|

| By Bruce Ng |

For the past week, Bitcoin (BTC, “A-”) has been trading sideways.

However, according to in-house cycles expert Juan Villaverde’s Crypto Timing Model, higher prices are likely by the end of May.

In the meantime, let’s look at Bitcoin dominance again — as well as the price action of Ethereum (ETH, “B”) — to determine where funds will flow within the ecosystem.

Click here to see full-sized image.

In the chart above, Bitcoin dominance (i.e., BTC.dom) is shown as the red and green candlesticks. The ETH/USD chart is overlayed in orange.

Remember that BTC.dom measures Bitcoin’s total market cap as a percentage of the aggregate of the market caps of all other coins in existence.

Essentially, it measures how large Bitcoin is to the rest of the crypto market.

In the past year, the levels of significance for BTC.dom are 40% support (bottom green line) and 47.5% resistance (top green line). BTC.dom has been cycling between these two important levels for a year.

Over the past month, we have noticed three things, as shown by the numbered yellow circles on the chart:

1. When BTC.dom exceeded the top green line, it spiked up slightly higher and then dipped back down.

2. After BTC.dom dipped back down, ETH/USD rallied upward, and then dipped down again.

3. ETH/USD dipped down because BTC.dom started to go up again.

BTC.dom has hit the same resistance of 47.5% again.

So, now we have two important scenarios that could play out.

If BTC.dom keeps going up, ETH and alts will continue to bleed. However, this is unlikely because 47.5% poses strong resistance.

On the other hand, if BTC.dom drops again like in the previous spike, ETH and all alts could go up.

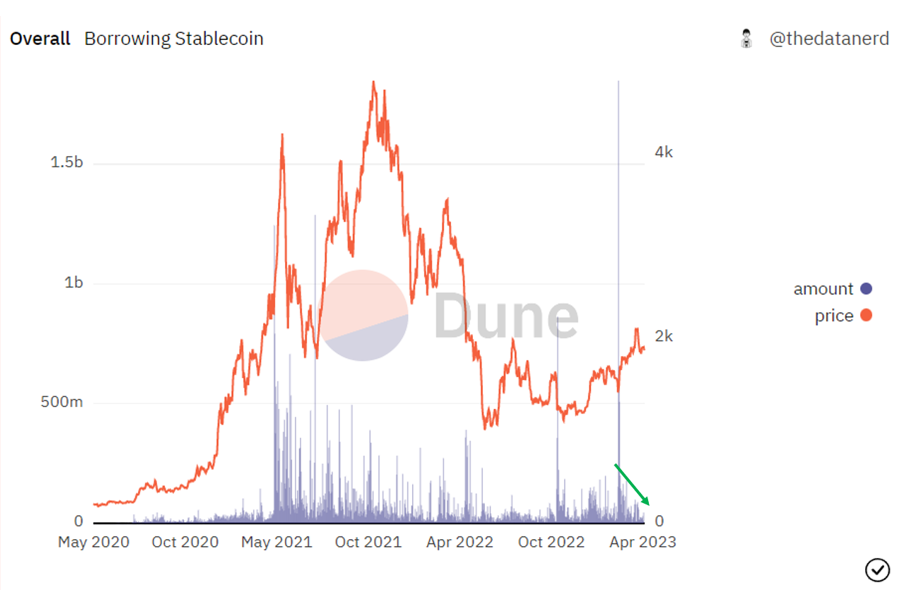

Now let’s look at the stablecoin borrowing metric we discovered last week.

Source: thedatanerd.

Click here to see full-sized image.

It seems like stablecoin borrowing decreased steadily during April, as indicated by the green arrow.

At this point, it does not seem like funds will flow into altcoins. But this is not necessarily bad news.

Although an altcoin rally will not occur anytime soon, this is the perfect time to invest in some alts that have long-term potential at spectacular discounts.

Whether Bitcoin rallies or not, certain alts make great long-term holds. For example, in the span of a year, they can go up by 10x.

But which alts are the ones to buy? To find out, we have prepared a few tools to help in that search.

First, you can browse our Weiss crypto ratings — for free! — to see the top-rated altcoins. You can also set alerts for your favorite coins to see if and when they start moving.

Or you can forego selecting specific coins as investments and start seeing them as tools in a different strategy. One of my colleagues — Chris Coney — has been using it to help his Crypto Yield Hunter Members earn yield from their cryptos.

This strategy has helped them through some tumultuous times, including the FTX collapse, the bank crisis and the depeg of USD Coin (USDC, Stablecoin). All while the most conservative, low-risk exposure opportunity is earning them 18% APY.

That’s double the yield currently available on high-yield junk bonds ... without the risk of failures and defaults!

Chris is revealing this exciting strategy in his Superyield Conference, which is now available to watch. I urge you to do so sooner than later, however, because it won’t be online long.

And, of course, keep checking in here for market updates as we prepare for the next altseason.

Best,

Bruce Ng