|

| By Bruce Ng |

The cryptoverse has become a birthplace for all sorts of innovative financial instruments.

That includes an entirely new generation of derivatives called crypto perpetuals.

You might have heard of, or even traded, derivatives in the traditional markets.

If you’ve ever bought or sold an options contract or a futures contract, that same idea translates to the crypto world.

A derivative is simply a contract between two parties to buy or sell an underlying asset at a specified future price.

By taking long (buy) or short (sell) positions, you can profit from rising and falling markets without needing to own the actual cryptocurrencies.

In the crypto world, you can trade futures contracts, too.

Or you can take advantage of the financial innovation that crypto is known for and participate in what’s known as perpetual swaps.

The Power of Perps

Colloquially known as crypto perps, these are futures contracts that never expire.

That’s right.

Unlike traditional futures, which expire unless you “roll” them to a later-dated contract, you can hold perps, well, perpetually.

In theory, anyway.

Many crypto perp traders like the idea that they can stay set up to benefit from crypto’s notorious market volatility.

But the “perpetuity” ends if their margin balance falls below the maintenance margin.

If that happens, their positions will be liquidated.

That is, unless they can pay the fee.

Perpetual Income (or Payments)

Unlike most derivatives, where the longs and shorts generally agree on one payment date in the future, perps require that counterparties pay (or receive) fees at regular intervals.

This can be every eight hours, though that varies by platform.

These fees depend on whether the price of the contract is trading above or below the spot market price of the asset.

- When the price of the contract is higher than the price of the underlying asset's market price, the long side pays the short side.

- When the price of the contract is lower than the underlying asset's market price, the short side pays the long side.

The farther away the futures contract price is from the asset price, the higher the fee.

Perps Go Beyond Futures

The crypto universe also offers perpetual options.

These are options that also never expire … provided you can continue to pay maintenance fees.

One Way to Trade Perp Options

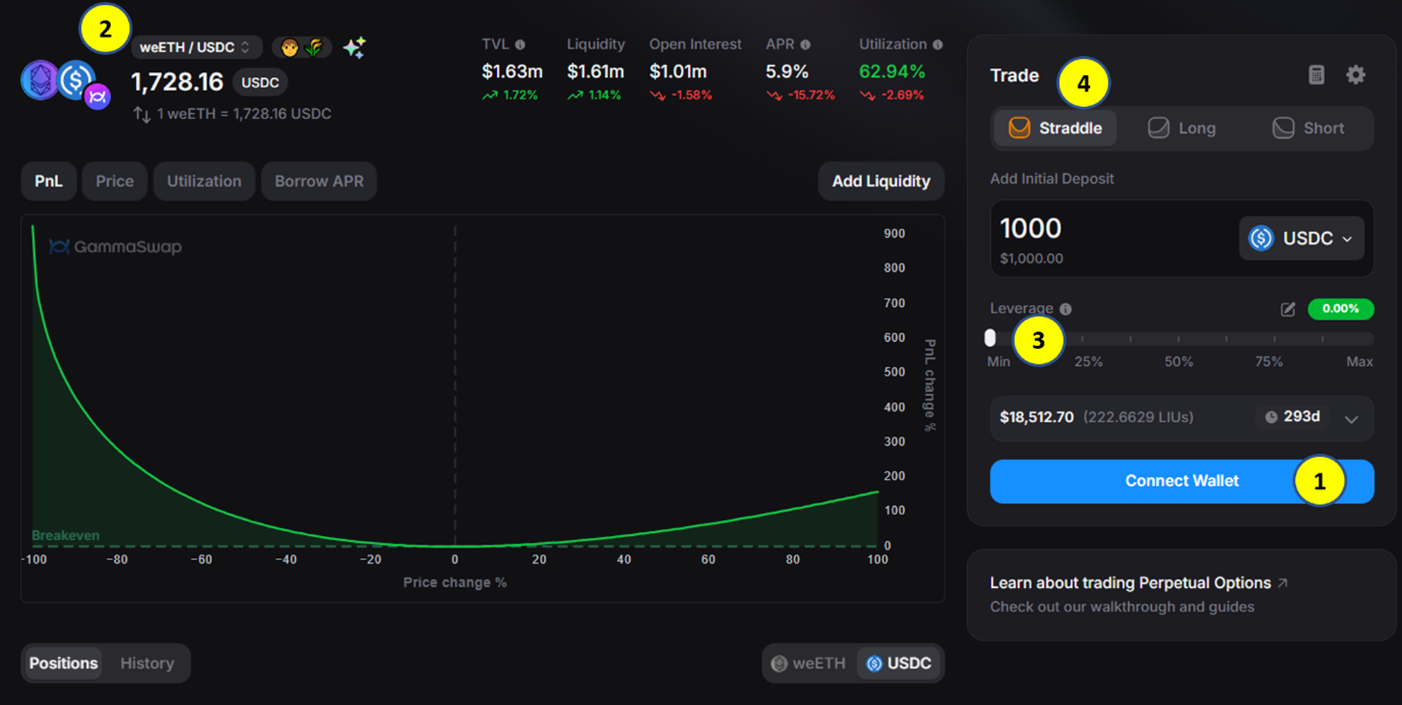

For example, you can now buy perp options on Ethereum (ETH) via GammaSwap.

Just head to this link here and see below for how you can do just that.

To get set up to trade perp options on GammaSwap:

First, make sure to select Connect Wallet on the right-hand side of the screen.

Then, switch your network to Arbitrum.

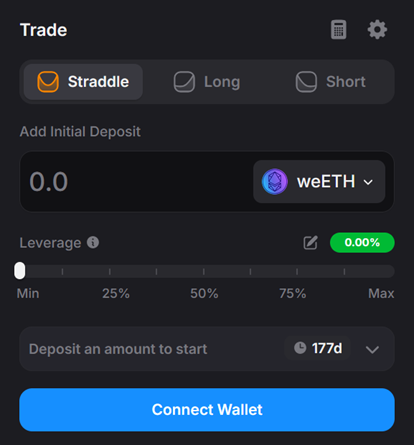

Next, select the weETH/USDC market. It’s a wrapper token for ETH but it tracks ETH’s price.

Now, make sure to adjust the leverage here. We suggest “0” leverage.

Finally, you want to pick your strategy type.

You’ll see three strategies listed on the right:

- Straddle: Which profits from either a rise or drop in the price of ETH.

- Long: If you choose to express a long trade.

- Short: If you choose to express a short trade.

The profit profile chart changes slightly as you click on these strategy buttons.

For our example, we are looking to make money only from the volatility of the asset.

To do that, irrespective of whether the asset goes up or down, we will select the Straddle strategy.

As seen above, when the price of the asset goes up by +40%, say, the profit is +31%.

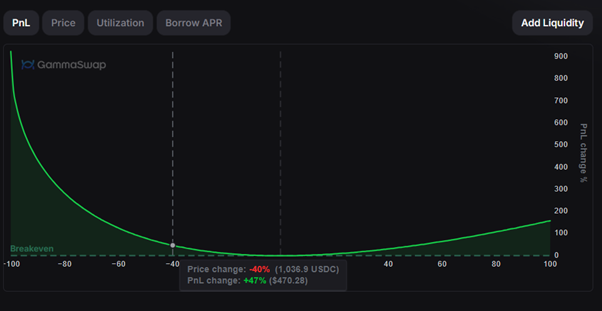

Conversely, here’s the same graph of when the price of the asset goes down:

The profit and loss (PnL on the image directly above) is +47% when ETH drops by -40%.

From the PnLs above, you’ll notice a couple of weird things:

- The PnL can be more than the price change of the underlying (e.g., a -40% price change can cause a +47% gain).

- You can make a profit whether the price goes up or down.

You’ll also notice that you’re seeing a lot of plus signs, which translate to potential profits, in this example.

So What’s the Catch?

Well, you actually have to pay a funding fee of 0.29% per day.

This amounts to about 100% per year.

And if markets continue to stagnate, it’s likely you’ll pay a funding rate continuously until your capital expires.

As you can see, the profit potential in perps and particularly perp options is clear evidence that there are still ways to make money in an uncertain market.

The trick is to find a healthy balance of making sure your capital doesn’t expire before your trade (theoretically) would.

If you’d like a more detailed tutorial on perp options, you can refer to GammaSwap’s guide here.

Best,

Dr. Bruce Ng

P.S. And if you’d like immediate access to another financial innovation, look no further than Dr. Martin Weiss’ just-released presentation.

It’s about an AI-powered technology that could have helped investors crush the market by 94-to-1 over the past 10 years.

Click here to watch it now and see if you agree with Martin that this may be the biggest investing breakthrough in his 54-year career.