|

| By Bruce Ng |

Total value locked, or TVL, is a popular metric when it comes to DeFi platforms.

TVL is the measure of how much liquidity has been deposited into a platform. The larger the TVL, the more liquidity.

It also is a good indicator of usage and adoption in DeFi.

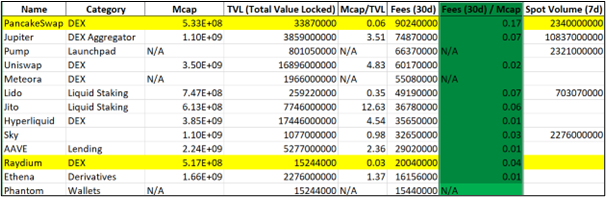

And a cursory glance on DefiLlama reveals the top DeFi protocols by TVL:

But there is a weakness when it comes to using TVL as a metric. Since that liquidity doesn’t belong to the platform, it can be removed. Unless there is a lockup period, liquidity providers can simply pull their funds and move on to the next platform.

This means metrics like the mcap/TVL ratio — useful for determining if a project is undervalued or overvalued — can be flawed, as well.

One way around this is to use the 30-day fee / mcap ratio, instead.

The 30-day fee the value in fees paid by users to the protocol over 30 days. To get the ratio, you divide that value by the protocol’s market cap.

In this case, unlike with the mcap/TVL ratio, higher is better.

Now, let’s apply that to the table above.

I extracted all the data from DeFi Llama and dumped it into an Excel sheet. Then, I calculated the 30-day fee / mcap ratio for each platform, shown in green below:

We can see that two of the leading DEXes by TVL stand out as undervalued, according to the 30-day fee/mcap ratio.

They are PancakeSwap (CAKE, Not Yet Rated) and Raydium (RAY, Not Yet Rated).

Let’s break down the former. And, if you like this style analysis, I can dive deeper into Raydium next week.

PancakeSwap: BNB Chain’s DEX

PancakeSwap, launched as a DEX on the BNB Chain. It uses an AAM model for its decentralized trading. It also offers yield farming and staking, including Ethereum (ETH, “B+”) liquid staking.

Additional offerings include …

- the Pancake Protectors game,

- a v3 position manager,

- a prediction market,

- Initial Farm Offerings (IFOs),

- An Ethereum/Aptos bridge,

- a lottery and

- an NFT marketplace.

But the DEX’s true value lies in its low transaction costs, thanks to BNB Chain. That means PancakeSwap can offer lower trading fees than its competitors. In fact, its transactions are both cheaper and faster than on Uniswap (UNI, “C”) the largest DEX on Ethereum, according to a CoinDesk analysis.

CAKE: Your Slice of the Action

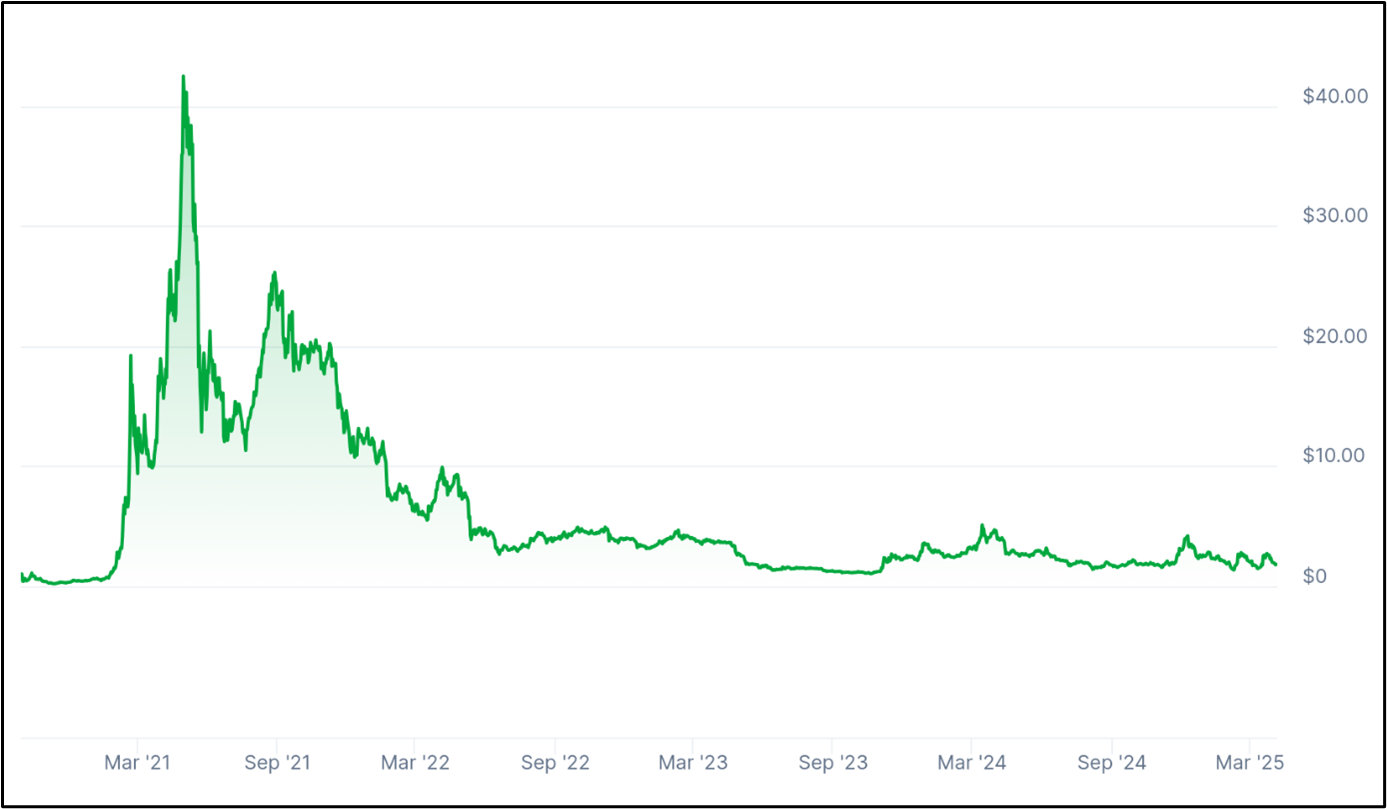

As the native token of the DEX, CAKE has been around since the first DeFi bull run in 2021. It is used for governance and also as an incentive for stakers.

CAKE rallied hard in the DeFi bull run of 2021. But since the ensuing bear market in 2022 to mid-2023, it has shown no appreciable rally. It did not even rally much during the most recent bull run of mid-2023 to mid-2024.

That said, it could be attractive to investors comfortable with more risk after this latest correction. That’s because CAKE is close to long-term support, which limits additional downside.

When you consider its undervalued position and strong fundamental metrics, these prices could look like a discount sign.

Some Red Flags

As with any investment, there are risks.

BNB Chain isn’t just the native network for PancakeSwap. It’s the native network of Binance, and the two are run by the same team. PancakeSwap’s ties to the centralized exchange giant means there is potential centralization when it comes to platform control and token holdings.

Additionally, the lack of any noticeable rally — especially when the broad market was ripping higher — is a big concern. It could just be the lack of liquidity in the markets meant CAKE couldn’t get its cut … or it could signal a lack of speculator interest within the crypto space.

Nonetheless, PancakeSwap still has some of the strongest metrics in terms of TVL/mcap and fees/mcap compared to all the DeFi protocols above.

To me, that means this DEX has earned its place on my watchlist for now. As the crypto market shifts from speculative narratives to utility and fundamental value, we’ll see how high this coin can go.

Best,

Dr. Bruce Ng