Is Post-Merge ETH Losing Its Censorship Resistance?

|

| By Chris Coney |

The grand premiere of the Ethereum (ETH, Tech/Adoption Grade “B”) network kicked off with a bang back in 2015, with an astonishing 7 million ETH sold approximately 12 hours after its presale launch.

I remember looking at the Ethereum website soon after its debut, where I was greeted with giant text on the homepage that said, “Build unstoppable applications.”

More importantly, note the subtext: ETH’s smart contracts are supposed to be “applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third-party interference.”

The Merge

Now, let’s cut to the chase here ...

As you probably recall, Ethereum recently went through a technical change when it swapped its consensus mechanism from proof-of-work to proof-of-stake.

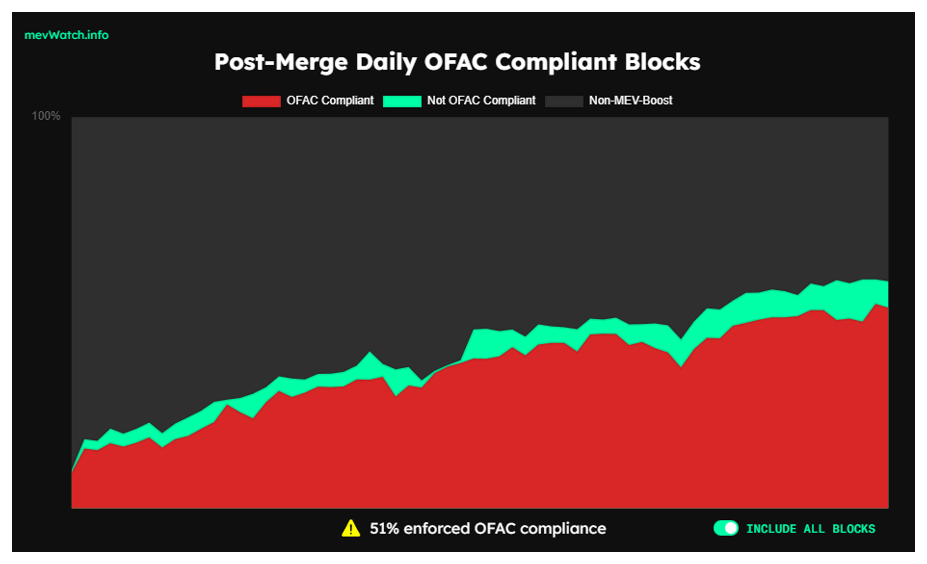

According to MEV Watch — a site that tracks how many post-Merge ETH blocks are compliant with the Office of Foreign Assets Control — and using a time frame of the last seven days, 49% of the blocks added to the ETH blockchain were “OFAC Compliant” at the time of writing.

And look at the increase in the percentage of compliant blocks over time:

OFAC — a financial intelligence and enforcement division of the U.S. Treasury Department that administers and enforces economic and trade sanctions based on U.S. national security and foreign policy goals — is the exact office that sanctioned Tornado Cash (TORN, Unrated) and several ETH addresses associated with it.

Tornado Cash is an Ethereum-based transaction privacy service, and many people were using the platform to make anonymous donations to Ukraine.

With this service, people were able to freely support Ukraine while protecting themselves from being identified and therefore potentially targeted and harmed.

However, since OFAC sanctioned it, those donations have all but stopped.

OFAC justified its actions by claiming Tornado Cash could also be used for money laundering, and thus sanctioned it like they would a foreign government or organization.

This has effectively scared the newly enthusiastic Ethereum validators into ignoring or refusing to include in a block any transactions related to Tornado Cash.

Why? Because if OFAC catches them including such a transaction from a sanctioned service, the validator is on the hook for it.

These enforcement agencies have such overreach that it doesn’t just stop with the U.S. If any foreign Ethereum validator puts a Tornado Cash transaction in a block, they will likely be singled out as well.

Leaning On Validators

There’s nothing technically in the Ethereum code that allows for this censorship. It’s not like the Ethereum developers have built in a special backdoor for regulators and government agencies to log in to and cancel transactions.

This is a social-level attack where the individuals and organizations in charge of operating network infrastructure are intimidated into following OFAC’s orders.

So technically anyone can still use Tornado Cash, but those transactions may never be confirmed.

But this isn’t really about Tornado Cash specifically. This incident brings up a much bigger issue: the neutrality of the base layer of the Ethereum blockchain, which is the single largest and most important smart-contract platform of them all.

What’s the Big Deal?

The reason why this has caused such an uproar in the crypto community is simple: This move by OFAC to sanction a smart contract is a bridge too far.

The community tolerates a bit of overreach, but this is beyond unacceptable. Some allege it’s actually unlawful.

Fortunately, Coin Center — a non-profit organization that advocates for responsible regulatory approaches to crypto — has filed a lawsuit against OFAC in an effort to revoke sanctions against Tornado Cash and establish this as a point of law for the future.

I hope to God this succeeds.

If we are going to usher in the era of financial freedom that blockchain technology promises, we need Ethereum to work the way it was designed — as a neutral, public and equitable platform for all.

I watch this topic with great interest and will be keeping a close eye on any noteworthy events.

But that’s all I’ve got for you today. Let me know what you think about OFAC’s sanctions against Tornado Cash by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

Kind regards,

Chris Coney