How Close Can You Get to Guaranteed Returns in DeFi?

|

| By Chris Coney |

One of the perks of writing for Weiss Crypto Daily is that it gives me the opportunity to share the most cutting-edge experiments I am working on in the lab.

The plus side is you get to hear about the latest and greatest projects and trends in DeFi that I have been tinkering with in near real time.

However, because what I am doing is experimental, I have not yet refined my methods down to a repeatable formula that works.

But this does not take away from the valuable knowledge of being up to date on what is new in the crypto industry.

So, in that vein, here is what I have been researching lately.

InsurAce (INSUR, Not Yet Rated) is a DeFi insurance market for the 21st century with $11.7 million paid out so far.

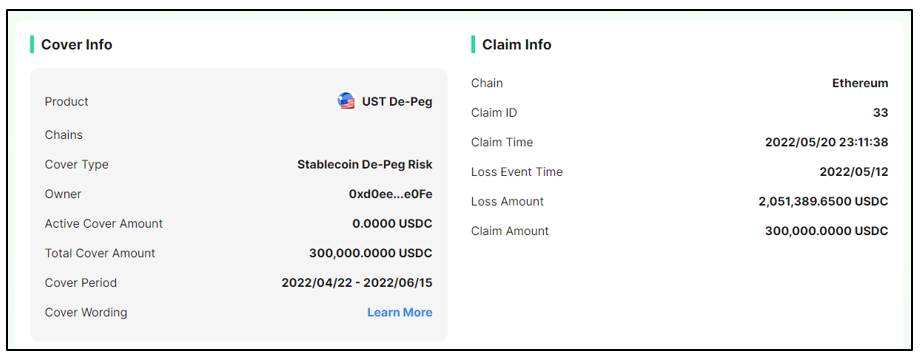

In fact, if you go to their claims section, you can find a list of recently paid claims.

I found this one, which paid out $300,000 when the Terra (LUNA) network fell victim to a speculative attack that caused TerraUSD (UST, Stablecoin) to depeg from the dollar.

An Open Two-Sided Marketplace

Being DeFi, InsurAce opens both ends of the insurance marketplace.

On one end, we have the underwriters who invest their stablecoins. They agree to pay out valid insurance claims from the pool in exchange for earning the premiums on policies that expire.

Fair deal.

However, I am quite surprised at how low the yields are. At time of writing, the highest yield available to underwriters who stake a stablecoin is 3.75%.

Perhaps as the volume of policies rises and premiums completely outstrip claims, those yields will increase as well.

We will have to see.

Ultimately, it is not that profitable for the underwriters. But what about the insurance purchasers?

Is it possible to protect your investments against downside risks and still turn a profit?

Insurance Arbitrage

While InsurAce’s yield is quite low at 3.75%, there are stablecoin investments out there in DeFi that currently pay as much as 19%. In fact, I have my Crypto Yield Hunter subscribers in one of them right now.

That may be a guaranteed return in the sense that it is a stablecoin investment with no market price risk … but that is not the only risk.

The other two risks that exist here beyond market price risk are:

1. Smart-contract risk and

2. Stablecoin depeg risk.

But what if you could take out insurance against these two risks? And what if each of those insurance policies only cost 2.5% each?

That would mean sacrificing 5% out of your 19% annual yield to almost eliminate risk completely.

At this point you would have:

• A net annual return of 14%;

• Protection against a total loss if the smart contract holding your funds got hacked;

• And protection against the stablecoin’s losing its peg and becoming worth less than $1, like what happened with Terra’s stablecoin UST.

That is about as close to a guaranteed return as you can get.

But is this too good to be true?

No, because it is simply the result of financial markets where risk is bought and sold.

When we take out insurance, we are buying certainty from the underwriters by transferring the risk to them.

They in turn are giving up some of their certainty and taking on someone else's risk while being paid for that service.

But I know what you are thinking:

“Why don’t the underwriters simply invest in the 19% yield opportunity instead?”

The simple answer to that is that they don’t know about it, which is why they should be subscribed to a premium research service like Crypto Yield Hunter.

As efficient as financial markets are, it is a mistake to think that every single participant has perfect information.

That would mean every market participant is aware of every single opportunity that exists and is then able to make the best possible choice that is objectively available.

But this is impossible, so that leaves the choices available to any one individual limited to the information they have.

Ultimately, that is why research organizations like Weiss Ratings exist. They trawl the vast ocean of information and then distill it down to a curated list that represents the best of breed.

Conclusion

No matter how many fancy strategies we come up with, there is a fundamental rule of investing that says risk and reward go hand in hand.

However, like Morpheus says to Neo in “The Matrix,” “What you must learn is that these rules are no different from the rules of a computer system. Some of them can be bent, others can be broken.”

But that is all I have got for you today. Let me know what you think about lowering your risk by purchasing insurance by tweeting @WeissCrypto.

I will catch you here next week with another update.

Until then,

Chris Coney