|

| By Chris Coney |

Greed and fear — these two emotions drive a lot of investing decisions … but usually produce the opposite of what was intended.

Let’s use Bitcoin (BTC, Tech/Adoption Grade “A-”) as an example.

Buying Bitcoin at $5,000 in March 2020 and holding it all the way up to $69,000 in November 2021 was one thing. But continuing to hold without taking any profit with the intention of selling it at $100,000? Now that’s greed.

Many people did exactly that — including myself — and the market promptly rolled over. Even if you took profit at a price of $50,000 on the way down, yes, you made money, but you made less than you could have due to greed.

I suppose this is what is meant by the phrase: “A bird in the hand is worth two in the bush.”

This is just one instance of how greed can carry the intention of making more money ... but in reality, it can cause us to make less. And we can apply this concept to plenty of other areas.

Take my current favorite strategy of being a liquidity provider on a decentralized exchange, for instance.

Traditionally, all DEXes use the same fee structure, typically around 0.3%. However, Uniswap (UNI, Tech/Adoption Grade “B”) — and now Trader Joe (JOE, Unrated) on Avalanche (AVAX, Unrated) — offer the unique ability to compete with other liquidity providers by charging higher or lower fees.

Because the yield on a liquidity position is based on the amount of volume traded rather than the amount of time, we want to end up with the maximum growth in our capital and nothing else.

So, let’s take a trading pair such as BTC/USD Coin (USDC, Stablecoin). If there are two fee tiers at 0.3% and 0.05%, respectively, which one do we charge?

Our greed would tell us to go straight for the 0.3% fee pool. But we need to justify this choice since we know that decisions based on greed typically backfire.

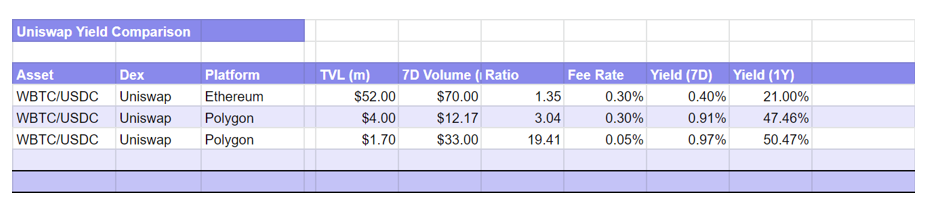

To compare these two fee tiers, I built a simple spreadsheet that measured the projected annual yield for three different liquidity pools for the same asset pair.

The first liquidity pool was BTC/USDC on Uniswap on the Ethereum (ETH, Tech/Adoption Grade “A”) mainnet.

The second and third pools were BTC/USDC on Uniswap on the Polygon (MATIC, Tech/Adoption Grade “B”) network.

At the time of writing, Uniswap on the Ethereum network only has one fee level for the BTC/USDC pair, at 0.3%.

The stats for this pool were:

- $52 million in total value locked

- $70 million in trading volume over seven days

If we divide the volume by the TVL, we get a ratio of 1.35. This is what I call the fee multiplier, because it determines how many times the TVL was turned over. In this case, the TVL was turned over 1.35 times.

This means each dollar of liquidity earned 0.3% x 1.35 = 0.4% during a seven-day period.

And 0.4% x 52 weeks = 21% projected annual yield.

Then, I applied this formula to the other pools.

Here are the results:

As you can see, this table proves my point.

If we had deployed capital into the 0.3% fee pool on Ethereum, our projected annual yield would be 21%.

If we deployed capital into the 0.3% fee pool on Polygon, our projected annual yield would be 47.46%.

But if we deployed our capital into the 0.05% fee pool on Polygon, our projected annual yield would be 50.47%.

By charging just one-sixth of the fee, we stand to make a greater overall yield. This is simply because traders are going to put more volume through whichever pool charges them the lowest fee.

In this example, it turned out to be the 0.05% fee pool on Polygon.

However, it’s worth doing this exercise regularly to make sure you’re in the pool that’s currently offering the highest overall yield.

The reason some traders are forced to use higher fee pools is to accommodate the size of the trades they want to do. Notice that there isn’t enough liquidity in the 0.05% fee pool to complete a $2 million trade.

So, the 0.05% fee pool is great for thousands of trades to go through that are trading a few thousand dollars each. But until the TVL in that pool grows, the big traders will have to stomach the higher fee.

In the example above, I’ve compared three pools for the BTC/USDC pair. Why not practice this yourself by going to the Uniswap BTC/USDC pool on Arbitrum and Optimism (OP, Unrated) and see what the overall yield comes out at?

Just apply the formula I’ve given above, and it’ll produce the answers for you.

That’s all I’ve got for you today. Let me know what yields you’ve practiced calculating by tweeting @WeissCrypto.

I’ll catch you here next week for my next update.

Until then,

Chris Coney