoin first before moving on and exploring the rest of the crypto ecosystem.

So, Ethereum will have its turn soon enough.

What’s Next

We have been saying this on repeat for over a year now: “The Fed will push this economy and raise rates until something breaks, after which they will reverse course.”

I would say that something has broken, and this is no small problem.

Juan and I both agree that a Fed pivot is coming soon … if it’s not already here.

In fact, the Fed has already reversed course on its balance sheet and wiped out the last four months of QT. The only thing stopping us from calling this a full Fed pivot is the interest rates.

Will it raise rates next week or will we see the start of the pivot? We will have to wait and find out.

One thing is for sure, though: Bitcoin isn’t waiting for anybody.

Best,

Alex