|

| By Chris Coney |

Lending in decentralized finance has pretty much always been the same.

In many ways, it's similar to traditional lending services offered by banks.

You lend your stablecoins, someone takes out a loan and they post collateral to protect the lender in case of a default.

If the borrower defaults, the collateral is used to recoup the lender's losses.

This system makes traditional DeFi lending on established platforms like Aave (AAVE, Tech/Adoption Grade "B") very low risk.

But as the old saying goes, "With low risk comes low returns."

As such, the highest yield Aave lists for a stablecoin right now is 2.37%.

So, how can we get higher yields without having to switch over to a variable price asset?

Well, there's one category of investors retail lenders previously haven't been able to access … but thanks to DeFi, now they can tap into this resource.

This category consists of institutional borrowers like algorithmic traders, market makers and high-frequency trading firms.

These companies typically aren't well-known because they mostly operate in the background. They provide liquidity to make markets more efficient and are able to profit in the process.

Since their margins are usually quite thin, the key asset to these firms is capital. The more capital they have, the more money they can earn.

For this reason, money markets like Aave just don't work for them.

Posting collateral for the money they borrow is counterproductive, because locking up some of their capital as collateral means they can't earn any money on it.

As a result, firms in this category tend to take out unsecured loans and pay higher interest rates.

Normally, all this activity would be going on behind the scenes and far away from the retail market, with firms borrowing money from other financial institutions.

But with DeFi apps like Clearpool (CPOOL, Unrated), the opportunity to lend to these firms for high-interest rates has opened up to everyone.

With Clearpool, you can lend your USD Coin (USDC) to a number of carefully vetted institutional borrowers at these high interest rates. However, the actual company — Clearpool — is the one responsible for developing the app and vetting the institutional leaders.

In that sense, Clearpool is kind of a hybrid. It's half a DeFi platform and half a traditional business.

But on the unsecured loan side, the level of due diligence here is much higher than with Aave simply because these loans are uncollateralized.

Collateralized loans on Aave can be administered anonymously because the loan and the collateral are all locked in a smart contract. That means onboarding lenders and borrowers is totally frictionless.

But with unsecured loans, there's a risk of default … without any collateral to fall back on.

So, there needs to be as much due diligence done up front as possible, plus enough information for Clearpool to instigate recovery processes using the legal system if necessary.

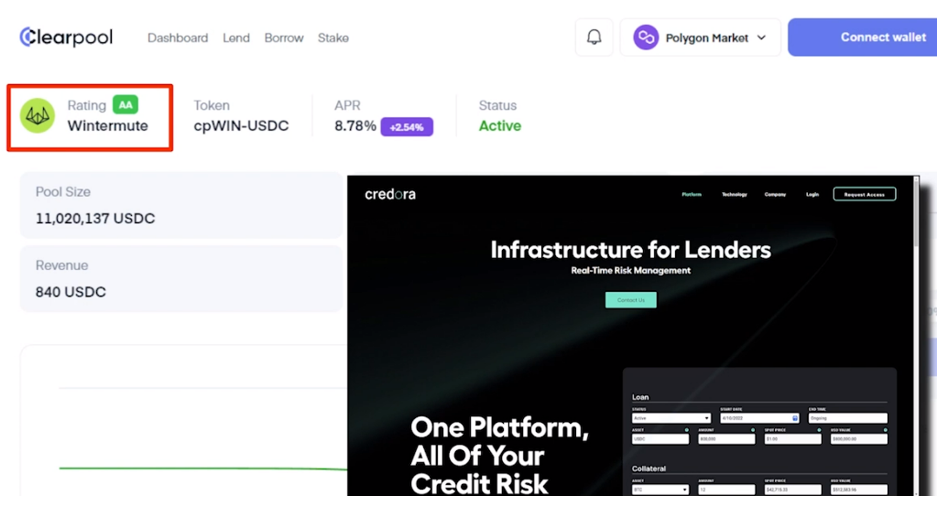

Now, let's take one of Clearpool's institutional borrowers, Wintermute, as an example.

What's preventing Wintermute from defaulting on the $8 million USDC loan they've taken out on Clearpool?

The answer to that is the same as if they were borrowing from a traditional institution: reputation.

If the creditworthiness of a firm in the institutional world is drawn into question, then that firm could go out of business.

This is one of the many reasons why your credit score is so important — it's a gauge of your trustworthiness as a borrower.

In Clearpool's case, it runs every one of their borrowers through Credora, which provides a real-time risk management system. The results are then fed back to Clearpool as a rating.

In Wintermute's case, with an "AA" rating, it's in pretty stellar shape.

But as a lender, you won't have to go through a Credora check.

All you need is some USDC in an Ethereum (ETH, Tech/Adoption Grade "A") or Polygon (MATIC, Tech/Adoption Grade "B") wallet and you can lend directly on the platform anonymously.

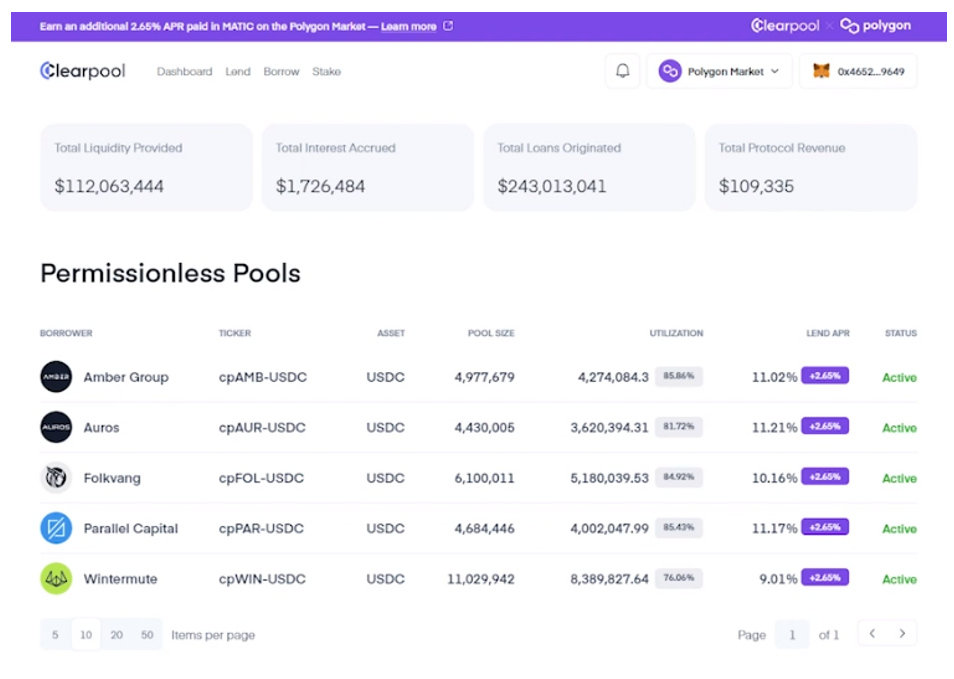

Currently, there are five institutions available for you to lend to.

While that may not sound like a lot, it's better to have a handful of highly vetted borrowers than a plethora of untrustworthy ones.

While you can spread your risk across multiple pools in any combination you'd like, I'd personally start with the pool that has the lowest utilization rate.

The utilization rate is the relationship between how much USDC has been loaned to a particular institution and how much of it it's actually taken out of the pool.

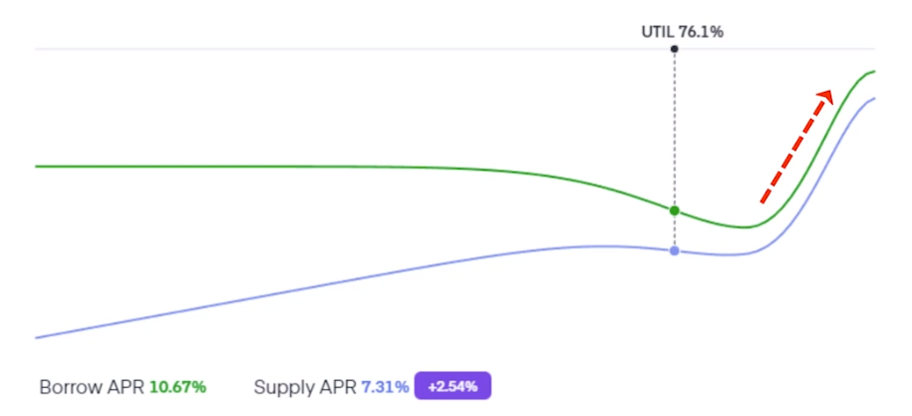

As an institution increases or decreases its utilization rate, its interest rate will also change.

If it does nothing, then the utilization rate automatically increases over time, because the interest charge is simply added to the debt.

But as you can see from the red arrow, the interest-rate curve goes up sharply as the utilization rate goes above 85%.

This is because the unutilized USDC is the total amount that is available for lenders to instantly withdraw.

So, that's something to bear in mind and a clear difference between Clearpool and Aave.

Additionally, there's an insurance fund set aside for each pool to assist lenders in the event of a default.

But this is currently only accruing 5% of the interest payment.

Right now, the Wintermute pool has less than $3,000 in it … so it's going to take a while for that amount to be meaningful.

So, to close out today, I want to go back to how I mentioned that Clearpool was a hybrid — half DeFi and half traditional.

But I want to assure you that its traditional business side, Clearpool, absolutely cannot touch the USDC that we lend.

That's because the USDC we lend goes into a smart contract with all of the protections of crypto we've come to know and love.

Clearpool can only get what the smart contract gives it as per the code that's been deployed. Nothing else.

So, as long as there's enough spare USDC in a pool for us to withdraw, we can withdraw at the click of a button.

And there you have it.

Perhaps this method is radical or a bit riskier than other stablecoin yield opportunities, but it's nonetheless a new way of earning sustainable stablecoin yields in the 10% range and beyond.

But whether you choose to pursue this endeavor is ultimately up to you.

And that's all I've got for you today.

Let me know your thoughts on earning yields with Clearpool by tweeting @WeissCrypto.

I'll be back next Sunday with another crypto update, so stay tuned.

Until then,

Chris Coney