ETH’s Biggest Upgrade Since the Merge Slid Under the Radar

|

| By Beth Canova |

Bitcoin (BTC, “A”) has been dominating the headlines recently.

And understandably so!

It shattered its previous all-time high of $69,000 earlier this week and kept going to peak near $73,700.

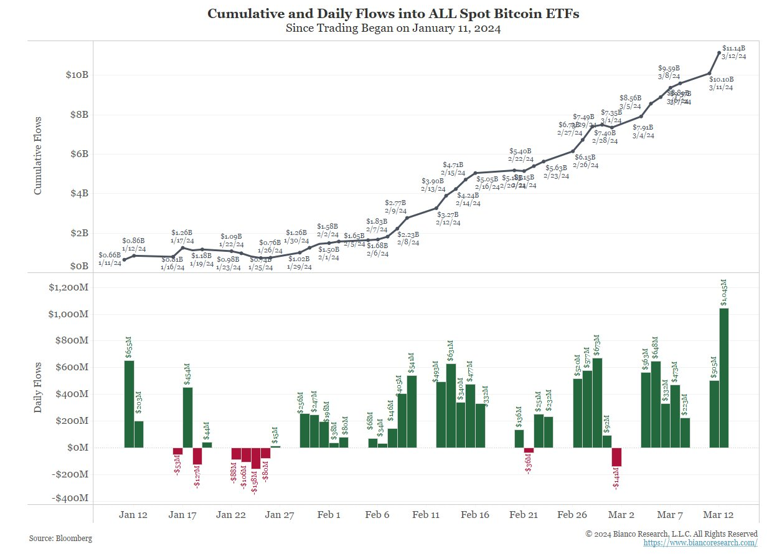

Most of this bullishness has been supported by the insane amount of institutional money flowing into the spot Bitcoin ETFs:

We’re talking a cool $11 billion in inflows and counting. This week alone witnessed the grand entrance of the first $1 billion day into these ETFs.

It’s even begun enticing retail investors into the fold.

Bitcoin has pulled back today, testing support at $68,000 briefly. We’ll have to wait to see several closes above that key level to confirm if can hold and keep this rally going.

But in all this excitement, another star is being overlooked: Ethereum (ETH, “B+”).

It broke above the psychologically significant $4,000 barrier earlier this week. And while it has also retreated in step with Bitcoin, this marks a legit step toward a run at its previous all-time high near $4,600.

And remember that the price of ETH/BTC is still expected to break out from its 7-year-old triangle pattern at some point this year.

Such a breakout is anticipated to trigger a significant price surge for ETH and alt coins, probably while nearing the deadline for ETH spot ETF approval.

But just as exciting as the price action is what happened on Wednesday.

See, the Ethereum ecosystem underwent its most significant upgrade since the Merge — a transformation dubbed Dencun.

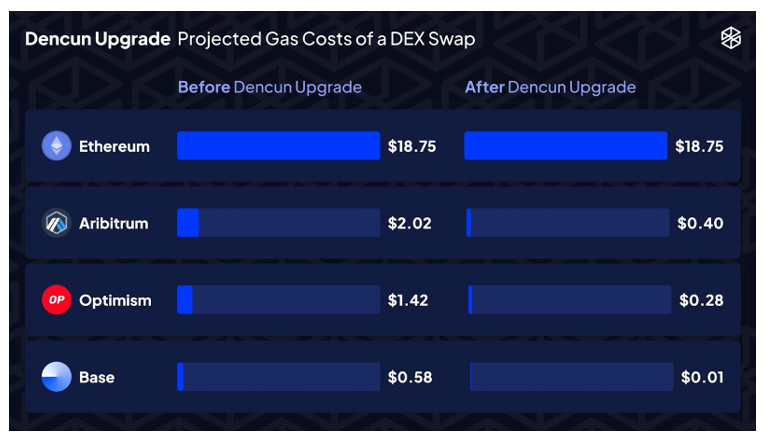

Dencun marks a pivotal development. Its primary objective is to drastically reduce fees across Ethereum's Layer-2 networks, with estimates projecting a remarkable decrease of over 75%.

To be clear, this upgrade does not affect the Ethereum base layer. Just its Layer-2 networks.

That misunderstanding — and subsequent disappointment — is very likely contributing to Ethereum’s weaker performance as the week comes to a close.

Nevertheless, the reduction in fees on Layer-2 networks holds considerable importance, particularly for individuals engaging in small-scale crypto swaps, active on-chain use or for use cases that require large numbers of micro-transactions, such as web3 gaming.

And Dencun will roll out on the different Layer-2 networks at different times. So far, Arbitrum (ARB, “B”), Optimism (OP, Not Yet Rated), Zora, and zkSync have gotten the upgrade.

As other Ethereum Layer-2 chains get updated in the next few weeks, users can anticipate significant reductions in fees.

Here are the estimated costs of swaps after the upgrade:

The goal of this upgrade isn’t just cheaper fees. It’s a big step toward developers’ end goal for the Ethereum base chain — that it’ll primarily be a settlement layer.

That means developers hope that most activity and transactions will be on Layer-2 networks — and even Layer-3 networks! — with the main Ethereum chain only used to verify and confirm those transactions.

This upgrade will mark a positive trajectory for Ethereum's future and adoption.

But what does this mean for you as an investor?

It means you’ll be paying less fees when performing DeFi actions on these networks!

This opens the world of DeFi even further to the wave of new crypto investors who — thanks to those spot ETFs — are now dipping their toes in.

Now, that’s what I call sweet.

Best,

Beth Canova