Fed’s Decision Could Fuel Crypto for the Next 100 Days

|

| By Mark Gough |

The big day is finally here.

Today, at the Federal Open Market Committee press conference, the Federal Reserve announced its first interest rate cut of this cycle.

The move itself may not come as a surprise — markets have been expecting it for weeks.

What matters far more is what happens next. Because while rate cuts always spark a reaction, the size and direction of that reaction depend heavily on the context in which they arrive.

And for crypto, that context matters even more.

Liquidity, rates and risk appetite flow directly into the broad crypto market. Not just the blue chips like Bitcoin (BTC, “A-”) or Ethereum (ETH, “A-”) either. In fact, altcoins tend to move even more closely with liquidity conditions than Bitcoin does.

That means the Fed’s decision won’t just ripple across Wall Street.

It could set the tone for the next leg of the crypto cycle … and your portfolio’s performance.

Why Today’s Cut Matters

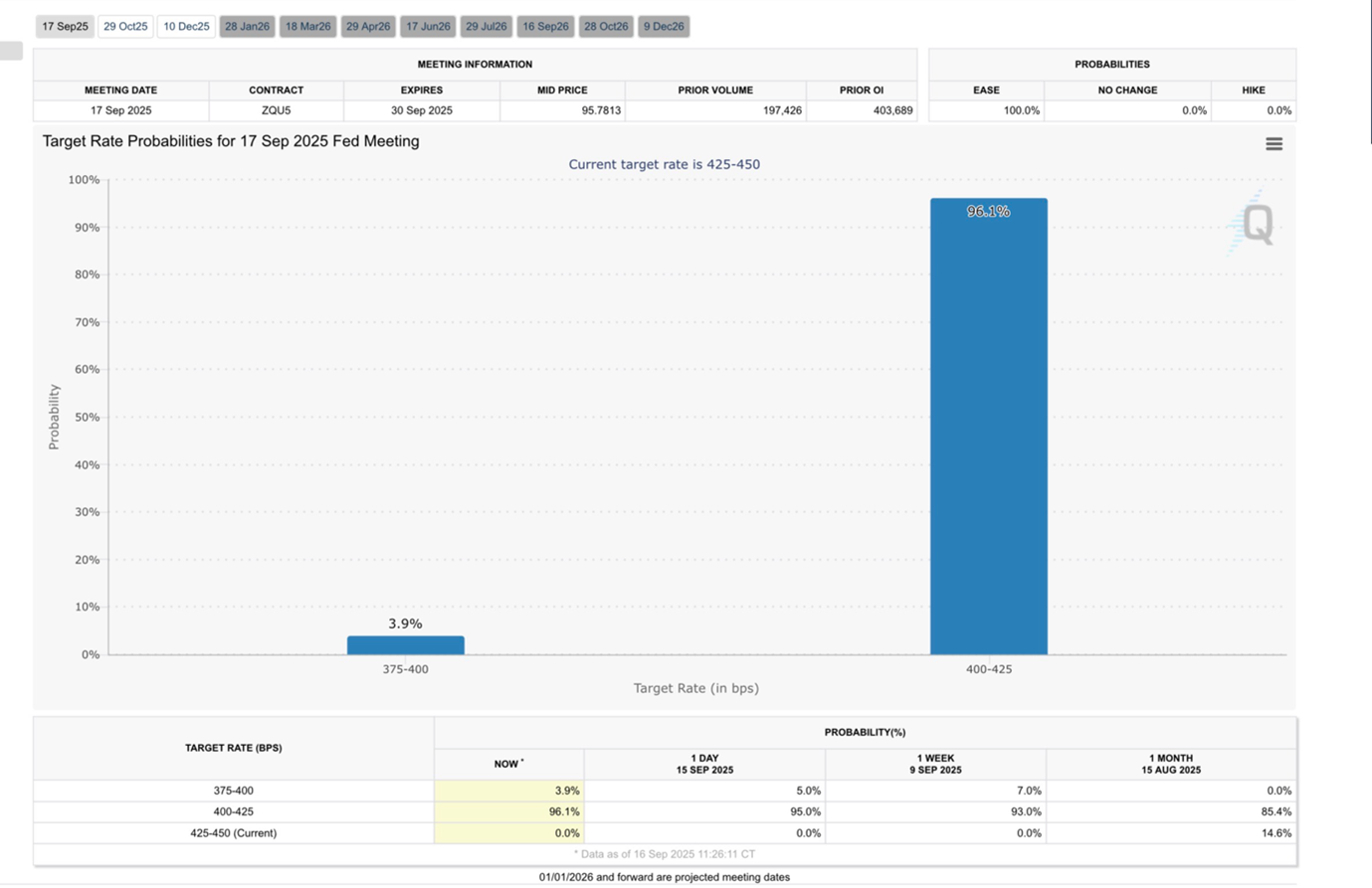

The Fed to trimmed its benchmark rate by a quarter point, or 25 basis points.

Put simply, this is a supportive step. One that will likely lead to near-term bullish momentum. But it’s not the kind of dramatic policy shift that ignites runaway rallies.

This was far and away the most likely outcome.

The Fed could have alternatively opted for a bigger, 50-basis-point move.

That would have likely shocked markets and sparked a sharper rally. Though, such a move would have raised concerns about whether policymakers see deeper trouble brewing.

It could also have done nothing at all, which would have likely started a wave of sell-offs for risk assets.

So, what can we expect in the medium-term now that the 25-bps cut has been confirmed?

What History Tells Us

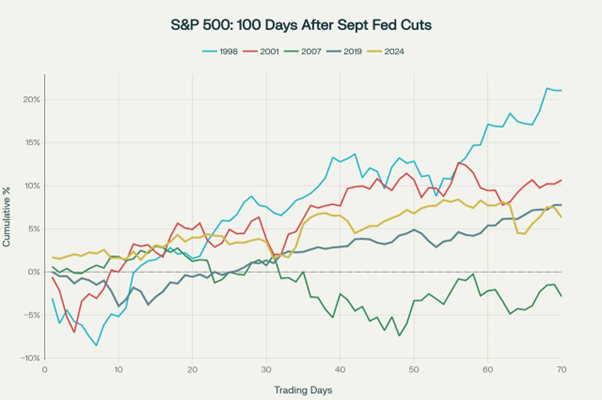

Looking back over the past 25 years, the S&P 500 has gained an average of 8.5% in the 100 trading days following a September cut.

But the paths have been anything but uniform …

- 1998 (Long-Term Capital Management crisis): A 25-bps cut restored confidence after a major hedge fund collapse threatened global markets. Stocks surged 21% in 100 days.

- 2001 (post-9/11): An emergency 50-bps cut helped spark a rebound, but structural weakness capped gains at 10.7%.

- 2007 (housing crisis): A 25-bps cut came too late. Within 100 days, the S&P was down 2.9%, foreshadowing the Great Recession.

- 2019 (trade tensions): A modest “insurance” cut steadied markets, producing a 7.8% gain.

- 2024 (inflation easing): A surprise 50-bps cut delivered a 6.3% gain, but stocks were already near highs, which limited enthusiasm.

The lesson is clear:

- Cuts delivered during crises tend to spark the biggest rallies,

- Normalization cuts provide a gentler tailwind

- And recession-onset cuts rarely help much at all.

This Time Could Be Different

What makes today’s cut especially interesting is the backdrop.

This isn’t 1998, when the Fed rescued markets from a hedge fund collapse. It’s not 2007 either, when the recession was already setting in.

That means this is a “normalization” cut, so we should expect modest momentum.

Still, the timing is delicate.

The labor market has softened in recent months, giving the Fed cover to ease policy. However, core inflation remains above the Fed’s 2% target, limiting its aggression.

On top of that, equities are already trading near cycle highs. That matters because history shows that when stocks are priced for perfection, cuts tend to have a more muted effect.

This combination makes today’s move closer to 2019 or 2024 — cuts designed to sustain momentum, not revive it.

But there’s another asset to keep your eye on: stablecoins.

These digital dollars have exploded in popularity and utility this bull cycle. They now act as the plumbing of crypto markets.

When interest rates fall, the appeal of holding yield-bearing Treasury notes diminishes … and capital rotates back into stablecoins. Once that happens, that liquidity often finds its way into higher-risk assets.

And right now in 2025, after months of stagnation, stablecoin supply is beginning to expand again. That’s one of the clearest signals that liquidity is on the move.

No Matter What, Cuts Hit Crypto Harder

Equities often respond to Fed cuts with measured, modest moves.

Crypto is another story entirely.

Bitcoin has historically acted as a liquidity barometer. When liquidity expands, it tends to move first, though not always in a straight line.

In 2019, Bitcoin declined during the easing cycle because it had already exploded higher earlier that year, running from $3,000 to $13,000 before the Fed even acted.

By contrast, in 2024, Bitcoin behaved more like a traditional risk asset. As the Fed began normalizing policy, Bitcoin rallied alongside stocks, leading the risk-on move.

Altcoins take things a step further.

They behave like high-growth tech stocks in the late ’90s — higher risk, more volatility and greater potential reward.

Once liquidity flows, altcoins often outperform Bitcoin. That’s why popular narratives within crypto can rally so explosively during easing cycles.

In addition, crypto is now deeply integrated into the financial system. Unlike in past cycles, institutional adoption is far more advanced, with ETFs, custody solutions and even corporate treasuries holding crypto.

Liquidity no longer leaks into the space — it floods in through structured channels.

In addition, the narratives driving crypto are broader than ever. Real-world assets, AI tokens and Solana’s DeFi ecosystem are just some sectors waiting for fresh liquidity to accelerate.

This wasn’t the case in 2019 or even 2021, when Bitcoin and Ethereum were the main drivers.

Today, crypto is bigger, more diverse and more interconnected with global markets.

What to Expect Next

As a crypto investor, the message to take away is straightforward: The Fed’s actions will impact the crypto market … and your portfolio.

Historically, crypto markets have been some of the biggest beneficiaries when the Fed opens the floodgates.

Which means today’s cut could mark the start of the next chapter in this cycle.

With the Fed following through with the expected 25-bps cut, Bitcoin will likely grind higher in the weeks ahead as Ethereum regains strength and altcoins start to gather momentum.

That said, since crypto reacts more quickly and more intensely to liquidity shifts than equities do, you should plan for volatility along the way — shakeouts are part of the process.

As you watch the headlines later today, don’t just focus on the size of the cut.

Focus on what it means for liquidity, risk appetite and the narratives poised to benefit. Because that’s where the real opportunity lies.

Best,

Mark Gough