How to Possibly Get Free Tokens from the ETH Merge

|

| By Chris Coney |

Nowadays, you can’t go five minutes in the crypto space without hearing about the Ethereum (ETH, Tech/Adoption Grade “A”) Merge.

This highly anticipated upgrade to the Ethereum mainnet has been in the works for years. Even though this Merge is expected to happen on or around Sept. 15, several important preparatory steps have already been completed.

However, while the hype around this monumental event is mostly justified … the direct benefits to the average user appear blown out of proportion.

That’s because yet another preliminary step for future upgrades stands in the way before these benefits can start rolling in.

Let’s pretend for a second that Ethereum is a train running along a track.

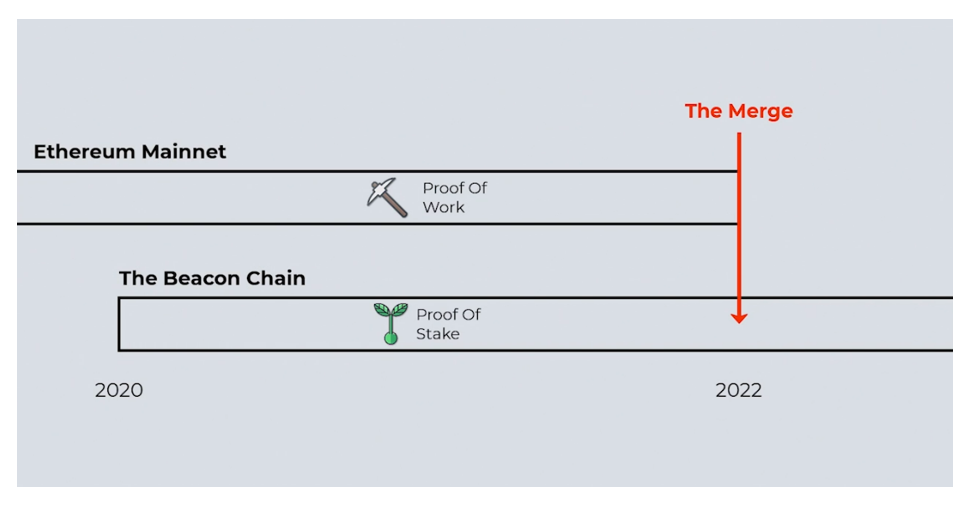

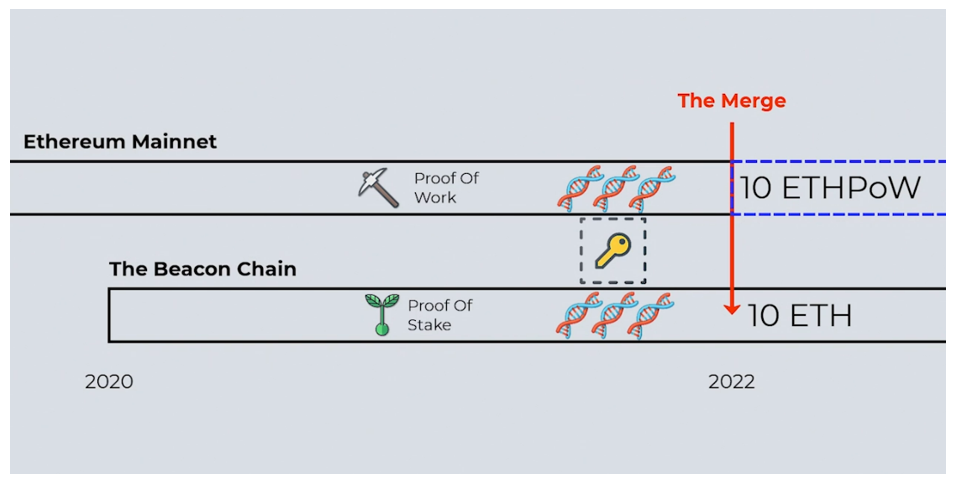

Since December 2020, there have been two Ethereum trains running on parallel tracks:

- The top train is the Ethereum mainnet, which is what most people use and what carries all the economic activity …

- And the bottom train is called the Beacon Chain — a new foundation for Ethereum that has been in development and testing for the past two years.

Essentially, the Merge is the point where all Ethereum activity will start running on new rails, with all the mainnet activity switching to the Beacon Chain.

The primary goal of the Merge is transitioning Ethereum from a proof-of-work system — where new blocks are mined through a highly energy-intensive process — to proof of stake, where blocks are mined by randomly selected validators who own coins associated with the blockchain.

While we can spend all day weighing the pros and cons of different mining methods …

Our main focus today is how to receive a potential airdrop of free tokens from the Merge.

The thing about blockchains is they’re networks of participants who come to a consensus based on a precise set of rules and protocols.

So, if any network participant is operating on even a slightly different set of rules, then they’re out of consensus and can no longer be a part of that network.

At that point, they’ve effectively established their own, brand-new network, with slightly different rules.

This is absolutely fine to do, and other people are free to join that new network if they please.

After all, that’s how the crypto world works — it’s extremely competitive.

So, for Ethereum, the plan is for everyone in the community to switch over to the Beacon Chain at the elected Merge date in mid-September.

As long as everyone does that, they all stay in consensus and in sync.

But again, any change to the network rules will effectively establish a new network.

So, from that point of view, the Merge is actually the establishing of a new network with new consensus rules.

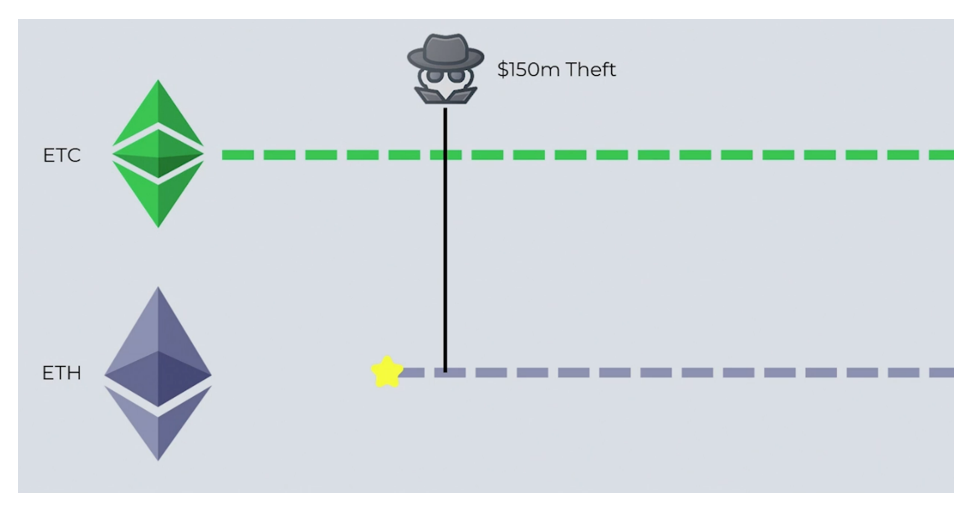

This mechanism is how we ended up with Ethereum and Ethereum Classic (ETC, Tech/Adoption Grade “B-”).

ETC is an original version of Ethereum before a new network was established. This was done to reverse the damage from a hack in which $150 million was stolen.

The Ethereum Classic network accepted that hack and continued to hold a record of it.

Whereas a large group of others established a new network and reversed the blockchain to a point before the hack so it could be patched and prevented.

While we’re not facing another hack, the Merge is a huge change that not everyone in the Ethereum community agrees with.

Meaning, when the time comes to complete the final steps of the Merge, it’s possible that some members of the community will continue to support the old proof-of-work chain.

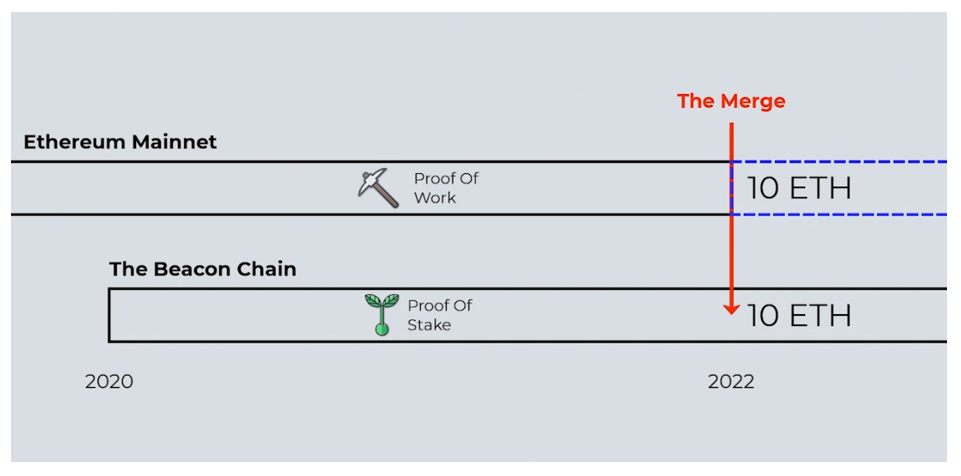

At that point, the network will be duplicated, almost like being cloned.

While their foundations may be the same, from the very moment that the two networks begin to have different experiences, they’ll become fundamentally different.

From your point of view as an investor, if you’re holding ETH in your wallet when the network splits, you’ll end up with the same balance on both chains.

Now, that doesn’t mean you’ll double the U.S. dollar value of your holdings.

That’s because the two tokens will trade at different prices.

After this month’s Merge, the new Beacon Chain-based network will be the one that carries the ETH ticker symbol.

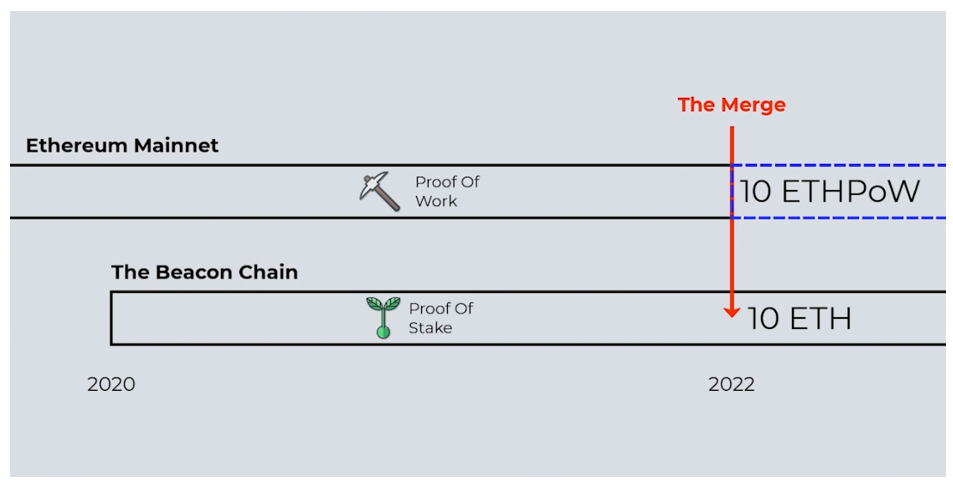

The other network looks like it’s going to carry the ticker symbol ETHPoW.

But until the split happens, there won’t be a new token to trade.

However, there are some preparations to consider if you’re dead set on getting the duplicated coins.

If you’ve already set up a decentralized finance wallet, you probably already know that your private key is what allows you to control the funds in your wallet.

My concern with this potential split is that ETHPoW-based wallets will require users to input their private key to access their ETHPoW coins.

This is because both networks share the same root DNA, so the same private key controls your coins on both networks.

I cannot emphasize this point enough …

If you reveal your private key to a wallet on the ETHPoW network … it also knows the key that controls your funds on the ETH network.

This is a privacy hazard. Your ETH could be at risk if you claim a new token that’s currently trading on the futures markets for around $50.

Now, you can take this information and do nothing. That might be the best approach because it protects the ETH you’re holding.

However, if you must take the opportunity to snag these new tokens, transferring your ETH to a reputable exchange (e.g., Binance) before the Merge might be your best bet.

While it’s best practice to always store crypto assets in your own custody, exchanges often automatically credit user accounts with the duplicate coins in these situations.

Meaning, all the technical aspects are taken care of for you.

And because the exchange controls that wallet anyway, you don’t have to reveal the private key to your personal wallet. You can just withdraw your tokens after the Merge and retake possession.

Just make sure your exchange intends to support the network split and that they intend to credit users with the duplicate tokens.

If I were to do this, I’d probably just swap my ETHPoW tokens into more ETH, consider it a dividend and withdraw it all back to my own wallet.

That’s because the ETH network is no doubt going to have more economic value in the long term, so I’d rather stick with the main token.

So, there you have it.

This is the most condensed explanation of the Merge that I can offer you.

And since it’s such big news, I’d be negligent if I didn’t provide some education around its risks … and how to work around them.

But that’s all I’ve got for you today. Let me know your thoughts on the upcoming Merge by tweeting @WeissCrypto.

I’ll catch you next week with another crypto update.

Until then,

Chris Coney