Don’t Let the Bitcoin Drama Distract You from This Golden Opportunity

|

| By Juan Villaverde |

The reaction to Bitcoin’s correction following the spot ETF approval has been fear and panic.

Which only makes sense if you ignore everything but recent price action.

But if you’ve been reading up on your Weiss Crypto Daily updates, you’ll know there’s so much more at work in the crypto market.

Namely, the context of this correction. It was sparked by the wave of investors selling the news following the spot Bitcoin ETF approval.

What fearmongers fail to mention is the fact that the four months leading up to that approval marked one of the longest 80-day rally in Bitcoin history.

That means Bitcoin was already in rally mode and ready to transition to the pullback phase of its 80-day cycle going into the approval announcement. Indeed, it’s likely that anticipation and hype kept Bitcoin at those elevated levels longer than it otherwise would have been.

You'd think after such a stellar performance in the last quarter of 2023, people would be chilling with some bubbly, celebrating the dawn of a new crypto bull market in early 2024.

But no, the crypto world loves a bit of drama. Let's recap the soap opera:

- Act One, the Hype Begins: BlackRock hints at a spot Bitcoin ETF, and Bitcoin jumps from a snooze at $25,000.

- Act Two, the Plot Thickens: The SEC loses a lawsuit, hinting at possible approval for Grayscale's GBTC Trust to convert to an ETF. Bitcoin flirts with $30,000.

- Act Three, the Climax Approaches: The market buzzes with rumors of the SEC approving not one, not two, but all 11 ETFs. Bitcoin shyly approaches $40,000.

- Act Four, the Hype Peaks: Everyone's expecting the biggest ETF party in history. We're talking tens of billions of dollars on day one! Bitcoin hits $50,000.

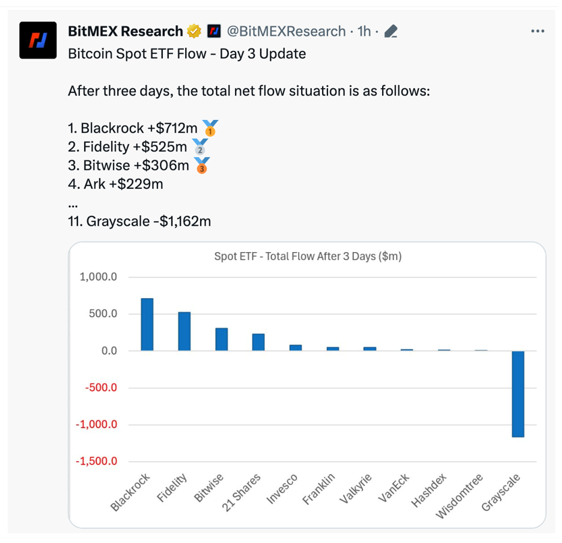

- Act Five, the Realization: And then reality hits. Despite the fact that, in total, the ETFs have seen nearly $5 billion in inflows as of earlier this week, there is still selling pressure.

Naturally, there was the wave of initial “sell the news” traders looking to grab gains at the top. But there is still selling pressure from Grayscale clients. Many are seeking to get away from Grayscale’s high fees, especially as there are 10 other ETFs with far more manageable fees.

It's the classic tale of sky-high expectations crashing down to earth.

And it’s brought us here, where talking heads are fretting because Bitcoin dared to dip below the (not actually) sacred $40,000 mark, touching the terrifying lows of $38,000.

Oh, the horror!

Forgive my dramatics, but most of us who have followed crypto for a while know this is just Bitcoin being Bitcoin. Indeed, I even said that a Bitcoin correction was imminent.

Even the strength of this pullback is being blown out of proportion for what we’ve seen so far. That’s evident when you understand that falling to $40,000 only represents a 15% drop from Bitcoin’s January high.

That shallow a correction is possible but unlikely, even in a crypto bull market.

Add in the fact that $40,000 wasn’t even a strong support level according to my Crypto Timing Model, and I have even less urge to feel concerned.

Yet analysts everywhere are scratching their heads, wondering if the sky is falling.

So let me be clear: It’s not.

This is classic market behavior: The cycle of inflated expectations followed by the inevitable disappointment.The whole "buy the rumor, sell the news" spiel couldn't be more spot-on.

And that’s why I'm not losing sleep over it.

As a seasoned cycles analyst, I knew the party had to end sometime. Seeing Bitcoin's meteoric rise from $25,000 to almost $50,000, I was ready for the tide of disappointment and the ensuing sell-off.

That’s why I shot you a warning earlier this week.

But I have another reason for my optimism beyond being able to anticipate the correction: There’s a perfect supply/demand storm brewing on the horizon that could send Bitcoin soaring.

The increased demand from the ETFs isn’t going away any time soon. But the Bitcoin halving expected to come in late April promises an even smaller circulating supply.

When those two conditions are met, Bitcoin will have all the fuel it needs to go even higher.

So, while the market takes a breather and the latecomers fret, those in the know — like you — should see this as the golden opportunity it is.

Savvy investors know this will likely be the best chance to load up on top-performing assets at a discount.

And once your portfolio is ready, all you have to do is wait to ride the next wave in this ever-entertaining crypto bull market.

Best,

Juan Villaverde