|

| By Mark Gough |

The day is finally here.

Today, Dec. 3, 2025, Ethereum (ETH, “B+”) will activate the long-awaited Fusaka Upgrade.

This is a massive two-part overhaul featuring two parts: the Fulu and Osaka upgrades.

Make no mistake, this is no routine patch. It's a fundamental architectural shift, the realization of a plan initially laid out years ago to eventually unlock 100,000+ transactions per second on Layer-2 networks.

In short, Fusaka will effectively rewire the network’s core to handle an entirely new scale of traffic.

|

Fast Facts: The TL;DR

|

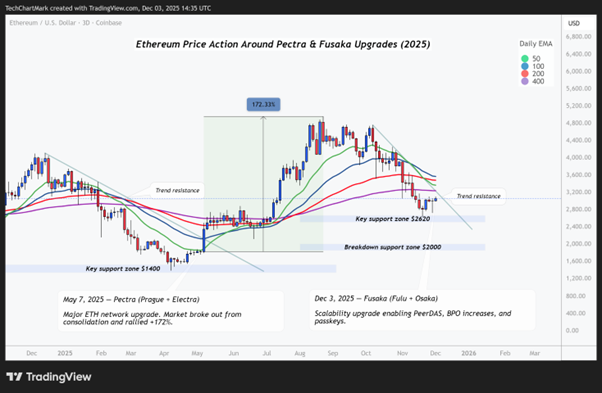

Before we drop into the deeper technical pieces of Fusaka, it’s worth taking a quick look at how Ethereum has behaved around previous network upgrades.

Because there’s a bullish price pattern here that’s hard to ignore …

After Pectra went live in May 2025, ETH broke through trend resistance and rallied more than 170% in just a few weeks.

What stands out now is how closely today’s structure mirrors that breakout both technically and fundamentally as the Fusaka upgrade rolls out.

With ETH above the key $2,620 support zone, this area is one of the most important to watch in the short term.

As always, past performance doesn’t guarantee the same outcome.

But when you pair a similar chart setup with the most meaningful scalability upgrade in years, it’s a scenario worth keeping firmly on the radar.

The Strategy: Ethereum Becomes “Value-Aware”

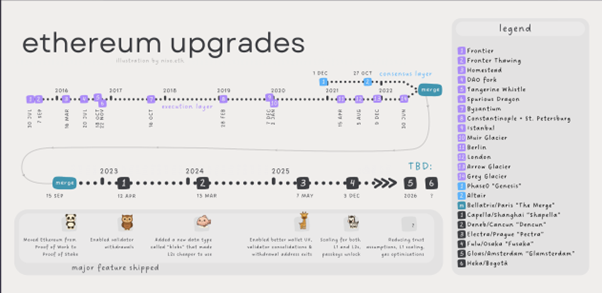

To understand Fusaka, you have to look at where we’ve been.

Previous upgrades tended to focus on one dimension at a time. The Merge Upgrade (2022) reduced energy usage by 99.9%. Then, Dencun (2024) introduced "blobs" to slash Layer-2 fees.

But Dencun created an unexpected side effect: It worked so well and fees dropped so low … that Ethereum stopped capturing value!

This is what led to periods of inflation over the past year.

Fusaka is the correction. It balances three competing goals:

Participation: Ethereum’s core ethos is that anyone can verify the chain. The upgrade dramatically increases data capacity without demanding supercomputer-level hardware from home stakers.

Value Capture: Ethereum is finally aligning blob fees with execution demand. As the network gets busier, ETH holders and the protocol capture value rather than giving away blockspace for pennies.

Usability: Wallets must adapt to humans, not the other way around. Fusaka opens the door to seamless authentication (biometrics) and mobile-friendly crypto.

Researchers are calling this a "Value-Aware" upgrade. It signifies Ethereum is a mature protocol that can efficiently price its own resources.

To accomplish all three goals, the Fusaka upgrade is comprised of two parts, or “forks”: Fulu, which focuses on the consensus layer, and Osaka, which deals with the execution layer.

The “Fulu” Upgrade: Breaking the Data Bottleneck

The Fulu side of the fork focuses on the consensus layer and solves a fundamental scalability problem: The Data Availability Bottleneck.

In the old model, if you wanted to double the network’s capacity, every single validator had to download twice as much data.

That is the "download-all" model.

And it’s excellent for security … but terrible for decentralization. That’s because eventually, only massive data centers can keep up with bandwidth requirements.

The new model features PeerDAS, the technical crown jewel of 2025. It flips the model on its head using a concept called Data Availability Sampling.

With this approach, think of the data on the blockchain like a book.

Instead of asking every validator to read the entire book, each one is responsible for 1% of the pages. If all validators confirm their page exists, then statistically, the entire book must exist.

This relies on Erasure Coding — the same tech that keeps data safe on scratched CDs or redundant hard drives.

The Result is that Ethereum can now increase its data capacity by 10x or more. All without requiring average stakers to buy expensive bandwidth or enterprise-grade SSDs.

This is how Ethereum will scale to meet the demands of the masses while keeping the network decentralized.

The “Osaka” Upgrade: Gas, Block Size & Face ID

While Fulu handles the background data, the Osaka upgrade focuses on the Execution Layer.

This is where the functionality that impacts your everyday usage lives: gas limits, transaction types and wallet security.

And there are three changes here that should have big impacts on your user experience.

First is the new gas limit.

For years, the gas limit hovered around 30 million. The “Pump the Gas” initiative has finally succeeded, doubling the block gas limit to 60 million. And the safety of this approach has been extensively tested on the Holesky testnet.

This doesn’t just mean Ethereum can fit more transactions into a single block on the chain. It also allows for much more complex applications.

Developers can now deploy heavier smart contracts and logic that were previously too expensive to run on Mainnet.

Second is the feature that will finally bridge the gap between crypto enthusiasts and the average person: face/touch IDs.

Historically, Ethereum used the secp256k1 cryptographic curve for signatures. However, the "Secure Enclave" chips in billions of iPhones and Android devices use a different standard: secp256r1.

Translating between these two standards on-chain was prohibitively expensive. And that made "Smart Wallets" that utilized biometric chips impractical.

But the Osaka upgrade adds a cheap translator for secp256r1.

The Implication:

- Your phone’s hardware security chip becomes your hardware wallet.

- You can sign transactions using Face ID or Touch ID natively.

- No more writing down 12-word seed phrases on paper for everyday spending accounts.

- Recovery can be handled socially or via iCloud/Google Drive passkeys.

This is the infrastructure required for mainstream adoption. Now, Ethereum is ready to onboard the next billion users who will never tolerate seed phrases.

The last piece of the upgrade deals with the price of "blobs."

These are the dedicated data spaces used by Layer-2 networks like Arbitrum (ARB, “C+”), Optimism (OP, “C”) and Base.

After the Dencun upgrade in 2024, blobs were often too cheap.

While cheap fees are good, selling premium blockspace for 1 cent is not a sustainable economic model for the base layer. It weakened the "burn" mechanism (EIP-1559) and turned ETH inflationary for parts of 2024 and 2025.

Fusaka introduces EIP-7918, which algorithmically links the price of blobs to the price of regular execution gas.

How it works:

- Dynamic Pricing: When the network is congested (high demand), the cost to post data rises proportionally.

- Spam Prevention: It becomes economically unviable to spam the network with junk data.

- Ultrasound Money: By ensuring data availability is priced correctly, the protocol burns more ETH during high-traffic periods, restoring the deflationary pressure that makes ETH a strong economic asset.

Crucially, despite these price adjustments, the sheer volume of new space added by PeerDAS means L2 fees will likely remain 40–60% cheaper than today's, even as Ethereum’s revenue grows.

What Happens Next?

You might expect the network to jump to 100,000 TPS the moment the fork activates instantly.

However, the core developers are taking a cautious approach, known as the BPO (Blob Parameter Override) Schedule.

Rather than opening the floodgates immediately, they are rolling out the capacity in guarded stages:

- Dec. 3 (Today): The fork activates. Blob target increases slightly to 6.

- Dec. 9: Assuming network stability, the target increases to 10 blobs.

- Jan. 7: The network targets 14 blobs (the intended full capacity for this phase).

This “agile fork strategy” allows client teams to monitor network health. If verification times lag or reorgs occur, they can pause the parameter increase without requiring another hard fork.

Final Thoughts

Fusaka is arguably the most complex engineering feat since The Merge — the upgrade that took Ethereum from a proof-of-work consensus mechanism to proof-of-stake.

And if it succeeds, Fusaka’s completion will be the moment Ethereum stops struggling to keep up with demand … and starts actively inviting it.

It lays the technical foundation for a future where:

- Transactions are instant and negligible in cost.

- Wallets look and feel like banking apps (biometric signing).

- The network scales to millions of concurrent users.

- ETH strengthens its monetary properties.

The "Surge Era" isn't just a roadmap slide anymore.

As of today, it is live on mainnet. And it’s the foundation for Ethereum’s future.

Be sure to jot down the dates above.

As this upgrade continues to roll out, investors will want to keep an eye on their ETH and any dApp tokens that live on the Ethereum network to see how they perform in the aftermath.

Until then …

Happy Fork Day!

Best,

Mark Gough