|

| By Beth Canova |

There is one big obstacle still in the way of mainstream crypto adoption: Lack of trust.

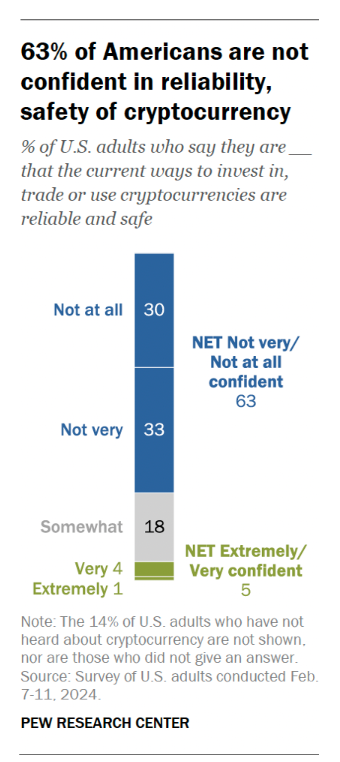

According to Pew Research, 63% of Americans are not confident that crypto is a reliable and safe asset type to invest in.

Some uncertainty about a new financial system is to be expected. Especially with the level of personal responsibility required to navigate the blockchain beyond trading on centralized exchanges.

But a lot of this mistrust is thanks to the prevalence of crypto scams.

It’s hard to have confidence in a system when headlines scream, “Danger!”

The latest popular trend targets Bitcoin ATMs.

Just like regular ATM breaches, this approach tricks people into believing a physical machine is secure. But their deposits never go into their accounts.

In 2024, Americans lost nearly $250 million to Bitcoin ATM scams, nearly double the damage from the previous year.

This issue is so widespread, AARP is even warning its members — all 38 million of them — to beware and do their due diligence when using Bitcoin ATMs.

And it’s not the only scam you need to guard against.

Protect Yourself from the Top 3 Crypto Scams

In 2024, cryptocurrency scams received at least $9.9 billion on-chain, according to Chainalysis. And that number is expected to increase as more illicit addresses associated with fraud and scams are identified.

To avoid getting caught in the next wave, here are the top three crypto scams … and how to keep yourself safe from them.

Scam 1: Advanced Phishing

Just like regular phishing scams, the crypto versions send deceptive emails posing as legitimate websites and platforms, urging you to act now.

Or they create a QR code that takes you to a scam site made to mirror the real things.

But when you click the link or scan the code and connect your wallet, you inadvertently give the hacker access to your funds.

To spot a phishing scam, be sure to …

- Verify the email sender. Phishing scams will try to mimic a real organization or person, but the email address will be slightly different, if not completely different.

- Check for typos. Not always, but phishing scams often have typos that, when combined with other evidence, can be a giveaway.

- Resist the urgency. Phishing scams often rely on urgency language to get you to act quickly … without doing your due diligence. It’s important to take a breath and approach the situation with calm clarity.

Scam 2: Rug Pulls

This type of scam is often harder for the average user to spot.

That’s because, instead of a misleading email, rug pulls present themselves as legitimate crypto projects.

Using the hype surrounding select narratives and the sense of FOMO — fear of missing out — that accompanies it, scammers will position their “project” as another opportunity in a hot sector. They’ll promise extraordinary returns or exclusive digital assets to draw your attention.

And once the project garners enough investors, the developers suddenly withdraw liquidity … and disappear with investors’ funds.

To spot a rug pull, be sure to …

- Take note of the promises. High returns with little to no risk sounds too good to be true … and often is.

- Audit available data. You’ll want to review token distribution. If the development team has a large percentage, that’s a red flag. And you should read any security audits and publicly available code to see if what’s under the hood matches the promotional material.

- Know the team. Look up information about the team behind the project. If none is available, that’s a sign they’re unwilling to share their identities or qualifications.

Scam 3: Fake Crypto Support

In this scenario, bad actors will often pose as customer support agents from trusted exchanges or wallet providers. They’ll reach out posing as support staff from platforms or projects through social media.

By offering seemingly genuine assistance, they exploit the trust of users already dealing with technical issues or looking for quick answers.

Then, scammers share phishing links disguised as support portals or they’ll ask for your private keys to offer refunds. Once they have access, they drain their victims’ accounts.

AI-powered deepfakes — designed to mimic a person’s appearance or just their voice — make this type of scam even more insidious. These generated videos or phone calls can convince you that a trusted person is asking for your keys.

To spot fake crypto support, be sure to …

- Never give your keys. Your private keys are what protect your wallet. They are what ensure that only you can access your funds. NO legitimate support team will ask for your keys. The request itself is a big red flag.

- Verify with the legitimate support team. If you get pinged on social media, you may want to reach out to that platform’s customer support directly through their legitimate website to see if the message is real.

Fake crypto support scams have even plagued our team. Smart Weiss Ratings Members have called in to warn us they’ve caught bots pretending to be our experts!

First, I want to give a quick shoutout to our members. They recognized the signs of a scam and were able to foil those nefarious plans.

Incredible work!

The big giveaway?

Juan Villaverde, Marija Matić, Mark Gough and all your editors here at Weiss will only ever communicate with you via our official email and on our website.

That means any private messages or DMs on social media should be a warning to you.

And you can find all our official accounts here.

For everything else, review the tips above to help keep your crypto safe. And remember the key crypto mentality: Verify, don’t trust.

Best,

Beth Canova

P.S. To learn which crypto cycles expert Juan Villaverde has already researched and included in his portfolio, click here.