|

| By Mark Gough |

As we head into Thanksgiving, markets naturally start to slow down.

Activity fades, the pace softens and attention shifts elsewhere.

But even in a quieter environment, certain developments still stand out.

And this week, it’s the resurgence of regulated public token sales in the U.S. that’s grabbing the spotlight.

And thanks to its recent successful ICO, the project leading this return is Monad (MON, Not Yet Rated).

How We Got Here: From Boom to Ban (and Back Again?)

Back in 2017, ICOs were the wild frontier of crypto. And they created the first generation of crypto giants.

Some of which are still around. Projects like Ethereum (ETH, “A-”), Filecoin (FIL, “E+”) and other early DeFi gems that offered investors massive returns as the market discovered what tokenized fundraising could do.

But that gold rush didn’t last.

By 2018, the U.S. Securities and Exchange Commission (SEC) ruled that most ICOs were unregistered securities offerings.

Enforcement actions followed. And within months, token sales disappeared from the U.S. market entirely.

For years, American investors were effectively locked out of early stage opportunities. While private funds and offshore platforms continued participating, retail investors could only watch from the sidelines as new networks went global.

Now that’s finally changed. And in a way that could permanently reshape how innovation is funded in crypto.

Coinbase’s Regulatory Breakthrough

Coinbase’s new platform brings ICOs back under a compliance-first framework. Every sale comes with …

- Identity verification,

- Investor disclosures,

- A new “filling from the bottom” allocation system designed to prioritize smaller participants before large buyers to prevent “whales” from loading up.

- And post-sale rules. If users sell their tokens immediately after receiving them, they may face reduced allocations in future ICOs. This is to encourage long-term participation instead of quick speculation or dumping.

In other words, the ICO model has been rebuilt for transparency and fairness.

This isn’t just a return to the wild days of 2017. It’s the dawn of a new age of ICOs, one focused on structure and regulation.

And Coinbase’s choice to debut with Monad shows how much confidence it has in this project’s credibility.

What Is Monad?

Monad is a new high-performance Layer-1 blockchain. It’s built to combine the best of two leading Layer-1 networks, Solana (SOL, “B-”) and Ethereum.

The team spent over two years rebuilding the Ethereum Virtual Machine (EVM) from the ground up to enable transactions to execute in parallel rather than one by one.

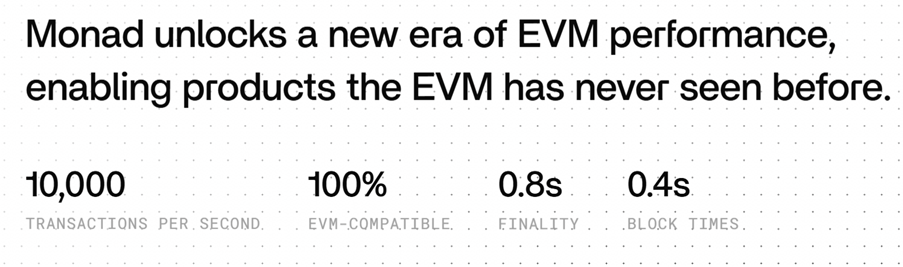

The result allows for Ethereum’s compatibility to benefit from Solana-style speed. Monad boasts …

- Up to 10,000 transactions per second.

- Sub-second finality.

- Full Solidity compatibility. This means developers can deploy Ethereum smart contracts to Monad instantly.

In short, Monad promises to do what Ethereum can’t yet do: natively scale to consumer-grade performance without sacrificing the ecosystem or developer base that made Ethereum dominant.

Institutional Muscle Behind the Project

If you’re wondering whether serious capital believes in this, the numbers speak for themselves …

Monad has raised $244 million across two rounds. That includes a $225 million Series A led by Paradigm.

That’s the same fund that backed Uniswap (UNI, “B-”), Optimism (OP, “C”) and Blur (BLUR, “D”).

Other investors include Dragonfly Capital, Coinbase Ventures, Greenoaks, Castle Island and Electric Capital.

It was the largest crypto funding round of 2024, underscoring how highly institutions value Monad’s technical approach.

The founding team — Keone Hon, James Hunsaker and Eunice Giarta — all come from Jump Trading and Jump Crypto. These are firms that are known for their high-frequency trading expertise and systems-level engineering.

And that background shows: Monad’s codebase is written like a trading engine. It’s optimized for throughput, latency and parallel performance.

The Results You’ve Been Waiting For

At the time of writing, Monad is trading at just over 4 cents.

That’s a 70% increase from its ICO price of 2.5 cents!

Early demand has been strong, with the Coinbase sale ultimately finishing oversubscribed by roughly 1.2–1.4x.

Reports indicate it raised $180–$200 million, which represents roughly 7.5% of total supply.

That means its fully diluted value (FDV) is just over $2.5B at the initial raise price.

This strong early performance reinforces the significance of Monad’s debut.

Both for the project itself … and for the broader return of compliant token offerings in the U.S.

Why This Could Be a Turning Point

Monad’s launch represents far more than just a new blockchain. It’s the symbolic return of U.S. crypto innovation to the public arena.

For years, early stage investing was reserved for insiders and offshore funds.

Now, Coinbase’s new model opens the door for ordinary investors to participate again, safely and transparently.

Monad’s success could spark a wave of compliant token launches and help the U.S. reclaim leadership in digital asset innovation.

Best,

Mark Gough

P.S. ICOs aren’t the only way to get into your next opportunity early.

Traditionally only for the ultra-rich and well-connected, pre-IPO investments have been open to the rest of us since the JOBS Act passed in 2012.

The trick is knowing where to look for startup opportunities … and how to evaluate them.

That’s where my colleague Chris Graebe comes in.

He’s a startup investment specialist. He put money into over 30 startups valued at just a few million dollars in total when he first invested.

Today, they’re worth a combined $1 billion and counting — including the ones that didn’t work out.

And in his recently released briefing, he gives you the details on a NEW deal that’s opening to Weiss Members in a matter of days.