|

| By Beth Canova |

Last week, the Securities and Exchange Commission officially shot down Grayscale’s proposal for a spot-price Bitcoin (BTC, Tech/Adoption Grade “A-”) exchange-traded fund.

What a shame. Besides the overall benefit of a spot Bitcoin ETF, many investors were hoping for approval to boost near-term sentiment and send prices even a little higher.

Now all eyes are on Ethereum’s (ETH, Tech/Adoption Grade “A”) Merge as the next potential catalyst for positive price action.

Set to take place in the third quarter of the year, Ethereum’s Merge will transition the network from proof-of-work to proof-of-stake, reducing transaction times and fees.

The reason so many are hanging their hats on this to be a near-term bullish event is because of how previous ETH upgrades have done exactly that. Look no further than last year’s London hard fork, and you’ll see what I mean.

In just 24 hours following the launch of the London hard fork, ETH was up 6.6%. And that’s not even considering the sizable run-up in price that preceded the event.

For now, developers are still focused on rolling out the change on Ethereum’s testnets.

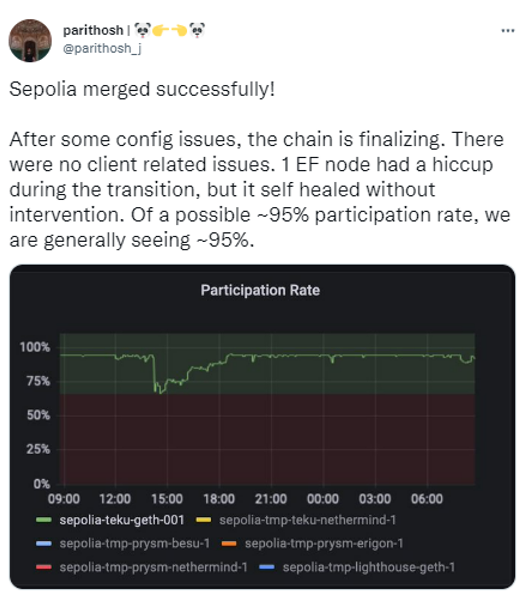

Testnets are where developers and node operators test stuff before it goes live on the mainnet. The first testnet, Ropsten, successfully transitioned to PoS in early June. And Ethereum’s second testnet, Sepolia, transitioned last Wednesday. Both tests went well, with only a few peripheral issues discovered in each.

In the Ropsten test, the snags were primarily caused by two small bugs that would only affect a minority of stakers and could be fixed locally, meaning no new code needed to be deployed.

As soon as those bugs and a configuration issue were resolved, validator participation rose to about 99% — just where it was prior to the merge.

Nice!

In Sepolia’s case, most issues were due to incorrect client configurations. For example, a small percentage of validators failed to participate because of missing keys.

Also, a handful of validators running Besu nodes ran into a minor data storage issue. But this had been flagged some time ago.

In other words, there was no glitch in the system, just some operators failing to keep up with already published information.

Once that was resolved, participation rose back to its pre-merge level near 95%.

That’s two successes down for the Merge. ETH developers are going for three before the main event.

Goerli will be the final testnet before Ethereum finally brings PoS to the mainnet later this year. The idea is for Goerli to mimic what happens when the actual mainnet goes live as closely as possible.

That way, stakers, node operators and developers all have at least one more dress rehearsal before the real thing. Indeed, online resources for this purpose abound, such as a merge readiness checklist.

The date for the Goerli merge has yet to be announced, but we’ll let you know when it is.

So, what does this mean for you if you’ve invested in Ethereum or are exposed to it in other ways?

Fortunately, most changes related to this mammoth upgrade relate to how nodes will run on the network. For end users, no action is required.

That’s because the Merge was designed to have minimal impact on the countless thousands of platforms, smart contracts and decentralized applications already running on Ethereum.

That’s a huge benefit, allowing dApp development on Ethereum to keep growing even in the face of the crypto winter. Indeed, it’s faster than ever, with dozens of new utilities starting up almost every day.

That includes tokenization of art, rights, loyalty, memberships, music, goods, real estate — and this is just scratching the surface. Plus, proposals abound for new features that would further reduce costs of transactions on Layer-2 platforms (which are already low).

On top of that, Ethereum has long been one of the safest networks in crypto — which should continue post-Merge.

How safe, exactly?

Well, suppose someone sought to rewrite history by overturning and replacing a previously finalized block of transactions. To do that, they would need to seize control of two-thirds of all network validators — which is already a virtually impossible task.

Plus, they’d need to own and burn (lose) at least one-third of Ethereum’s total stake. Right now, that’s 4.5 million ETH, worth a hefty $5.3 billion. It’s hard to even imagine a bad actor with the means and movtive to pay such a price, making this attack unreasonable.

And safety will increase much further after the Merge when miners shift to staking.

Overall, Ethereum should expect a nice boost when the Merge finally comes along. Of course, timing will play a part in the price action, as will the macroeconomic climate, if at all different from what we’re experiencing now.

So, I suggest holding on tight to your Ethereum (if you own any) ahead of this potentially bullish catalyst.

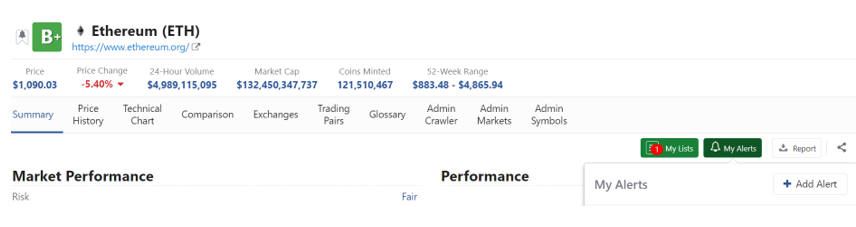

And if you want to stay on top of every ETH move, I recommend setting up an alert on our website. Simply go to the Ethereum page, then click on My Alerts on the right side of your screen.

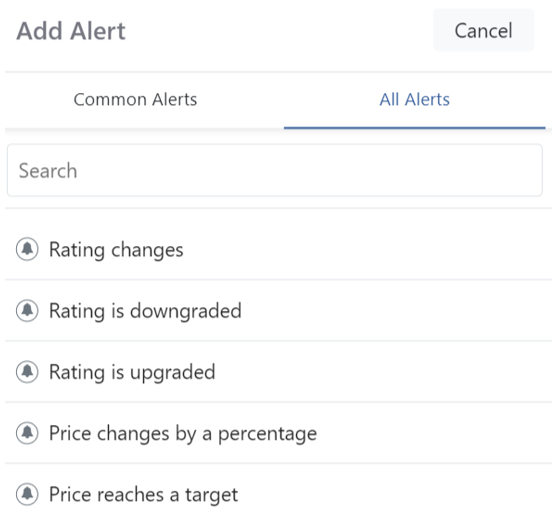

Then click Add Alert, then All Alerts:

From there, you can choose to be notified whenever Ethereum’s price changes by a certain percentage, reaches a set target or if the asset experiences a rating change according to the Weiss Crypto Ratings.

This way, you’ll never miss a moment of action.

Best,

Beth Canova