|

| By Bruce Ng |

Last Friday, Bitcoin (BTC, “A”) fell slightly from $72,000 to $68,000 due to the release of lower-than expected employment figures.

That’s not a terribly concerning correction. Altcoins, on the other hand, dipped way more:

Above is the broad market minus the top 10 cryptos by market cap. So, it represents the price action of altcoins much better than TOTAL3.

Last Friday, $40 billion of market cap in OTHERS was wiped out, corresponding to a drop of roughly 14% caused by the liquidation of leveraged positions.

As you all know, over the past month, the broad market was chopping sideways. Crypto traders have gradually added leverage over that same time period. So, when the price dipped, something had to give and altcoins dumped.

But I think these are just short-term shenanigans. I don’t expect to see this impact the market beyond a week or two.

Looking further ahead, alts are a great buy here. In fact, BTC is just $3,000 away from its all-time high of $72,000.

I think the whole crypto market is about to explode to the upside shortly.

But Which Coins Will Outperform?

There is a concept called relative strength, which shows which sectors overperform over other sectors.

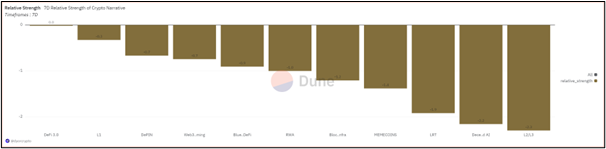

Let’s check out the relative strength for each sector over the past seven days:

Some points to note:

- My favourite sector, memecoins is the fourth worst performing sector over the past seven days. This makes sense as memecoins fall further than most other sectors when there’s downside pressure, like we saw this week.

- Layer-2 and Layer-3 networks fared the worst.

- Defi 3.0 is in first place. While it hasn’t posted impressive gains so far this year, it also has not corrected much.

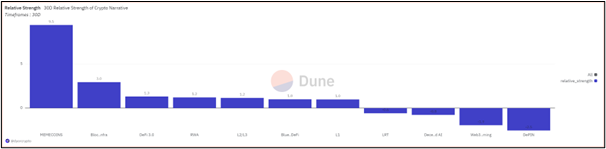

It shouldn’t be a surprise that the correction has pulled the performance of each sector down. But what if we look at performance over the past 30 days?

Well, then we get a very different picture.

- Memecoins are outperforming significantly.

- Blockchain infrastructure and Defi 3.0 follow in the second and third slots.

The point is narratives always switch around in terms of relative strength. To put it even simpler, different narratives outperform at different times.

That’s why investors need to keep on top of the market. Otherwise, you may find yourself left behind.

Then, once you’ve identified the leading sector, you can research the top-performing coins in each.

But if that sounds too time-consuming, there is another way to beat the market. One that doesn’t require you to keep up with narratives, because the goal isn’t to reap the most capital gains.

The goal is to go for the high-yield opportunities only available in decentralized finance.

I’m not talking about the pittance you receive for a typical savings account. I’m talking yields up to 169% on investment funds.

My colleague and DeFi expert Marija Matić just sat down with Weiss Ratings founder Dr. Martin Weiss to break down how these yields are generated and walk him through how to benefit from them.

And we’ve recorded that entire briefing, so you can benefit as well. But I urge you to watch it now, as we’ll be taking it offline soon.

Best,

Dr. Bruce Ng