|

| By Chris Coney |

We’ve talked about crypto bridges before. They allow assets native to one blockchain to move to a non-native network as a wrapped asset.

And it should be no surprise that each swap over a bridge requires a fee, like most crypto transactions.

But you may not know that there’s a way you can get a cut of those fees.

There are a few ways this can work, depending on the asset and bridge. But for our purposes today, I’ll use cBridge as the example and I’ll stick with a stablecoin — USD Coin (USDC) to be exact — to keep things simple.

Let’s say you have some USDC in your Ethereum (ETH, Tech/Adoption Grade “A”) wallet and you want to move it over to the Polygon (MATIC, Tech/Adoption Grade “B”) network to take advantage of some opportunity.

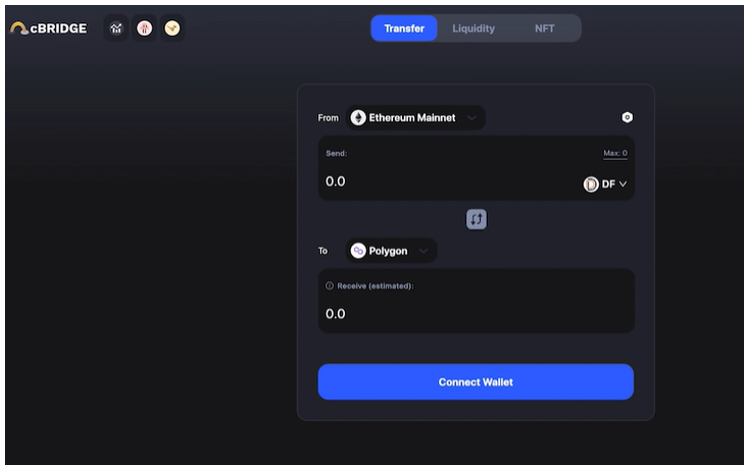

If you go to the Transfer tab on cBridge, you’ll see a standard-looking token swap interface.

But instead of swapping one asset for another, let’s swap the same asset from one network to another.

So we’d select Ethereum as the From network and Polygon as the To network.

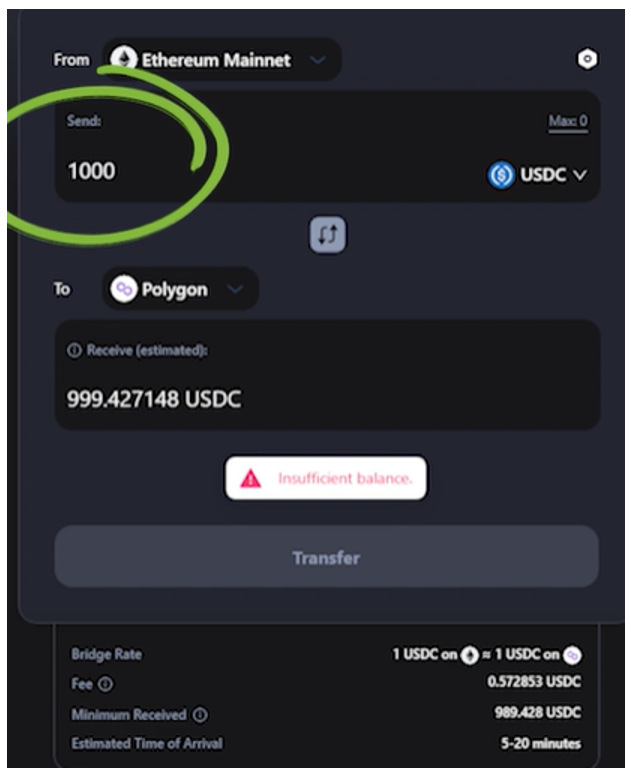

Then we’d select the asset that wants to cross the bridge, which in our case will be USDC, along with the amount we want to move.

And at the bottom it quotes us a fee and how long the transaction will take to complete.

And that’s all there is to it from a user's perspective.

Once that transaction goes through, the funds will arrive in the same wallet address on the Polygon network.

Now we have established that bit, let’s get back to the promise of this episode — how to earn yield using these bridges.

We’ll do that by being a liquidity provider.

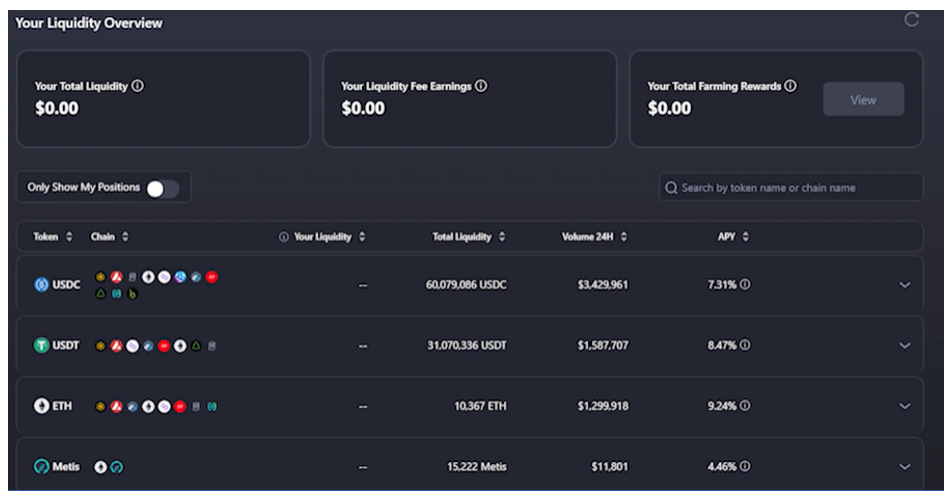

To do that, we head over to the Liquidity tab on the top of the cBridge screen. Here we have all the data pertaining to the other side of the transaction.

When we ran through that example as a user, we surrendered ownership of some USDC on the Ethereum network for USDC on the Polygon network.

So, whom did we send the USDC to … and then receive it back from? And who charged us the fee?

These liquidity providers.

These folks are willing to have their balances on various chains moved around different chains in exchange for bridge fees.

And we can be among these people.

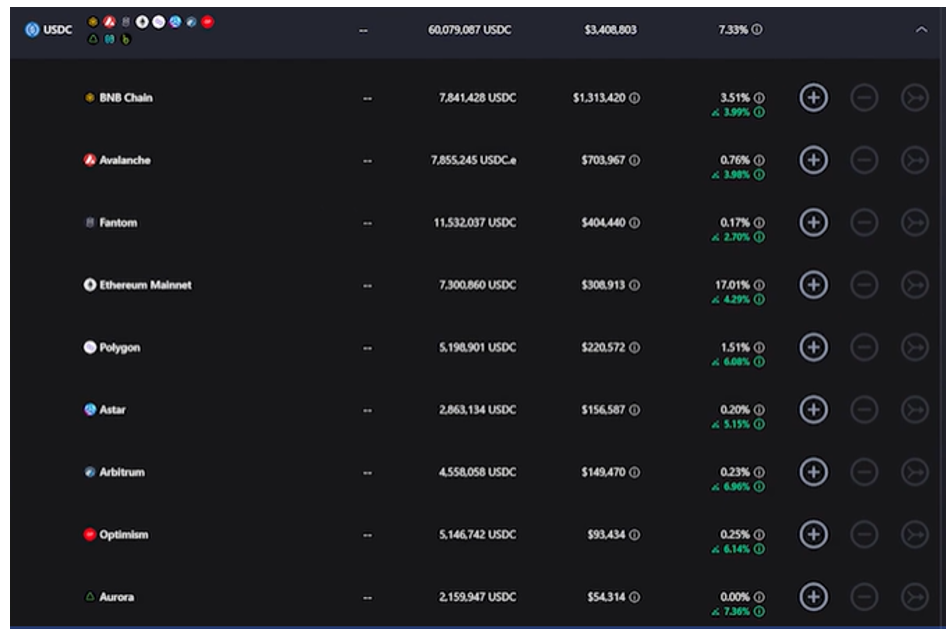

Sticking with USDC, you can see there’s roughly 60 million USDC locked in cBridge, giving an aggregate yield of 7.32%. You can also see the yields broken down by individual blockchain and can start adding liquidity on any blockchain by clicking the relevant plus button.

Now take a look at the Ethereum blockchain, which is boasting a juicy 17% yield for USDC.

However, that’s when your USDC is going from the Ethereum network.

While your funds may start there, they most definitely won’t stay there. That’s kind of the point of being a liquidity provider: You’re willing to let your assets fly back and forth from chain to chain to earn a share of the fees generated.

Once you’ve deposited your liquidity, you don’t have to do anything — all the swaps are automated.

The reason I’m mentioning this, and the only time it really matters, is when you want your money out. It’s unlikely that your assets will be all nice and tidy on one single network.

But never fear, cBridge has got you covered.

The plus button is obviously to deposit liquidity, and the minus button — which is right next to it — is to remove liquidity. Then we have this third icon, the arrow, which is used to aggregate your liquidity onto one chain.

If you wanted all your USDC back in your original wallet on the Ethereum network, you would use the aggregate button on the Ethereum row.

And remember that the yields are paid in the token you initially deposited.

In this example, I used USDC, meaning my aggregate yield would be paid in USDC.

Now, let’s say you deposited 10,000 USDC. With an aggregate annual percentage yield at roughly 7%, you’d be looking at a $700 return in a year.

And if I were to deposit ETH as liquidity at 7%, after a year I’d have 7% more Ethereum than I started with.

So, in that regard, the yield is disconnected from the market price of the asset and could present a way to increase your exposure to select assets … without buying more.

That’s all I’ve got for you today. I’ll be back next week with another episode.

Until then,

Chris Coney