Forget ETFs; There’s a Better Way to Max out Your Ethereum Returns

|

| By Beth Canova |

The long-awaited Ethereum (ETH, “A-”) ETFs are finally on the horizon.

And, like the Bitcoin (BTC, “A”) ETFs did for BTC back in January, they're expected to trigger a strong wave of institutional investment that could significantly influence the price of ETH.

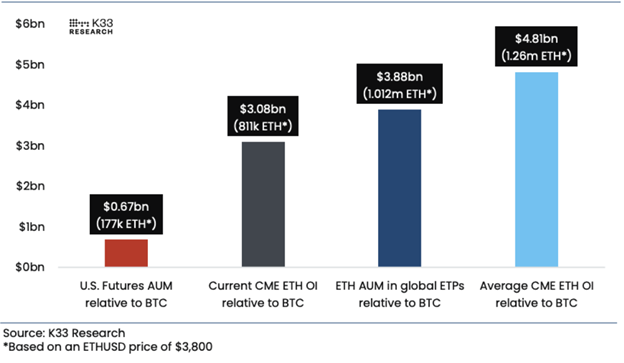

Analysts predict a massive influx of capital — up to $4.8 billion in the first five months — will pour into these new ETFs.

Estimated Five-Month Net Inflows to Ethereum ETFs

This news might have you wondering: Should you jump in and buy some when they're approved?

Well, it depends.

The ETFs offer a simple way to get exposure to cryptocurrencies for anyone still intimidated by buying crypto on their own.

And you don’t have to worry about setting up an account on a centralized exchange or managing your own crypto wallet.

However, you personally won’t own any Ethereum. And the golden rule of crypto is “not your keys, not your crypto.”

It’s a common saying to remind you that if you’re not in complete control of your assets, then you have to rely on and trust whoever does control them — a big sticking point in crypto ideology.

Not to mention that once you have your position in an ETH ETF, you will have to pay fees, which will vary based on which one you choose.

But if you’re ready to explore the crypto market, then there are other strategies to help you make the most from your Ethereum.

Specifically, I’m talking about staking.

When you stake, you provide some of your crypto to a blockchain or decentralized platform, which then use the liquidity you and others provide to operate.

As a reward, you get a portion of the fees generated by transactions on that blockchain or platform.

And that’s where the ETFs just can’t compete.

Unlike in the world of decentralized finance, the yet-to-be-listed Ethereum ETFs won't offer staking rewards.

And that is a big deal considering staking is a core function of the Ethereum network. It allows users to earn passive income while contributing to network security.

Unfortunately, the SEC is not going to approve any staking-related ETFs. At least not any time soon, considering it demanded applications be amended to remove references to staking.

This means ETF investors won't benefit from the returns liquidity providers are currently enjoying through staking.

How to Stake Your Ethereum

There are a few ways you can stake your Ethereum, but the most accessible way is through custodial staking.

In this method, you delegate your tokens to a third-party custodian — usually centralized exchanges or web3 wallet providers — to handle the staking process on your behalf.

The benefit is that you can stake as much or as little ETH as you’d like. There’s also no technical knowledge needed and custodial platforms usually have accessible and user-friendly interfaces, making them easy for beginners to navigate.

The main drawback comes down to security.

You need to give custody of your crypto over to a third party in order to stake. And as centralized exchanges are popular choices for custodial staking, any hack or attack on that exchange could put your crypto at risk.

The average yield you can expect with custodial staking will depend on the custodian, but it is generally around 4% to 6%, though that will fluctuate based on market conditions and activity on the Ethereum network.

Supercharged Returns

But there is another strategy that can supercharge those yields.

In fact, Marija Matić and her Crypto Yield Hunter Members have seen a whopping 15.63% average yield on their Ethereum position.

How is this achieved? Through a "money Lego" approach.

You remember Legos? The toy building blocks?

Well, imagine Legos for finance, and you’ve got a rough idea of how this strategy works.

It cleverly combines staking with advanced decentralized finance techniques like automated lending and liquidity provision, all working seamlessly in the background.

It's simple and passive. They have been able to set it and forget it.

Then, while they relax, this strategy actively maximizes their returns, unlocking far greater potential than an ETF purchase or even custodial staking.

And Marija believes the increased demand fueled by Ethereum ETFs will act as a bullish force to push Ethereum prices even higher, allowing them to squeeze even more juicy yield out of the market.

This money Lego strategy isn’t the only one Marija is using to target outsized yields in the world of decentralized finance.

In fact, her Crypto Yield Hunter Members have targeted yields as high as 600% APY earlier this year.

Impressive, right?

Well, Weiss Ratings founder Dr. Martin Weiss thought so, too. He asked Marija to show him how she hunts down these incredible yield opportunities … and how he can, too.

That’s why next week — on Tuesday, June 11, at 2 p.m. Eastern — Martin is hosting an urgent conference where he’ll show you exactly how it works so you can take advantage of it as well.

Just be sure to save your spot, as seats to this event are first come, first served.

Best,

Beth Canova

Crypto Managing Editor