|

| By Bruce Ng |

The markets are quiet this week.

That’s good. It gives us as investors time to take stock of where we are without getting bogged down in near-term volatility.

And where we are … is on the precipice of a memecoin maelstrom.

I’ve pointed out that memecoins have been leading this bull market consistently. And I have every expectation they’ll continue to do so.

But now, another domino in the chain has fallen that could push the narrative closer to its next rally.

And that domino is actually a TradFi name: Gamestop (GME).

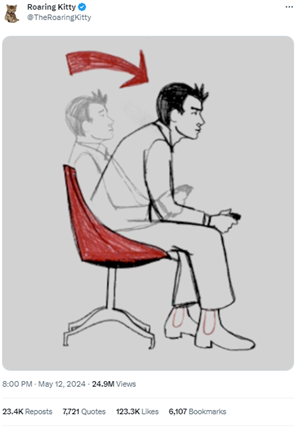

Over the weekend, Keith Gill — one of the best retail stock traders out there — awakened from a three-year hibernation to post the following on X, formerly Twitter, under his handle @TheRoaringKitty:

This was in response to AMC Entertainment Holding Inc.’s (AMC) massive 224% gains over the past week.

The meme indicates that Gill is now paying attention to the markets once again. And now, other traders are paying attention, too.

That’s because Gill was instrumental in building up hype around meme stocks back in 2021, and they believe he’s going for another round.

Remember that? When legions of retail investors from Reddit’s r/WallStreetBets invaded the equity markets to pump stocks brushed off by seasoned traders as jokes, like GME and AMC?

Well, that community saw them as undervalued. Redditors then decided to short squeeze GME, so hedge funds would be forced to buy shares of GMC to cover their positions and propel the stock higher as they scrambled to find shares to buy.

And it worked. So much so that several brokerage firms, including Robinhood, restricted access to buying GME and other volatile target companies — such as AMC and Nokia Corp. (NOK) — crushing demand and sending shares lower … for retail investors.

Big institutions, on the other hand, were still allowed to trade the shares. This caused public outrage and accusations of price manipulation.

Naturally, that brought many of those disgruntled retail traders to the more democratic crypto market, where decentralized exchanges can never be shut down … or shut out specific traders. And many of those new crypto users were drawn to memecoins, which makes sense as memecoins appeal to the same type of community as meme stocks.

Just look at the chart below, showing the connection between GME and what was the biggest memecoin of the previous bull cycle, Dogecoin (DOGE, “C+”):

The GME pump occurred in January 2021. And 10 days later, DOGE rallied modestly as memecoin popularity enjoyed the boost from its correlation to meme stocks.

But five months later, DOGE shattered all expectations with an incredible 17,000% rally.

It is widely believed that the GME community poured their funds into crypto memecoins after liquidating those large hedge funds.

And now, we’re seeing retail investors, led by Gills, pumping GME once again. From its close on Friday of $17.31 to its peak earlier today, GME soared an incredible 352.19%!

It has corrected a bit and is trading at the time of writing near $37.

I believe this could be a powerful tailwind for memecoins. And it is hitting right as the rest of the market is lazily digesting its Q1 gains.

But as I’ve pointed out before, memecoins are notoriously volatile and difficult to trade. It’s not a sector where investors can match the market by putting a little into each coin. Rather, it will likely be more prudent to focus on the most promising projects.

Now, there is no way of definitively knowing which memecoins will lead the pack.

But just as we use the broad market narratives to determine which sectors will outperform, we can look at the categories of memecoins and evaluate their performance.

With Bitcoin has been trading sideways, this is an excellent opportunity to measure the strength of these categories.

And I’ve identified three with real promise.

Category 1: Dog Coins

Dog coins have always led the pack, as the 2021 ascent of DOGE showed.

DOGE is the OG memecoin in crypto and has survived multiple cycles … even as L1s and Defi protocols with supposedly “fundamental value” could not. But DOGE has chugged along and achieved higher market caps from bull run to bull run.

While it has less room to grow as it once did, DOGE is likely to lead the memecoin rally … at least at the start.

But because of DOGE’s popularity, it has inspired a legion of dog-related memecoins.

I anticipate dog coins that ride a secondary narrative will be among the top performers. Coins such as dogwifhat (WIF, “E+”) and The Doge NFT (DOG, Not Yet Rated).

WIF also has the support of the Layer-1 narrative, as it is built on the Solana (SOL, “B”) network and acts as a leveraged play on SOL.

Meanwhile DOG is riding the NFT narrative, giving holders fractional ownership of an NFT of the original Dogecoin dog picture. This NFT sold at auction for $4,240,000 million, cementing its importance for both memecoins and NFTs.

Category 2: Cat Coins

Cat memecoins have been performing well, even before Gill’s tweet. There’s a case to be made that while cat coins may not achieve as high a combined market cap as dog coins, they can still grow by a large amount, given their novelty.

Especially if this pump is led by a man whose profile picture on X is of a cat.

When it comes to promising cat memecoins, savvy investors may want to look into Shark Cat (SC, Not Yet Rated), Popcat (POPCAT, Not Yet Rated) and MichiCoin (MICHI, Not Yet Rated).

Category 3: Political Coins

With a presidential election coming up in the U.S., political candidates will dominate the headlines on mainstream news.

And already, we’ve seen political coins performing well. Jeo Boden (BODEN, Not Yet Rated), for example, already posted 1,000% gains in less than a month.

With both President Biden and former president Donald Trump set to dominate the headlines, the political memecoins on my watchlist are TrumpCoin (TRUMP, Not Yet Rated), Doland Tremp (TREMP, Not Yet Rated), BODEN and America Coin (USA, Not Yet Rated), which is primarily a play on American patriotism and a hedge irrespective of which political party wins.

There is even a small but reasonable chance that some political candidates will capitalize on the crypto hype train by accepting campaign donations in crypto. If this happens, the floodgates to a new form of political funding will emerge, causing a domino effect that could persuade other candidates to follow suit. Further popularizing crypto to the retail masses.

If you do decide to trade memecoins, no matter which category, I urge you to be vigilant. Memecoin volatility is not for the faint of heart … or weak of stomach. The balance between avoiding emotional trading and being proactive is a fine line.

Go in with an exit plan and never invest more than you can afford to lose.

And if you’re interested in trading other leading crypto narratives — such as Layer-1s, AI, real-world assets and more — I suggest you check out my colleague Juan Villaverde’s Weiss Crypto Investor newsletter.

In it, he uses his Crypto Timing Model to target the best entry and exit prices for the cryptos leading each sector. His model portfolio boasts an average return of 301%.

To learn more, click here.

Best,

Dr. Bruce Ng